New Zealand Dollar Forecast to "Stay Heavy" by HSBC

- Written by: Gary Howes

- NZD to struggle says HSBC

- As NZ economy faces 'hard landing'

- Lower forecast profile for NZD

Image © Adobe Stock

"A dismal growth outlook as hard landing risks rise adds to the challenging external backdrop facing New Zealand," says HSBC, the international investment bank and lender.

The latest assessment of the outlook for the New Zealand economy leads HSBC's foreign exchange research team to lower their New Zealand Dollar forecasts and maintain a cautious stance on the currency.

"We have been bearish on the NZD for some time as persistent geopolitical tensions, global supply disruptions, a slowing Chinese economy, and a hawkish Fed painted a challenging backdrop for the risk sensitive currency," says Paul Mackel, Head of FX Research at HSBC.

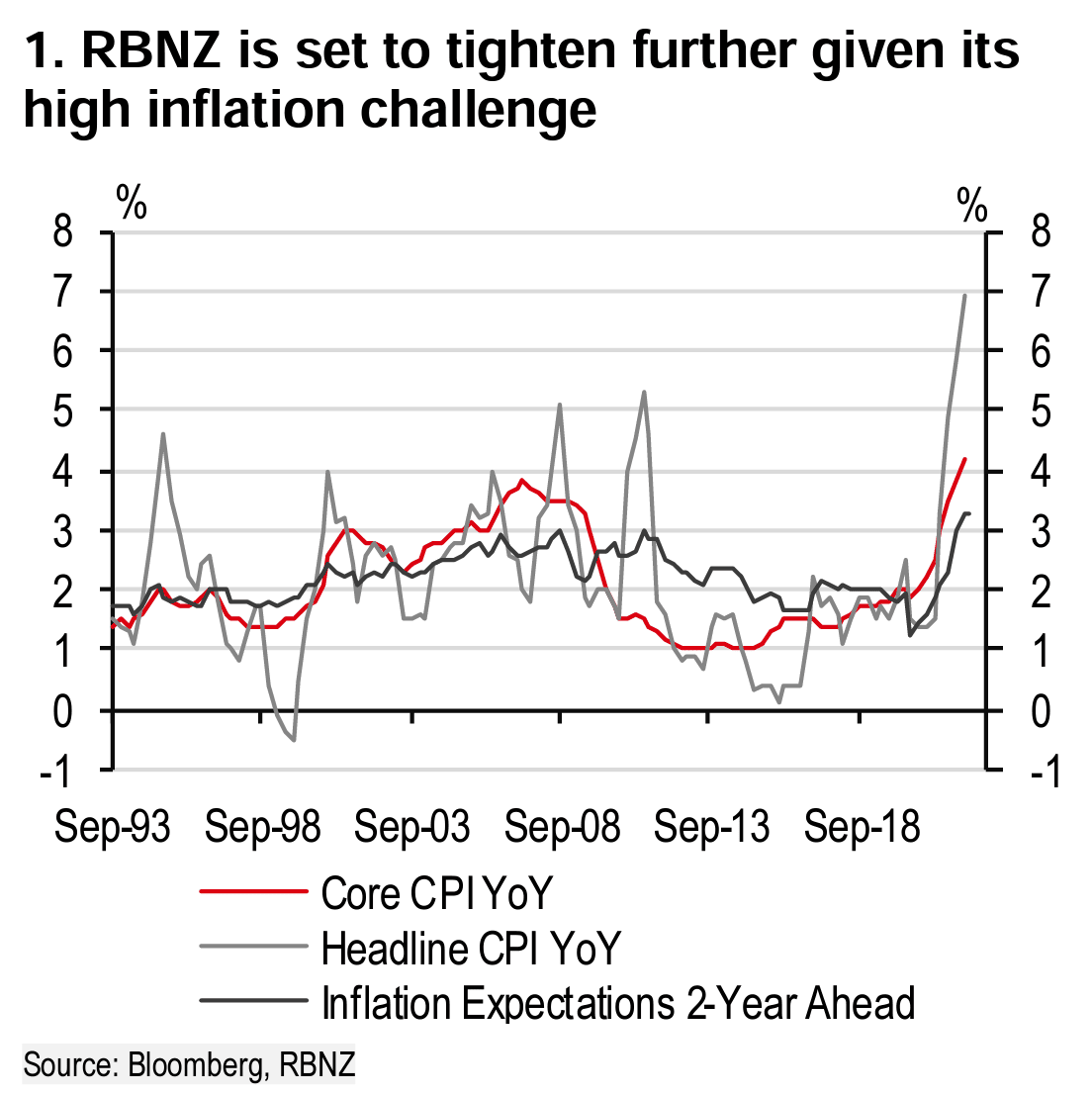

In a mid-year currency market assessment Mackel adds "Domestic growth concerns are now becoming more prevalent at a time when the RBNZ is hiking further and faster to re-anchor inflation expectations."

The call comes as the New Zealand Dollar registers a loss for 2022 of 8.77% against the U.S. Dollar but a gain of 2.40% against the Pound and a gain of 2.3% against the Euro.

Compare GBP to NZD Exchange Rates

Find out how much you could save on your pound to New Zealand dollar transfer

Potential saving vs high street banks:

NZ$5,350

Free • No obligation • Takes 2 minutes

The NZD had been one of the best performing currencies of 2022 earlier in the year as markets moved to price a series of rapid Reserve Bank of New Zealand (RBNZ) interest rate hikes, while surging commodity prices also offered support.

Further interest rate hikes are meanwhile expected from the RBNZ as HSBC economists say inflation is still yet to show any signs of easing and inflation expectations continuing to climb higher.

However, this dynamic is no longer anticipated by HSBC's currency analysts to provide outright support for the NZ Dollar.

"Further RBNZ hikes will struggle to lift the NZD given how much is already priced in and the dominance of risk over relative rates," says Mackel.

The RBNZ was one of the earliest amongst the major central banks to hike in this tightening cycle and has lifted its cash rate by 225bp to 2.50% in ten months.

Money market pricing shows investors anticipate a further 150 basis points of hikes to be delivered during the remainder of 2022.

A rule of thumb in foreign exchange is that by raising interest rate a central bank supports its currency, as global capital tends to go where rates offer better returns.

But it is perhaps more accurate to say a currency rises when markets are raising their expectations for future central bank rate hikes, with the opposite being true when these expectations peak and start to reverse.

"Further RBNZ hikes will struggle to lift the NZD given how much is already priced in and the dominance of risk over relative rates," says Mackel.

