New Zealand Dollar Falls as "Hard Landing" Fears Grow in Wake of Strong NZ Inflation Data

- Written by: Gary Howes

- NZ inflation exceeds expectations

- Bolsters case for rapid near-term hikes at RBNZ

- But further out rate cuts are seen

- And this is weighing on NZD

Image © Adobe Stock

The New Zealand Dollar lagged other major currencies at the start of the new week after a leap in New Zealand inflation rates surprised investors and raised bets for a faster raising of interest rates at the Reserve Bank of New Zealand.

However, fears of a 'hard landing' for the economy have grown as investors fear the combination of high inflation and rising interest rates will kill off economic expansion, which might help explain the NZD's negative reaction to the data.

New Zealand CPI inflation rose 1.7% quarter on quarter in the second quarter said Stats NZ, besting the 1.5% the market was looking for.

The annual inflation rate stood at 7.3% in the year to the end of the second quarter, a 32-year peak, which was both higher than the 7.1% forecast and the 6.9% recorded at the end of the first quarter.

The data prompted analysts to raise RBNZ interest rate hike expectations.

"Today's red-hot print bolsters our call for a 4th consecutive 50bps hike by the Bank at its August meeting despite softer growth data as inflation outturns continue to surprise the RBNZ," says a note from the global FX strategy team at TD Securities.

The currency's reaction is surprising: typically strong inflation and rising rate hike expectations bolster a currency.

The market reaction therefore suggests investors are fearful a combination of higher inflation and rising interest rates will prompt a sharp economic downturn.

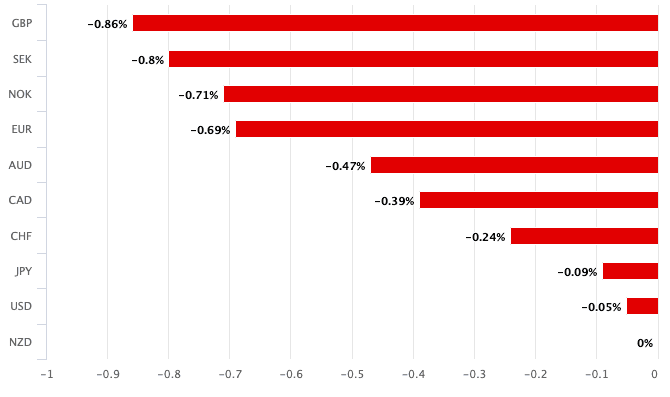

The reaction in the NZD was unambiguous as it was down against all G10 rivals:

Compare GBP to NZD Exchange Rates

Find out how much you could save on your pound to New Zealand dollar transfer

Potential saving vs high street banks:

NZ$5,350

Free • No obligation • Takes 2 minutes

"The headline reading was far enough above our and the RBNZ’s pick to keep the market on the back foot, and the strength in non-tradables and the core measures has only contributed to a sense of unease that a 75bp OCR hike may in fact be on the cards," says Sharon Zollner, Chief Economist at ANZ.

"Fears of a hard landing are growing," adds Zollner.

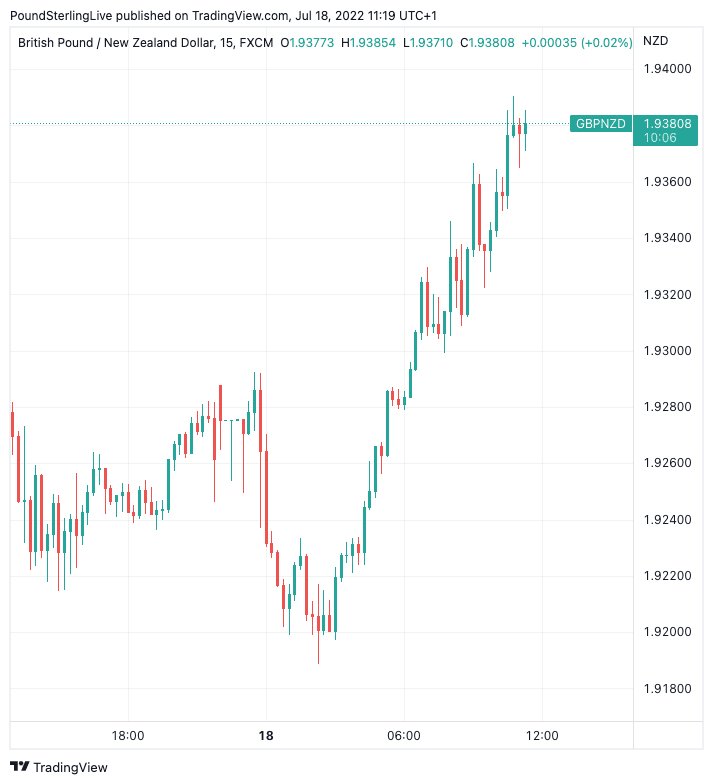

The Pound to New Zealand Dollar exchange rate rose 0.88% on the day to 1.9379, meaning bank accounts were offering in the region of 1.8846 for NZD payments and independent providers 1.9330.

The New Zealand Dollar-U.S. Dollar rate was down on the day at 0.6183, the Euro-New Zealand Dollar rate up at 1.6448.

Above: GBP/NZD at 15 minute intervals showing trade in the wake of the inflation data release.

"Record high annual non-tradable inflation will be of concern to the RBNZ," says Mark Smith, Senior Economist at ASB.

"Today’s prints supports the view of high inflation becoming increasingly entrenched. As such, more restrictive OCR settings earlier than envisaged are required," he adds.

ASB now expects 50bp hikes in August and October, a 25bp November hike and a 3.75% end of 2022 OCR peak.

ASB have also now pencilled in OCR cuts from 2024.

It is perhaps expectations for future cuts - as the RBNZ reverses its rate hikes in the face of economic contraction and rapidly falling inflation - that is driving the New Zealand Dollar at present.

This is therefore a market that is looking not at the near-term rate hikes, but the negative growth outlook and its implications for future rate cuts.

Economists at ANZ have changed their OCR call and now expect the run of 50bp hikes to continue through to November, meaning an OCR endpoint of 4.0% rather than 3.5%.

The bank warns a 75bp hike at the August MPS is a very real possibility, particularly if the labour market data on 3 August delivers another hawkish surprise.

"Domestically driven inflation tends to stick around a lot longer than the imported variety, and as such, the mix of inflation pressures revealed today demands a more aggressive RBNZ response," says ANZ's Zollner.

ASB's Smith agrees: "persistently high inflation runs the risk of more aggressive OCR action, including a possible 75bp August hike and higher OCR endpoint this cycle."

Compare GBP to NZD Exchange Rates

Find out how much you could save on your pound to New Zealand dollar transfer

Potential saving vs high street banks:

NZ$5,350

Free • No obligation • Takes 2 minutes