Pound / New Zealand Dollar Rate Eyeing 2.03 after NZD/USD Buckles

- Written by: James Skinner

- GBP/NZD targets 2.03 as NZD/USD slides

- Supported near 2.00 & 1.99 on weakness

- Could rise to 2.0280 if NZD eases further

- NZ CPI & Fed decision key in week ahead

Image © Adobe Stock

The Pound to New Zealand Dollar rate has scope to reach an eighteen-month high around 2.03 over the coming days after heavy losses pushed NZD/USD beneath an important level of support on the charts.

Sterling appeared poised to extend a two-month climb against the New Zealand Dollar on Tuesday as the NZD/USD pair continued a fortnight long slide that took it back beneath the 0.67 handle on Monday for the first time since November 2020.

Ongoing declines in NZD/USD were helping to sustain GBP/NZD above the recently recovered 2.01 handle and would lift Sterling further still this week if strategists at Westpac are right in their outlook for the main Kiwi exchange rate.

“Last week, we wrote that we would sell NZD/USD upon a break of 0.6735. That break occurred on Friday, and triggered our short position. The main rationale for the trade is an expectation that the US dollar will appreciate further,” says Imre Speizer, head of NZ strategy at Westpac.

“This week’s FOMC meeting should signal a March rate hike, supporting the USD. US GDP data should also be supportive. Technically, Friday’s break below the month-old ascending channel at 0.6760 signalled a move to 0.6615,” Speizer and colleagues wrote in a Monday note to clients.