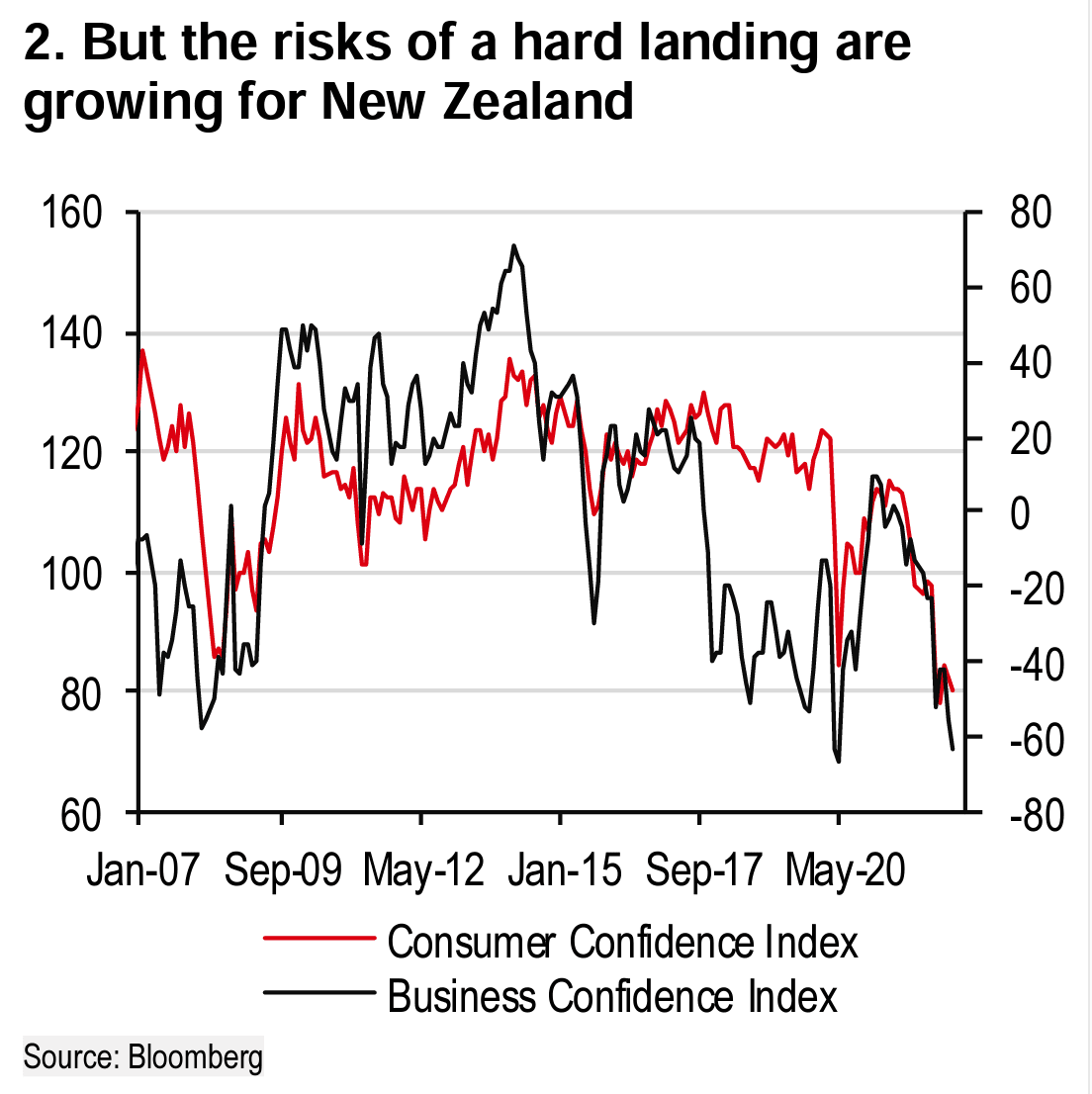

Furthermore, HSBC says the New Zealand economy is set for a 'hard landing' whereby economic growth is constrained by rising interest rates and other negative factors.

"The potential uplift to the NZD from higher rates may be tempered by the growing risks of a hard landing," says Mackel.

HSBC notes the cost of living in New Zealand is surging and the housing market is cooling rapidly, creating a negative wealth effect.

Consumer confidence meanwhile fell to a record low in June and business confidence has fallen to levels last seen at the start of the Covid pandemic.

"New Zealand’s economy does not look well placed to handle an even more aggressive hiking cycle, and the risks to growth makes it more challenging for the RBNZ to over-deliver on markets’ expectations," says Mackel.

HSBC remains bearish on the NZ Dollar and lower their NZD/USD forecasts to 0.58 by the end of the fourth quarter of 2022 and 0.57 by the end of the second quarter of 2023.

HSBC's forecasts for the GBP/USD exchange rate for these points are 1.17 and 1.16, this implies a Pound to New Zealand Dollar forecast of 2.0172 and 2.030.

Compare GBP to NZD Exchange Rates

Find out how much you could save on your pound to New Zealand dollar transfer

Potential saving vs high street banks:

NZ$5,350

Free • No obligation • Takes 2 minutes