Pound / New Zealand Dollar Rate Risking Further Corrective Setback

- Written by: James Skinner

- GBP/NZD supported at 2.0120 short-term

- But strength wanes on NZD/USD recovery

- Setback likely if NZD/USD’s rally continues

- RBNZ decision, outlook dictate path ahead

Image © Adobe Stock

The Pound to New Zealand Dollar rate has waned in its uptrend of late and would be at growing risk of a corrective setback this week unless Wednesday’s Reserve Bank of New Zealand (RBNZ) policy decision happens to disrupt a nascent recovery in the main Kiwi pair NZD/USD.

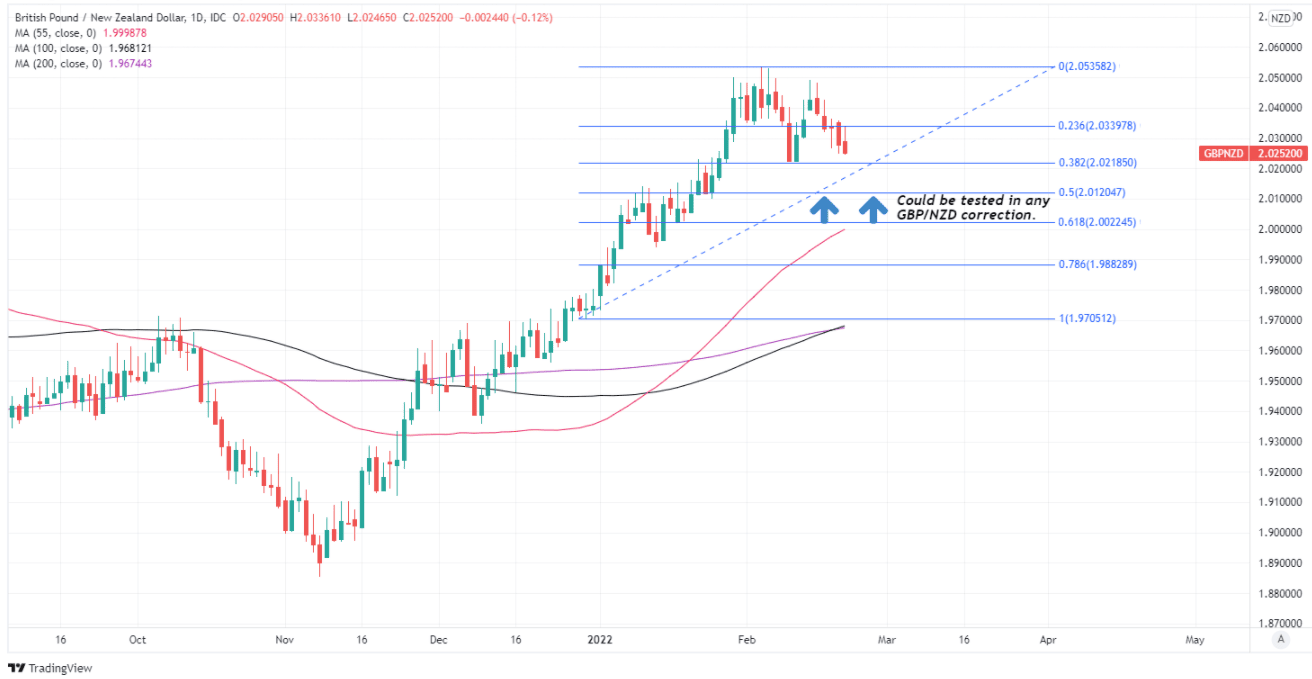

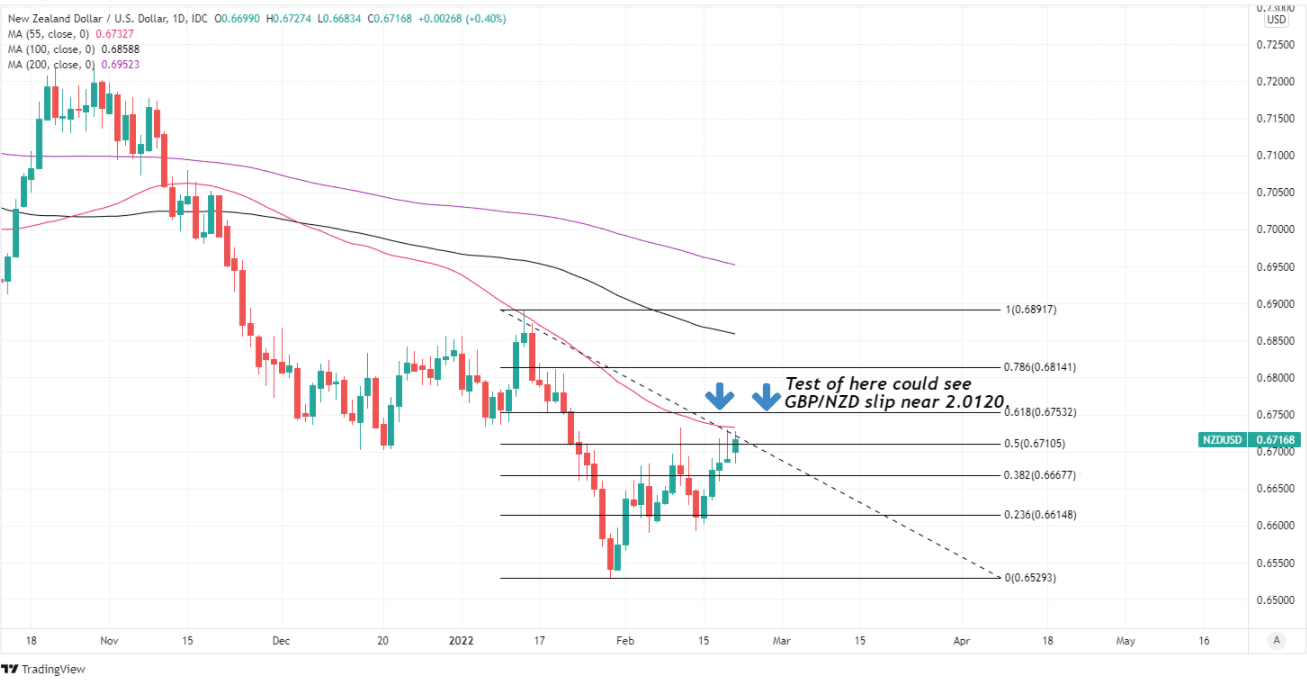

Sterling retreated further from early February’s near-two-year highs above 2.05 against the Kiwi Dollar during the week to Monday following a five-day rally in the influential NZD/USD exchange rate that would risk pushing GBP/NZD back to 2.0120 if it continues through the new week.

New Zealand’s Dollar made its initial bid for recovery last Tuesday when it was reported that some of the Russian military personnel encamped on the border with Ukraine would begin returning to their bases, while the new week opened with fresh support from market hopes of a further de-escalation.

However, there may have been some domestic factors at play on Monday and certainly would be from Wednesday when the RBNZ announces its latest interest rate decision and economic forecasts.

“Now that the local market is in the benchmark global index, New Zealand fixed income securities are expected to enjoy higher prices and greater liquidity as fund managers who track the index (with trillions of dollars) buy NZ government bonds. There may also be some implications for the currency as these purchases take place, but in practice they are likely to be difficult to identify,” says David Croy, an FX strategist at ANZ.

Above: GBP/NZD shown at daily intervals with Fibonacci retracements of January 2022 and November 2021 indicating possible areas of support for Sterling in the event of any further declines. Selected moving-averages also denote possible areas of support.

- GBP/NZD reference rates at publication:

Spot: 2.0235 - High street bank rates (indicative band): 1.9527-1.9668

- Payment specialist rates (indicative band): 2.0053-2.0134

- Find out about specialist rates, here

- Set up an exchange rate alert, here

The trouble is there’s a high risk of the nascent improvement in global market sentiment proving to be short-lived and should that happen it would potentially call a halt to the rebound in NZD/USD, which could then be likely to place a floor under GBP/NZD.

That’s unless this Wednesday’s policy decision from the RBNZ puts fresh wind into the currency’s sails, which many analysts say is unlikely.