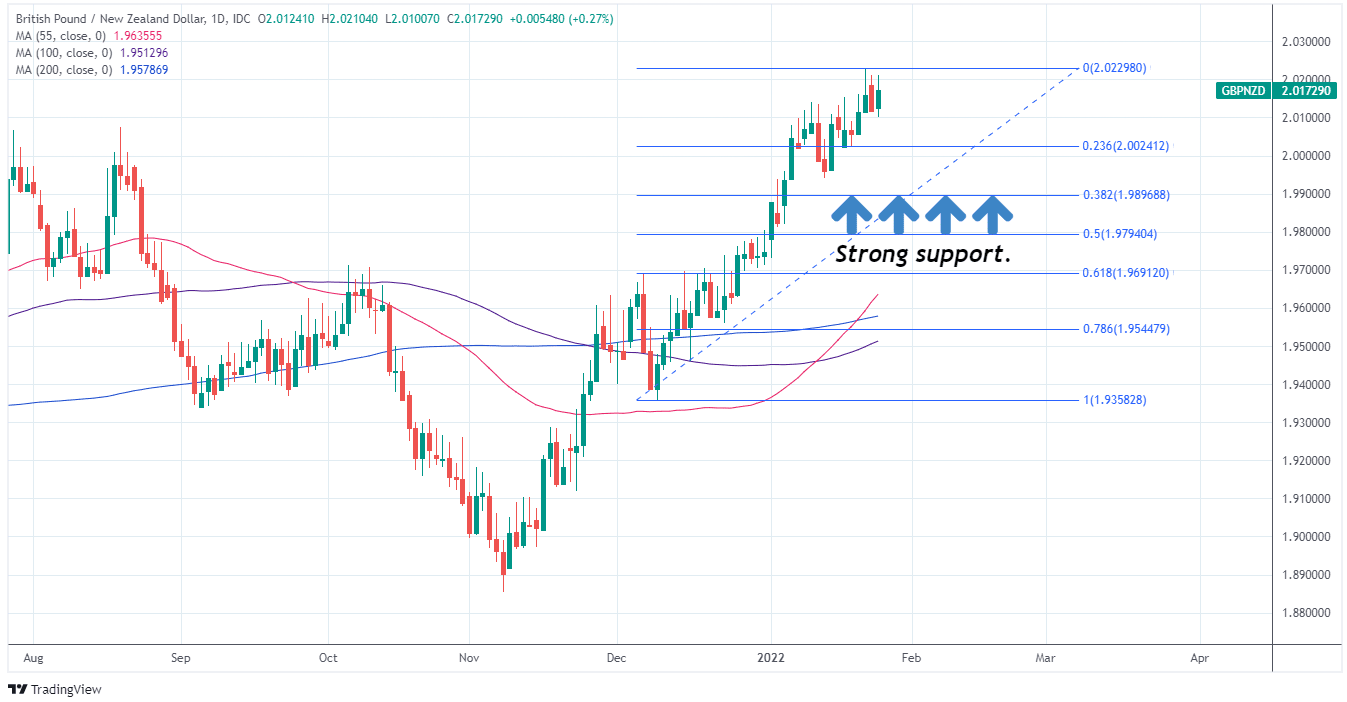

Above: GBP/NZD at daily intervals with Fibonacci retracements of November rally indicating likely areas of technical support.

- GBP/NZD reference rates at publication:

Spot: 2.0190 - High street bank rates (indicative band): 1.9483-1.9625

- Payment specialist rates (indicative band): 2.0008-2.0089

- Find out about specialist rates, here

- Set up an exchange rate alert, here

GBP/NZD tends to closely reflect the comparative performance of NZD/USD and its Sterling equivalent GBP/USD, and would likely be seen trading above 2.03 and at its highest level since May 2020 in the event that NZD/USD declines to 0.6615 over the coming days.

At Tuesday’s level of GBP/USD, the GBP/NZD would rise to 2.0380 this week if NZD/USD falls to 0.6615, although this advance would almost certainly be tempered if GBP/USD eases lower alongside the main Kiwi exchange rate.

“Risk-off sentiment worsened as concerns about a Russian invasion of Ukraine intensified, and expectations built for another hawkish tilt by the Fed this week. Equity markets were already being sold down due to expectations of tighter monetary policy ahead but equity markets dropped more sharply and bonds rallied as political tensions rose,” says David Croy, a strategist at ANZ.

New Zealand’s Dollar was one of the biggest fallers to open the new week when slumping in sympathy with widespread and heavy declines for global stock markets, which many analysts suggested were a sign of market unease over tensions between Russia and western countries.

{wbamp-hide start}

{wbamp-hide end}{wbamp-show start}{wbamp-show end}

“The kiwi continued its slide against the USD, amid broader risk-off moves in markets. Data are pointing to an easing in economic activity at the start of the year, amid broader inflation concerns. We await the FOMC meeting later this week. The risk with the meeting may be that the Fed comes out even more vociferously in its intentions to adjust policy in response to inflation,” said Croy.

The U.S. Dollar was the prime beneficiary among major currencies from risk aversion in international markets and could be likely to remain on its front foot this week due to expectations around Wednesday’s Federal Reserve (Fed) monetary policy decision.

The Fed has moved rapidly during recent months to prepare the market for a withdrawal of the extraordinary monetary support provided to the U.S. economy since the onset of the pandemic, and one which is now widely expected to take place at a somewhat accelerated pace.

“Headwinds for the NZD are to remain leading up the 8am Thursday FOMC decision, but we expect a strong Q4 NZ CPI print on 10:45am on Thursday to be NZD supportive,” says Mark Smith, an economist at ASB Bank in Auckland.

