GBP/NZD Week Ahead Forecast: Uptrend Intact

- Written by: Gary Howes

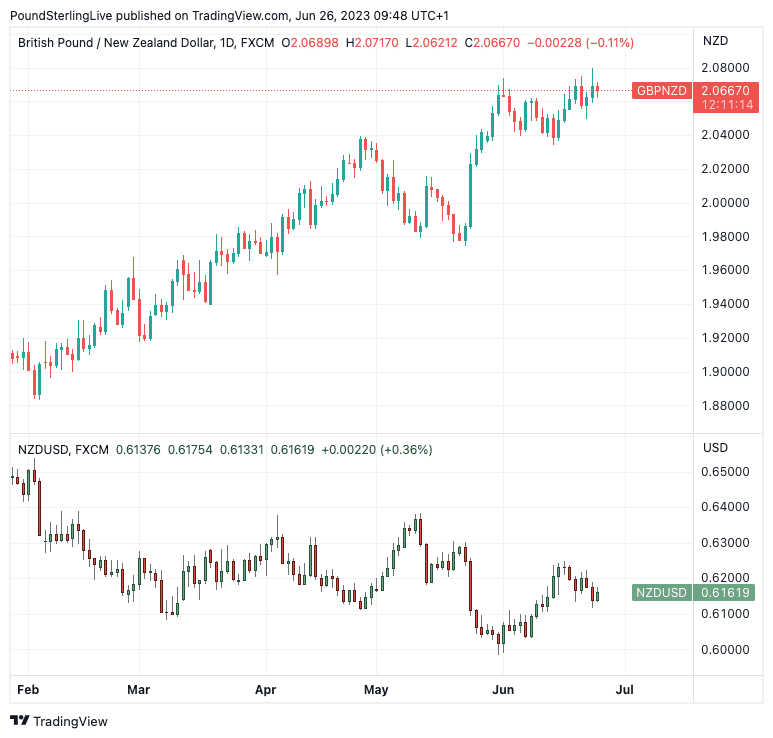

- GBPNZD uptrend firmly entrenched

- Restest of 2023 highs likely near-term

- Global economic growth worries weigh on NZD

- As does RBNZ signal that rate hikes are complete

Image credit: Lux Tonnerre. Sourced: Flickr. Licensing conditions: CC 2.0.

With domestic data and events out of the way in both New Zealand and the UK, the Pound to New Zealand Dollar exchange rate (GBPNZD) will rely on global developments and technical momentum for guidance.

On both counts, further upside is favoured as fears for a slowdown in global economic growth - owing to rising central bank interest rates - are helping underscore GBPNZD's uptrend that has been in place for 20 weeks now.

There is simply little reason for those with an interest in this market to now bet on a turn in trend given the risk-reward ratio is heavily skewed against such an outcome.

GBPNZD last week printed its highest level since 2020 at 2.0800 as investors read the Bank of England's Thursday interest rate hike of 50bp as being a decisive and unambiguous policy response to the UK's elevated inflation levels.

The prospect of further interest rate hikes suggests Pound Sterling can endure further support via this channel, according to analysis from Goldman Sachs, particularly against currencies issued by central banks that will either end their rate hiking cycle soon or have already done so, as is the case with New Zealand.

Above: GBPNZD (top) and NZDUSD at daily intervals.

The Reserve Bank of New Zealand (RBNZ) earlier this month surprised markets by signalling it has ended its hiking cycle in the belief it has already done enough to bring down inflation.

To be sure, New Zealand has some of the highest interest rates in the developed world (5.5%), but those in the UK look set to overtake, with markets showing investors are expecting the Bank of England to end its hiking cycle closer to 6.0%.

The rates advantage can favour the Pound over the New Zealand Dollar, particularly if the 'carry' trade remains favoured. (This is whereby capital favours markets with higher interest rates, in turn boosting demand for the higher-yielding currency).

"NZD's June ascent came to a halt last week with NZD falling roughly 1 cent," says Kim Mundy, an analyst at Auckland Savings Bank. "Widespread hawkish rhetoric is starting to erode NZ's favourable interest rate differentials. The RBNZ is increasingly standing out as dovish amongst peers... narrowing interest rate differentials reduce a key NZD tailwind."

Compare GBP to NZD Exchange Rates

Find out how much you could save on your pound to New Zealand dollar transfer

Potential saving vs high street banks:

NZ$5,350

Free • No obligation • Takes 2 minutes

But global factors also favour the Pound over the high-beta and cyclical New Zealand Dollar amidst growing concerns the world economy is to slow down sharply in the face of rising interest rates.

This is reflected most obviously in global commodity prices which have fallen of late, impacting so-called commodity currencies such as the Australian and New Zealand Dollars.

"Last week reinforced that central banks are still grappling to get fully on top of inflation. The Bank of England upped the pace of interest rate increases to 50bp, taking its policy rate to 5%," says Nick Tuffley, an economist at ASB.

The Norges Bank and Swiss National Bank also hiked as did the Central Bank of Turkey which went with a 650bp hike to lift the borrowing rate to 15%.

Expectations for further rate hikes out of the U.S. Federal Reserve and the European Central Bank amidst 'sticky' inflation rates mean the rate hiking cycle continues to extend itself and economists warn there is a chance central banks risk over-hiking. "Fed Chair Jerome Powell's hint at potential rate hikes cast a shadow over the market's sentiment. Although futures markets remain sceptical about this likelihood, recent events like the accelerated rate hikes by the Bank of England and Norges Bank, Norway’s central bank, heighten the rate hike fear," says Bas Kooijman, CEO and Asset Manager of DHF Capital.

The current "shocking decline in the money supply" as a result of rate hikes is being ignored by central bankers, and this could yet result in "financial collapse" warns Albert Edwards, Co-head of Global Strategy at Société Générale.

Edwards says these late-cycle interest rate hikes could prove to be a mistake in the same vein as these same central bankers made mistakes when dismissing the prospect of a surge in inflation that has subsequently proved unwilling to fall back.

He notes money supply in the U.S. is falling at the fastest rate since The Great Depression, meaning if monetarists are right "economic growth and inflation may soon collapse as central bankers make yet another huge policy error."

"It will also come as a big shock to investors who, as usual, are giving up on their forecasts of recession, just as one looms into view," he warns, citing evidence that "economists usually give up forecasting a recession immediately before it occurs."

Should a global recession come to fruition, pro-cyclical currencies such as the New Zealand Dollar can be expected to underperform the likes of the Dollar, Euro, Yen and Pound, suggesting the medium-term outlook remains challenging for the Kiwi.

Compare GBP to NZD Exchange Rates

Find out how much you could save on your pound to New Zealand dollar transfer

Potential saving vs high street banks:

NZ$5,350

Free • No obligation • Takes 2 minutes