Pound / New Zealand Dollar Rate Rise to 2.00 in Early January

- Written by: James Skinner

- GBP/NZD could attempt test of 2.00

- If NZD/USD remains under pressure

- Amid strong start to 2022 from GBP

Image © Adobe Stock

The Pound to New Zealand Dollar exchange rate approached the two-for-one level as Sterling rose and the Kiwi Dollar softened to open the new year in price action that was suggestive of a rough 1.98 to 2.00 range being set to prevail for GBP/NZD through the early days of January.

Sterling strengthened across the board on Tuesday as trading in London resumed and the festive holiday bid for the British currency was sustained, although the Pound to New Zealand Dollar rate’s advance was aided by a softening Kiwi Dollar.

New Zealand’s Dollar opened the new year on the defensive as the late December rally in NZD/USD began to reverse, with the main Kiwi exchange rate slipping back toward last month’s lows near to the round number of 0.67.

With the main Sterling pair GBP/USD trading buoyantly above 1.35 this week, any continuation of NZD/USD’s retreat could potentially lift the Pound to New Zealand Dollar rate back above the 2.00 handle for a period of time during the early days of January.

“Global financial markets are generally in a 'risk-on' posture, with equities moving higher (Eurostoxx 50 +1.0%, March S&P 500 +0.4%) and longer-term yields drifting up. In particular, GBP yields have experienced a stellar run thus far today,” says Stephen Gallo, European head of FX strategy at BMO Capital Markets. “The GBP has been one of the better-performing G10 currencies overnight.”

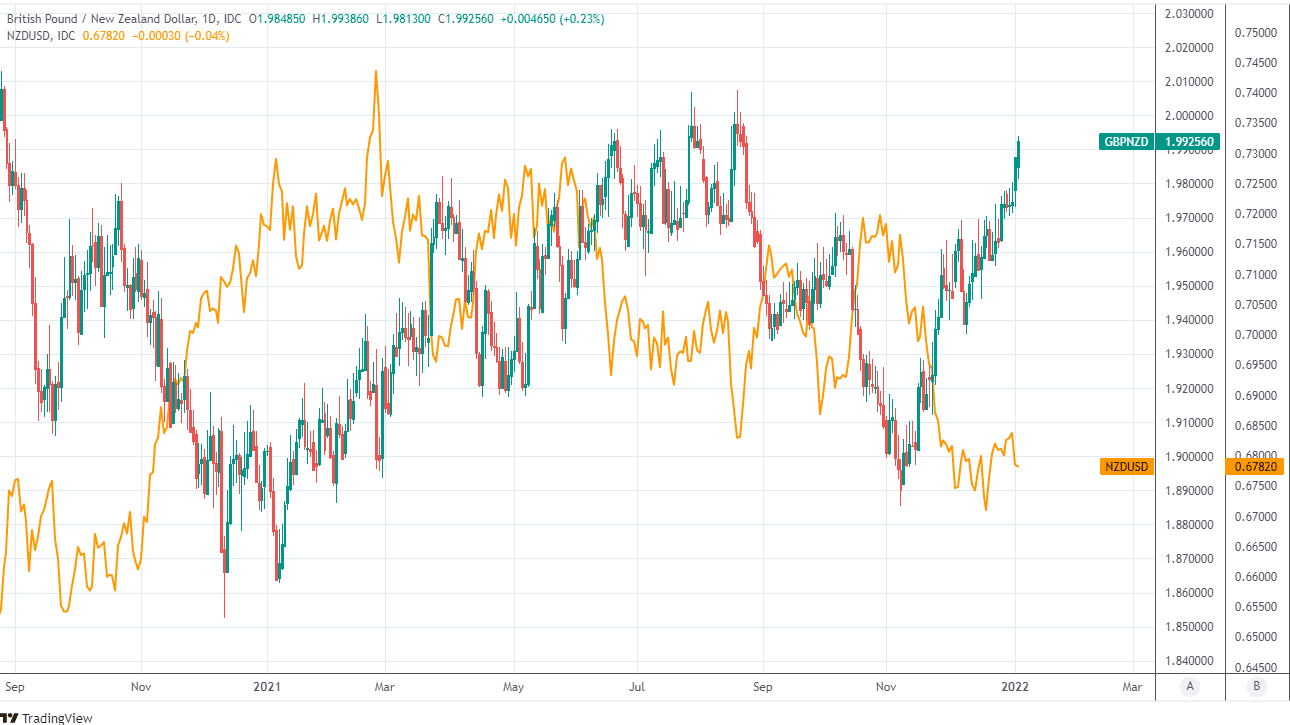

Above: GBP/NZD shown at daily intervals alongside NZD/USD.

