New Zealand Dollar Forecast: ANZ says Recession Won't Stop Appreciation

- Written by: Gary Howes

- NZ economy to enter recession in Q2

- As RBNZ interest rate hikes impact

- But NZD forecasts upgraded

- On global, China-focussed factors

Image © David McKelvey, reproduced under CC licensing

Recession looms for the New Zealand economy but the China-focussed and risk-sensitive New Zealand Dollar can still appreciate from current levels, according to economists at ANZ.

In a quarterly economic and financial market update ANZ says the Kiwi economy is set to contract as the Reserve Bank of New Zealand's (RBNZ) interest rate hikes work through the financial system and stifle consumer behaviour.

But global financial markets and a reopening of the Chinese economy are likely to provide the domestic currency with ongoing support following a brisk start to 2023.

"The primary driver of recent NZD strength has been an improvement in global risk sentiment," says David Croy, Senior Strategist at ANZ.

One of the primary impulses of the improvement in global investor sentiment during 2023 has been the reopening of China's economy, to which the New Zealand economy has strong links.

"A recent Chinese State Council Meeting issued a statement promoting the accelerated recovery of consumption and a goal to make it the driving force of China's economy. This consumption-led rather than investment-led approach to economic stimulus could bode well for food producers like New Zealand," says Croy.

Compare GBP to NZD Exchange Rates

Find out how much you could save on your pound to New Zealand dollar transfer

Potential saving vs high street banks:

NZ$5,350

Free • No obligation • Takes 2 minutes

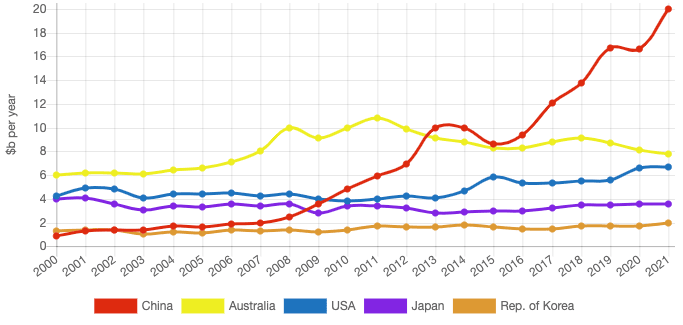

New Zealand exported a record $20BN worth of goods to China in the year to December 2021, over double that of its next biggest export market, according to StatsNZ.

The country's major goods exports include Dairy (milk powder, butter and cheese), meat products and wood products according to official data. Services exports include tourism, education (visiting tourists and students), transportation services and financial services.

"Expect positive economic ripples from the rebound in Chinese activity to be another source of NZD strength, particularly against currencies that are less sensitive to Chinese demand (GBP, CAD)," says Croy.

Above: New Zealand's Goods Exports: Top Markets ($b per year). Image courtesy of New Zealand China Council.

The New Zealand Dollar softened in the third quarter of 2022 before firming and recovering into 2023 amidst increasing evidence China was on the road to rapidly abandoning its growth-sapping zero-Covid policy.

The behaviour of global equity markets, particularly those of the U.S., are meanwhile also expected to determine Kiwi Dollar performance over the coming months.

"Correlation analysis shows the NZD has traded most closely with risk appetite and US equities over the first month of 2023. This confirms that global dynamics are still the dominant drivers of NZD direction," he says.

ANZ's strategy team is cautious about extrapolating NZ Dollar strength too much further, but "we still believe its path is modestly higher".

An extension of the global equity market recovery and a rebound in Chinese demand and tourism are all likely to underscore NZ Dollar value, however, ANZ says domestic developments are less bullish.

