GBP/NZD Week Ahead Forecast: On the Cusp

- Written by: Gary Howes

Image © Adobe Images

The Pound to New Zealand Dollar exchange rate (GBP/NZD) is on the cusp of breaking to fresh multi-month highs, but any advance hinges on the outcome of this week's UK inflation release and Bank of England decision.

GBP/NZD opens the new week at 2.0886 as it defends the 0.56% gain made on Friday, setting it up for further upside in the coming days.

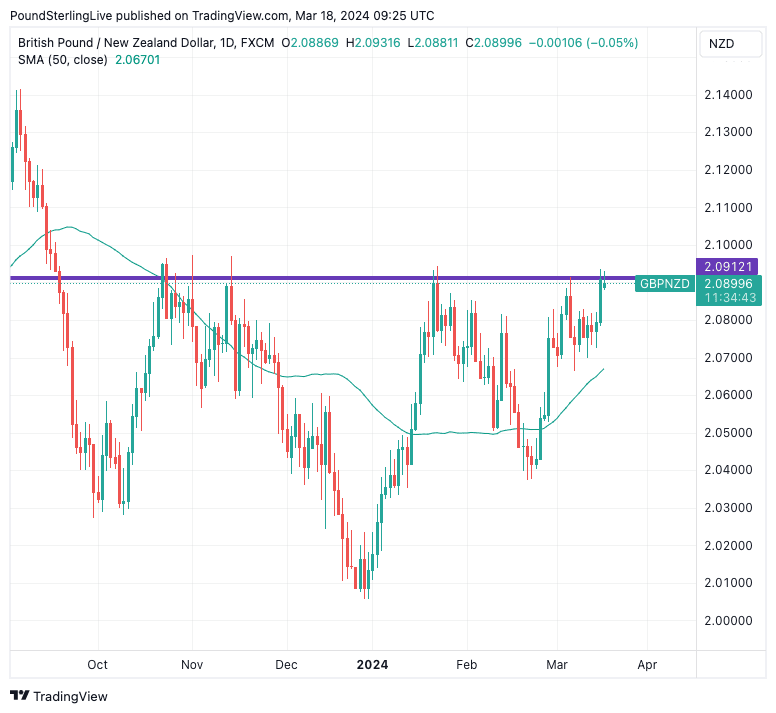

The exchange rate ended last week with its highest daily close since October, and we consider current levels to be part of a broader multi-month resistance area. The unblocking of this area will bring the 2024 high at 2.1580 into the conversation.

Above: GBP/NZD at daily intervals. Track GBP and NZD with your own custom rate alerts. Set Up Here

Looking at the vitals, GBP/NZD trades above its key moving averages while the RSI is comfortably positively positioned. We see the ADX at 20 and note the scope for a further rise in this momentum indicator, which would be consistent with a break higher in GBP/NZD.

For now, the global backdrop suggests the Pound can remain preferred to the New Zealand Dollar and any weakness in GBP/NZD will likely be limited to the 50-day moving average, currently located at 2.0670.

Compare GBP to NZD Exchange Rates

Find out how much you could save on your pound to New Zealand dollar transfer

Potential saving vs high street banks:

NZ$5,350

Free • No obligation • Takes 2 minutes

The make-or-break of the aforementioned resistance level hinges on the outcome of this week's data, with Thursday's New Zealand GDP forming the NZD highlight.

The market looks for a very slight 0.1% y/y and q/q rise in GDP, but any negative number would confirm New Zealand to have been in recession in the second half of 2023.

"There is some risk the Q4 NZ GDP data release next week confirms a technical recession in H223. The RBNZ forecasts real GDP to be unchanged in Q4 and thus narrowly avoiding recession. With the NZ rates markets pricing in a full rate cut only by October, a technical recession would weigh on the NZD," says David Forrester, an analyst at Crédit Agricole.

UK Inflation: Tuesday, 07:00

The biggest data event on the Pound's calendar is the release of headline CPI inflation, where a rate of 3.6% is expected for February, down from 4.0% in January. The month-on-month increase is expected to read at 0.6%, up from -0.6%.

The Pound-New Zealand Dollar rate will come under pressure if the print undershoots expectations and prompts markets to raise expectations for a June rate cut at the Bank of England.

"We are forecasting a sustainable return to 2% inflation this year," says Brian Martin, Head of G3 Economics at ANZ. "We forecast wage growth will fall towards 4% y/y by mid-year, allowing the BoE to be confident that underlying inflation is falling sustainably."

Bank of England: Thursday, 12:00

The Bank of England will keep Bank Rate unchanged at 5.25%, but any changes to the accompanying statement and vote composition will potentially move markets.

Should another member of the Monetary Policy Committee (MPC) join Swati Dhingra and vote for a cut, the Pound could come under pressure. Any shift in guidance that hints at the prospect of future rate cuts could also weaken the Pound.

"The GBP could be vulnerable to any evidence that more MPC members are coalescing around the view for stable rates and/or rate cuts," says Valentin Marinov, Head of G10 FX Strategy at Crédit Agricole.

"We think August is the earliest that the MPC will have enough evidence of progress on inflation to start cutting rates. The May labour market report and June inflation data will feed into its updated macroeconomic forecasts as part of the Monetary Policy Report," says ANZ's Martin.

UK PMIs: Thursday, 09:30

Thursday sees the release of PMI data for March, which will give a strong snapshot of this month's activity. The headline services PMI is expected to read at 54.2 which would indicate a strong expansion and confirm the recession is truly over.

Markets are positioned 'long' on the Pound, which hints that it will require a sizeable beat to prompt any meaningful gains. By the same token, the bigger reaction would likely be to the downside on any undershoot in the data.

UK Retail Sales: Friday. 07:00

January's release of December retail sales showed an unexpectedly large slump, which prompted a decent sell-off in the Pound.

Meanwhile, February's release showed a 3.4% y/y increase in January, indicating that the economy likely exited recession at the start of the new year.

In short, the retail sales print matters, and another strong reading could shore up the Pound and confirm that a strong recovery is underway.