“This week’s RBNZ policy meeting is unlikely to have a lasting impact on NZD. The RBNZ is widely expected to raise the official cash rate by 25bpto 1.0%. But downside risks to NZD remain. In our view, NZD (and AUD/NZD) are vulnerable to a near term fall back below 0.6600 if Russia invades Ukraine,” says Kim Mundy, a senior economist and currency strategist at Commonwealth Bank of Australia.

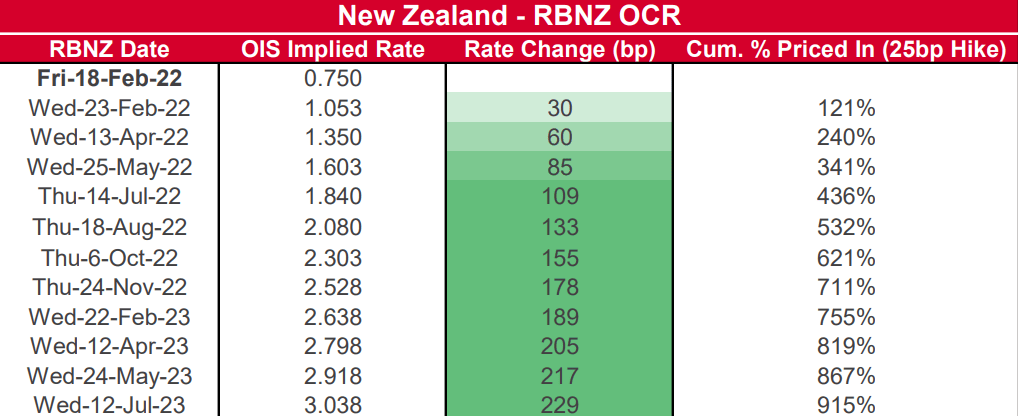

The RBNZ’s anticipated decision to lift its cash rate back to 1% would mark its third interest rate rise in as many meetings in addition to a complete reversal of the interest rate cuts announced at the onset of the pandemic in March 2020.

Above: Market expectations for RBNZ cash rate following each policy decision. Source: Westpac.

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

“The RBNZ MPS this Wednesday, which is expected to tighten further, may provide some support on the day. Medium term, though, while the NZD should retain solid fundamental backing, it is likely to be dominated by USD developments,” says Imre Speizer, head of NZ strategy at Westpac.

“We see potential for another significant rally in the USD once the Fed cycle is underway, which could push NZD/USD back towards 0.6500,” Speizer and colleagues wrote in a Monday research briefing.

Limiting the prospective upside for the Kiwi is financial market pricing that has more-than fully baked into New Zealand government bond markets the 0.25% increase in the cash rate that many analysts and economists see as being the most likely outcome of this Wednesday’s decision.

That means the New Zealand Dollar is likely to need either a larger 0.50% increase in the cash rate or some other favourable policy development in order to sustainably benefit from February’s RBNZ decision, which many analysts say is also unlikely.

Above: NZD/USD shown at daily intervals with selected moving-averages and Fibonacci retracements November decline indicating likely areas of technical resistance to any further recovery for the Kiwi.

“We expect a 25bp hike but a 50bp hike can’t be ruled out. The larger move could put some upward pressure on the currency,” ANZ’s Croy said Monday.

The RBNZ indicated in its November monetary policy statement that its forecast for Kiwi inflation to return to the bank’s two percent target over the coming years was hinged on the assumption that its cash rate would rise to around 2.75% by the end of next year.

However, since then pricing in financial markets has shifted to imply investors are betting heavily that the bank would be likely to lift the benchmark for borrowing costs to that level as soon as February 2023.

This is why many analysts suspect the Kiwi could struggle to capitalise meaningfully on anything the RBNZ says or does this week, and is another reason why the potential downside for GBP/NZD is likely to be limited over the coming days even if its upward momentum is currently waning.

“It remains difficult to see the New Zealand dollar staging a sustained rebound on the back of this week’s RBNZ’s policy meeting alone even if they deliver a larger 0.50-point hike,” says Lee Hardman, a currency analyst at MUFG.

“In light of higher inflation, tighter labour market conditions, the buoyant housing market, and the long gap since the last RBNZ policy meeting, we believe there is a high risk of a 0.50-point hike,” Hardman wrote in a Monday research briefing.