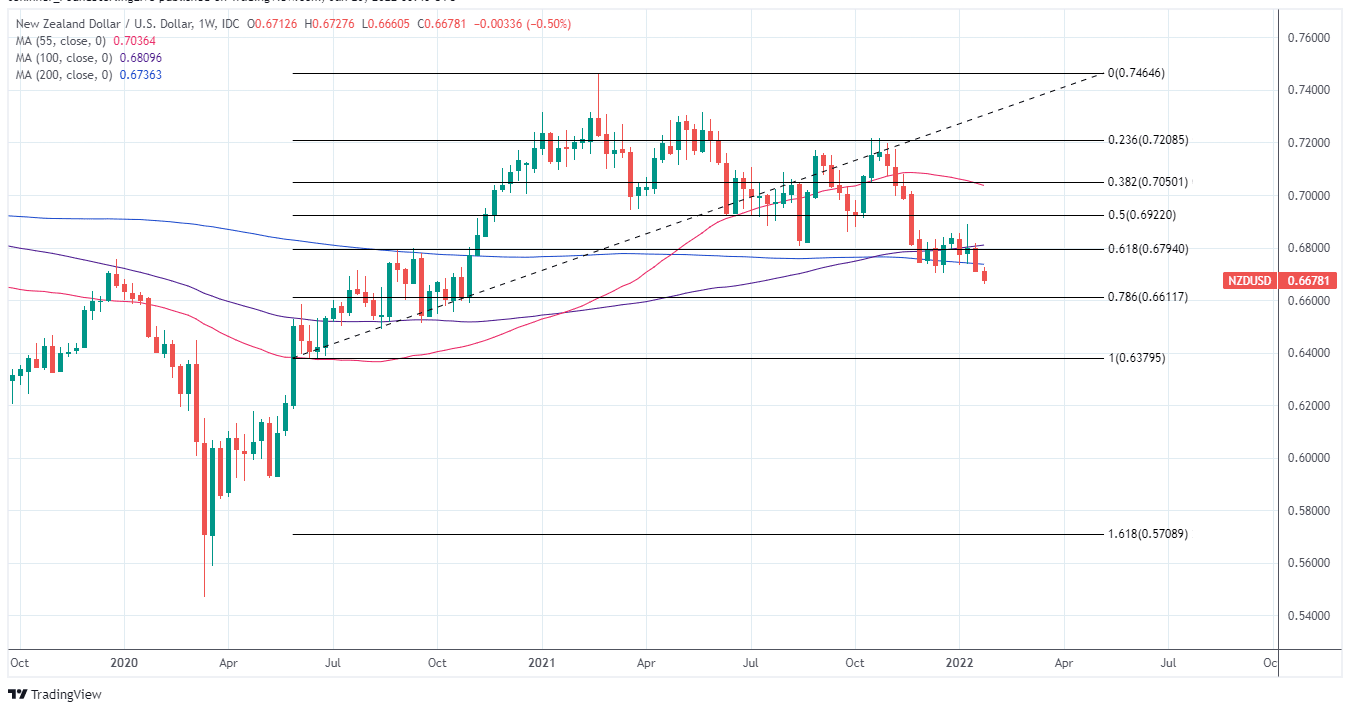

Above: NZD/USD at weekly intervals with Fibonacci retracements of November 2020 rally indicating likely areas of technical support for the Kiwi.

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

The Fed has rapidly pivoted into a position where its interest rate could be raised as soon as this March, lifting the U.S. Dollar and in the process weighing on NZD/USD, although this week’s decision is quickly followed by final quarter inflation data from Statistics New Zealand on Wednesday.

This could offer support to the Kiwi if it leads the market to perceive an increased probability of a 0.50% interest rate rise being announced by the Reserve Bank of New Zealand (RBNZ) next month.

“A strong NZ Q4 21 CPI print could push market pricing for a 50bp rate hike in February above 20% (9:45pm tomorrow London time),” says Joseph Capurso, head of international economics at Commonwealth Bank of Australia.

“Nevertheless, a sustained lift in NZD is unlikely in the event of a sharp re‑pricing higher of Fed Funds rate expectations. Indeed, a hawkish FOMC and ongoing weakness in global equities suggests NZD may remain below 0.6700 in the near term,” CBA’s Capurso and colleagues said on Monday.

Market pricing suggested on Tuesday the RBNZ is almost certain to lift its cash rate for a third time in its February 23 decision, taking it up to 1%.

Wednesday’s data is the economic highlight of the week for the New Zealand Dollar although with a full slate of U.S. figures due out before and after Wednesday’s Fed decision, trading in U.S. Dollar exchange rates will also be an important influence on the Kiwi and Sterling.