Pound Sterling Forecast: Time to Bet on Further Falls vs. the Euro says Strategist

Image © Adobe Stock

Foreign exchange strategists at Nomura - the global investment bank - say there is little likelihood of a rebound in the value of the British Pound for the foreseeable future, and they therefore see value in entering a bet against the currency against the Euro.

The call from Jordan Rochester - Nomura's London-based currency strategist - comes as political risks facing Sterling arise following the resignation of Prime Minister Theresa May and the rapid rise of the Brexit Party which are heaping pressure on the Conservative Party to pursue a 'no deal' Brexit.

"It’s hard to see any near-term positives to keep the currency supported or to suggest a rebound. There are a host of reasons to be negative on GBP for now and we’ve run out of any positives that are likely to arise in the short-term," says Rochester.

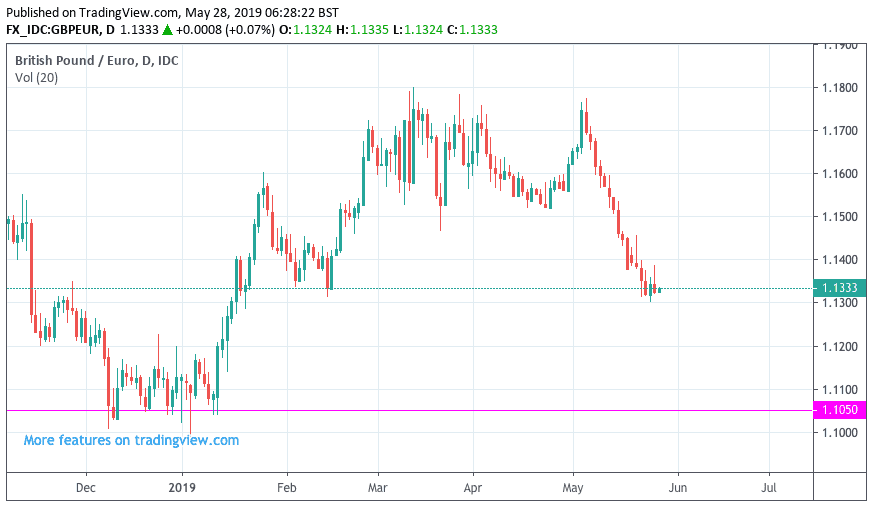

A rapid increase in market expectations that a 'no deal' Brexit will take place on October 31 has seen the value of Sterling fall sharply as investors demand a premium for holding a perceptibly risker currency: the Pound-to-Euro exchange rate has fallen 2.5% over the course of the past month and is quoted at 1.1333 at the time of writing, the May high is located at 1.1776.

Nomura now see the prospect of a 'no deal' Brexit of being 30%, a deal coming in at 40% and remaining, or the UK joining the European Economic Area, as being at 30%.

A hard Brexit could see a 7% decline in the value of Sterling say analysts.

Interestingly, this is the decline that can be expected in the event of Jeremy Corbyn - the Labour leader - winning the next General Election and becoming Prime Minister: a Corbyn government is believed to be as detrimental for Sterling as a 'no deal' Brexit.

And, there is a 50% chance of an election being called and a 55% chance of Corbyn winning that election say analysts, a second referendum taking place meanwhile enjoys a 50% chance.

So convinced are Nomura that further declines in Sterling lie ahead they have entered a trade that looks to take advantage of Euro strength against the Pound.

Rochester is looking for the Pound-to-Euro exchange rate to fall to a target set at 1.1050.

This is seen as the bottom of a longer-term range that the exchange rate has respected for months.

The move to this target is however expected to be slower than the rate of decent seen during May "because of the build-up of short-term positioning it’s more likely to be a grind lower from here rather than any acceleration," says Rochester.

The 'positioning' referred to by Rochster relates to the market adopting bets against Sterling in expectation of further declines.

Data from the International Money Market (IMM) - a unit of the Chicago Mercantile Exchange that deals with the trading of currency - shows that bets against the Pound rose 23K in the week ending May 21, and now stand at -26K.

This is by no means elevated by historical standards and we would expect this position have been added to over the course of the past week.

When positions build in this manner it shows the market is becoming heavily invested in the same directional bet which actually can slow the decline. This is because it requires more and more market participants to come forward and enter the same bet at a time when a large portion of that market has already committed.

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of foreign exchange specialists at RationalFX. A specialist broker can deliver you an exchange rate closer to the real market rate, thereby saving you substantial quantities of currency. Find out more here.

* Advertisement