New Zealand Dollar Defies the Reality of A Shrinking Economy

- Written by: Sam Coventry

- NZD at fresh multi-month highs

- Thanks to cheerful market sentiment post-Fed

- But NZ economy shrinks in Q3

- And raises questions about future RBNZ policy

- Accordingly, NZD strength looks vulnerable

Image © Adobe Stock

The New Zealand Dollar's positive momentum has extended and taken it to a fresh seven-month best against the Pound and a new four-month high against the U.S. Dollar, thanks to supportive global developments and despite a dour domestic GDP report.

The Kiwi shook aside StatsNZ's revelation that the economy shrunk in the third quarter to build on the gains that followed the Federal Reserve's midweek policy decision and guidance that effectively rubber-stamped the market's suspicions that 2024 will be a bumper year for interest rate cuts.

Global markets rose - taking high-beta currencies such as the NZ Dollar higher alongside - after the Fed added 25 basis points of cuts to its projections. Fed Chair Powell said in the press conference that the Committee discussed the timing of interest rate cuts, seeing a need "to reduce restriction well before 2% inflation".

"Those comments suggest rate cuts could happen sooner rather than later," says strategist Joseph Capurso at Commonwealth Bank.

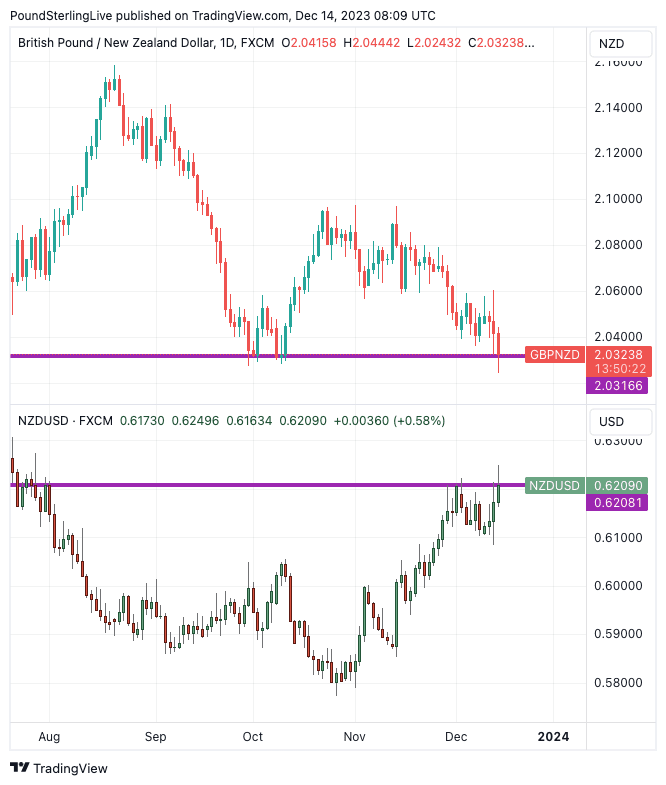

Above: GBPNZD (top) and NZDUSD at daily intervals. Track NZD with your own custom rate alerts. Set Up Here.

The New Zealand Dollar is highly sensitive to investor sentiment, meaning it rallied amidst expectations that global growth can improve in the coming months as falling interest rates stimulate economic activity.

The Pound to New Zealand Dollar fell to its lowest level in seven months at 2.0243 on the back, but the chart below shows the pair hasn't closed below 2.0310 during this period.

If GBPNZD holds a close above here, we would see a significant piece of support forming on the chart.

Compare GBP to NZD Exchange Rates

Find out how much you could save on your pound to New Zealand dollar transfer

Potential saving vs high street banks:

NZ$5,350

Free • No obligation • Takes 2 minutes

The New Zealand to U.S. Dollar exchange rate (NZDUSD) also exhibits a similar pattern, with resistance forming at ~0.6280.

To be sure, the New Zealand Dollar has momentum, and there is a good chance further gains are likely over the coming days.

The NZD faced a short-lived setback earlier on Thursday after it was revealed the New Zealand economy shrank 0.3% in the third quarter, which surprised markets expecting growth of 0.2% to be reported. The downward revision to second-quarter growth to 0.5% from 0.9% added to the dour tone.

StatsNZ said the decline was led by a fall in manufacturing, but a decline in exports that impacted the logistics sector was also apparent.

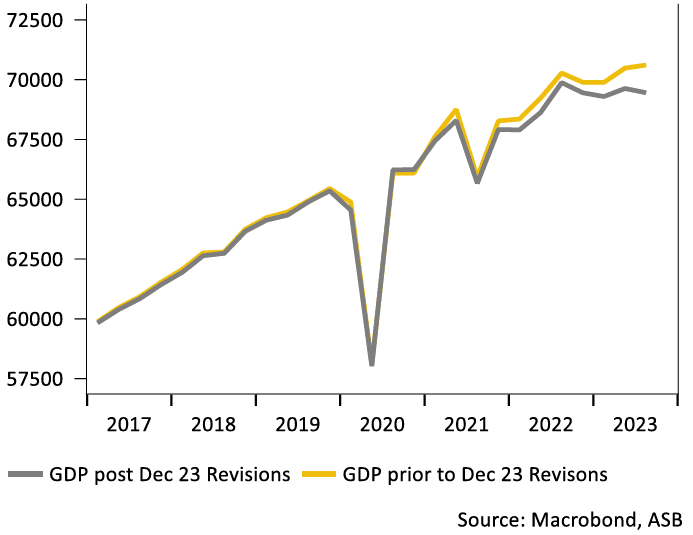

Above: "GDP Shrinks, NZ economy 1.6% smaller than we thought" - ASB.

"Curiously, pricing for RBNZ rate cuts did not change as much as elsewhere, helping NZD to out‑perform," says Commonwealth Bank's Capurso.

Yet, given the domestic economy's state, it feels like the NZ Dollar is defying gravity.

For one, the Reserve Bank of New Zealand will be reluctant to raise interest rates again, given the current backdrop. If anything, interest rate cuts are more likely.

"Compared to the RBNZ’s November MPS forecast there appears to be a bit less momentum out there, and all else equal that raises the bar considerably for a hike," says Miles Workman, Senior Economist at ANZ.

"Taking this quarter’s outturn and those past revisions together show growth on a considerably softer trajectory than we’d thought we’d experienced," says Nathaniel Keall, an economist at ASB in Auckland.

"The risk is that OCR cuts from the RBNZ can come meaningfully earlier than our previous expectation of early 2025," he adds.

ASB says economic output has experienced considerably less momentum than previously thought over the last eighteen months.

The economy is now around 1.6% smaller than ASB had expected prior to these GDP results.

"That is a considerable gap when we are talking about billions of dollars in real output," says Keall.

Compare GBP to NZD Exchange Rates

Find out how much you could save on your pound to New Zealand dollar transfer

Potential saving vs high street banks:

NZ$5,350

Free • No obligation • Takes 2 minutes