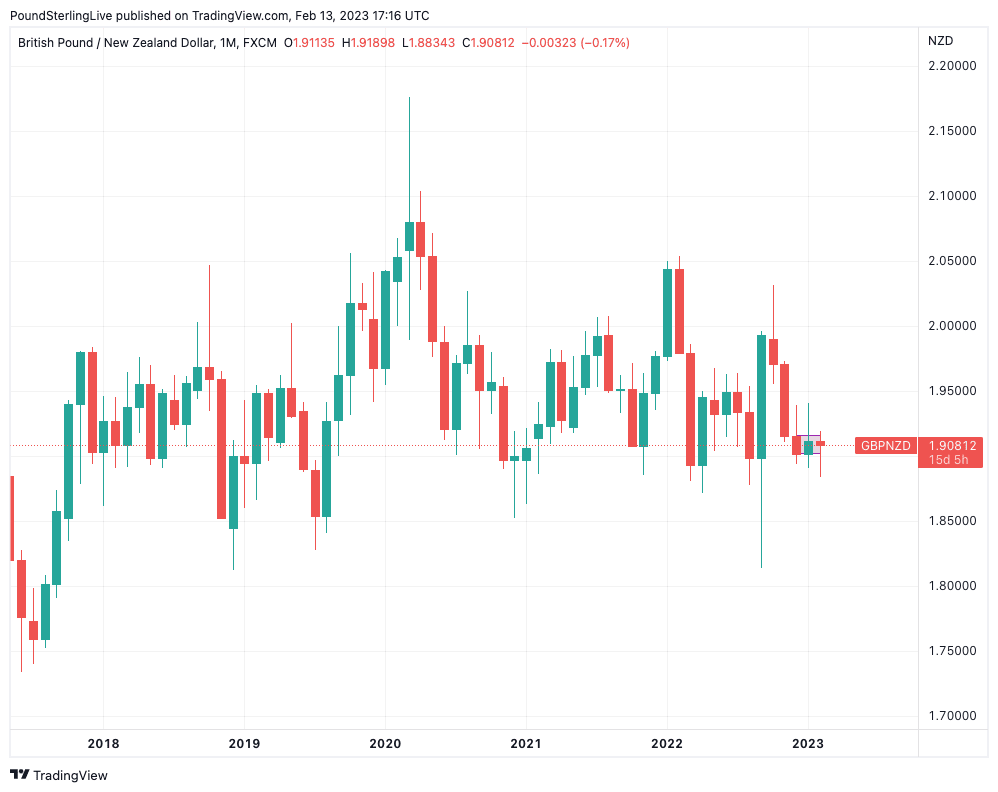

Above: GBP/NZD has carved out a relatively clear range since 2017. Consider setting a free FX rate alert here to better time your payment requirements.

NZ Recession

ANZ says the impact of the RBNZ's interest rate hikes is starting to impact the economy as house prices fall, consumer and business confidence fades and labour demand eases.

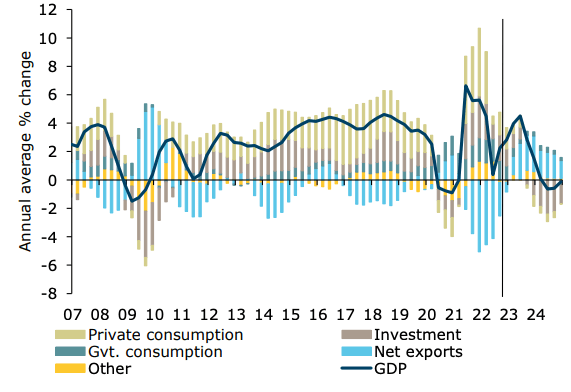

"Recession is looming... slower domestic demand is expected to more than offset the net exports recovery," says Sharon Zollner, ANZ's Chief Economist.

ANZ's forecasts show the economy entering a recession in the second quarter.

Forecasts also show the unemployment rate "lifting sharply" from the second half of 2023, peaking at 5.4% in 2024.

ANZ's economists anticipate a higher unemployment rate in New Zealand and slower growth in wages, which should see the country's core inflation rate fade.

Indeed, the RBNZ is expected to succeed in getting inflation under control as it raises interest rates to the extent that the economy shrinks.

"A policy-induced recession is looming. While it’s going to hurt some households more than others, we’re hopeful this slowdown will turn the tide on domestic inflation, and set the broader economy on a more sustainable path over the longer run," says Zollner.

Above: "Recession is looming. Slower domestic demand is expected to more than offset the net exports recovery" - ANZ.

Although the outlook is fraught with two-way risks ANZ thinks they are broadly balanced around its updated OCR call for a peak of 5.25%.

Money markets meanwhile indicate investors are anticipating cuts to the RBNZ's OCR by year-end as the central bank reacts to economic recession.

However, ANZ's forecast is for the OCR to remain on hold at 5.25% from May through to the end of our forecast horizon as inflation proves sticky.

"The looming downturn is being deliberately engineered. That’s what’s required to get the economy operating sustainably once more," says Zollner.

NZD Forecasts

Taking account of the above factors, ANZ's NZD/USD exchange rate forecast is for 0.64 by the end of the first quarter of 2023, 0.65 by the end of the second quarter, 0.66 by the end of the third quarter and 0.66 by year-end.

The NZD/GBP forecast profile is 0.52, 0.52, 0.53 and 0.52. This gives a Pound to New Zealand Dollar exchange rate path of 1.92, 1.92, 1.89 and 1.92. (If you are looking to protect or boost your international payment budget you could consider securing today's rate for use in the future, or set an order for your ideal rate when it is achieved, more information can be found here.)

The NZD/EUR profile is 0.59, 0.59, 0.58 and 0.58.

For NZD/AUD the predictions are 0.90, 0.89, 0.89 and 0.88.

ANZ's predictions contrast with those at ASB, where the New Zealand Dollar is expected by economists to underperform over the course of much of 2023.

"Our new forecasts still have NZD/USD heading lower over the medium term given a variety of structural factors. NZ's current account deficit sits at multi-decade highs around 8% and is likely to widen further over the coming quarters before it closes," says Nathaniel Keall, an economist at ASB.

"NZD's greater risk sensitivity should also see it underperform against JPY, EUR, and GBP over H2 2023," he adds.

Compare GBP to NZD Exchange Rates

Find out how much you could save on your pound to New Zealand dollar transfer

Potential saving vs high street banks:

NZ$5,350

Free • No obligation • Takes 2 minutes