New Zealand Dollar's Winning Streak Boosted By RBNZ's 'Hawkish' Turn

- Written by: Gary Howes

Above: File image of RBNZ Governor Orr. Image © Pound Sterling Live, Still Courtesy of RBNZ

The New Zealand Dollar rose noticeably against the Pound, Dollar and other major currencies after the Reserve Bank of New Zealand (RBNZ) put markets on notice that it was prepared to raise interest rates again.

The RBNZ left the base rate (OCR) unchanged at 5.5% but said in the statement, "ongoing excess demand and inflationary pressures are of concern, given the elevated level of core inflation. If inflationary pressures were to be stronger than anticipated, the OCR would likely need to increase further."

The guidance was more activist in nature than was the case with previous 'placeholder' statements and confirms the RBNZ is increasingly frustrated with stubborn inflation.

It sees consumer and business demand as driving this inflation, which it thinks higher interest rates can remedy.

The rise in New Zealand bond yields and the NZD suggests the market was not quite prepared for the thrust of the RBNZ's guidance and is now preparing for a hike in early 2024.

Compare GBP to NZD Exchange Rates

Find out how much you could save on your pound to New Zealand dollar transfer

Potential saving vs high street banks:

NZ$5,350

Free • No obligation • Takes 2 minutes

The Pound to New Zealand Dollar fell by two-thirds of a per cent to trade at 2.0566, the Euro to New Zealand Dollar fell 0.70% to trade at 1.7796. The New Zealand to U.S. Dollar exchange rate rose by a similar margin to 0.6177.

"NZD/USD shot up to around 0.6200 following the hawkish RBNZ meeting," says Carol Kong, a strategist at Commonwealth Bank. "The RBNZ’s updated OCR forecast track suggests interest rates will remain higher for longer."

"We remain bullish for the week ahead. The technical break above the 0.6055 H&S neckline was sustained, with a textbook target of 0.6340," says Imre Speizer, a strategist with Westpac in Auckland.

Track NZD with your own custom rate alerts. Set Up Here.

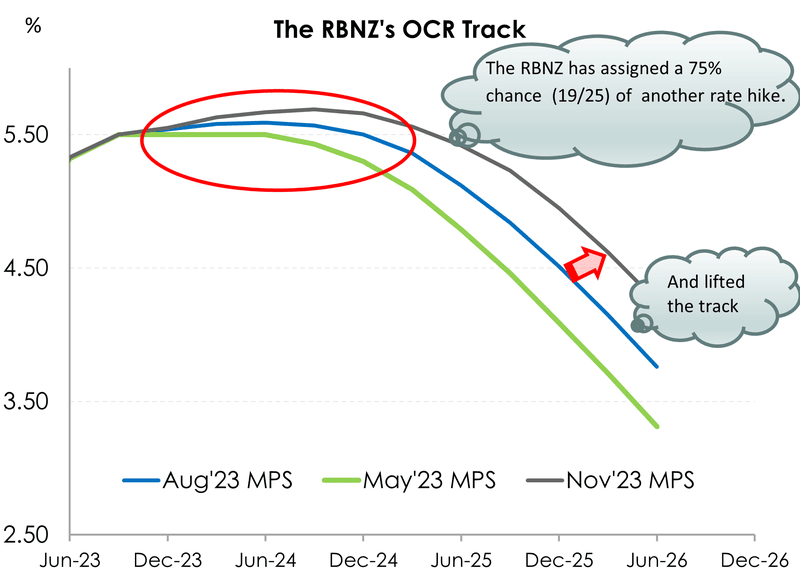

The Monetary Policy Statement showed the RBNZ was now expecting interest rates to remain higher for a more protracted period, revising up the peak OCR to 5.66% (from 5.6% in August). Rate cuts were pushed back to mid‑2025 from Q1 2025 forecast in August.

"The RBNZ left the cash rate unchanged at 5.5% today. No surprises there. But their hawkish tone certainly surprised," says Jarrod Kerr, Chief Economist at Kiwibank.

Above image courtesy of Kiwibank.

"Despite a number of data points which would have suggested the end of the tightening cycle, the RBNZ have kept the door wide open for another hike. Lifting the OCR track to 5.69% by September 2024, signalling a 75% chance of a hike," says Kerr.

Kiwibank says the threat of a further rate hike comes despite evidence of downside risks posed to the economy by a softening global backdrop and previous rate hikes which are still making their way through the economy.

"The hawkish tilt comes despite recent data that on balance has gone the RBNZ’s way, particularly the labour market," says Sharon Zollner, Chief Economist at ANZ.

Zollner suspects the 'hawkish' surprise might be a "strategy" from the RBNZ, "talking tough to prevent the market running away with the idea of cuts and thereby easing monetary conditions."

She concedes, however, that there is genuine concern that the bulk of monetary policy transmission is now in the rear-view mirror and core inflation and inflation expectations have not responded as hoped.

As such, more rate hikes might be what is required to bring inflation to heel.

Compare GBP to NZD Exchange Rates

Find out how much you could save on your pound to New Zealand dollar transfer

Potential saving vs high street banks:

NZ$5,350

Free • No obligation • Takes 2 minutes