- GBP/NZD reference rates at publication:

Spot: 1.9861 - High street bank rates (indicative band): 1.9166-1.9305

- Payment specialist rates (indicative band): 1.9682-1.9762

- Find out about specialist rates, here

- Set up an exchange rate alert, here

Sterling’s rally over Monday and Tuesday gave the British currency a tentative lead over others to open the new year and helped to lift the Pound to New Zealand Dollar rate, although this would likely be reigned in and pulled back toward 1.98 if the Kiwi happens to find its feet over the coming days.

Much about the GBP/NZD outlook through January remains to be determined by price action in NZD/USD, which has been one of the foremost casualties of the U.S. Dollar rally that began in June last year and extended through much of the final quarter.

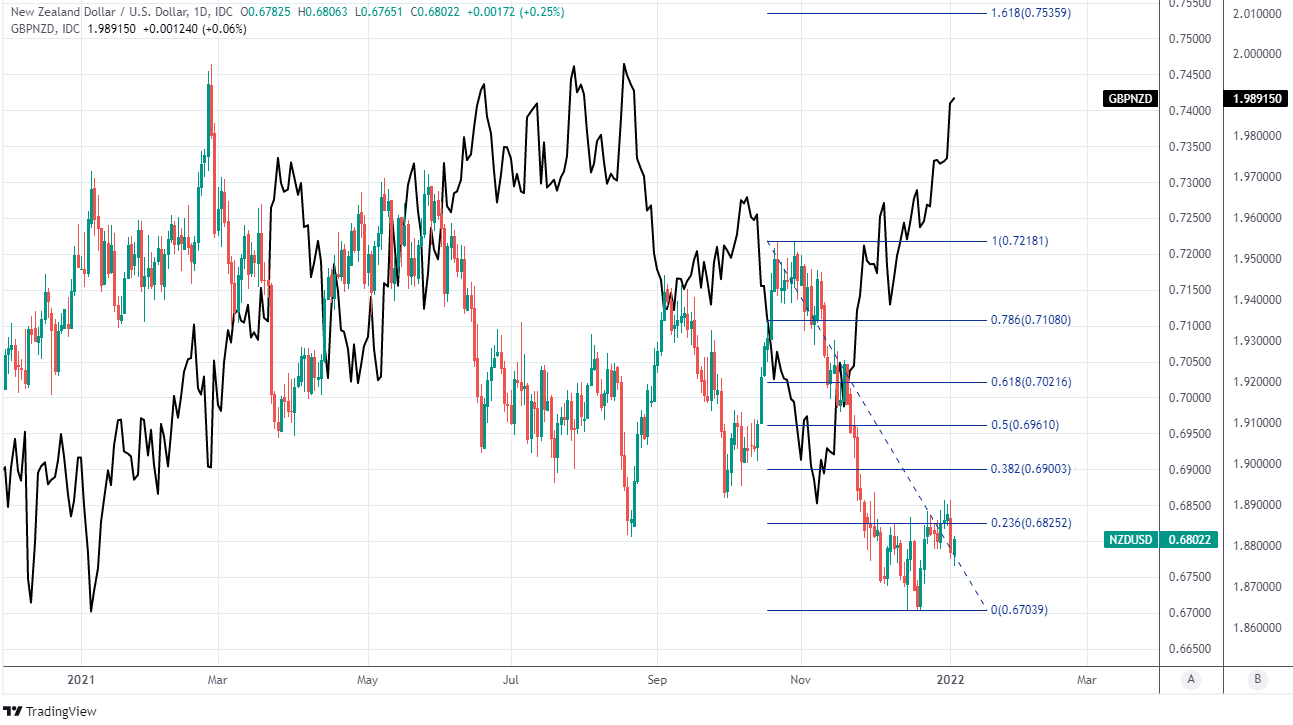

“The 0.6700 support is out-done by the cluster of resistances within the 0.6830/60 band,” says Jonathan Pierce, a currency trader at Credit Suisse, in reference to NZD/USD. “We are neutral here but will fade a stop-driven move through this level as a way to get long USD with a tight stop.”

New Zealand’s Dollar fell hard in November after it emerged that U.S. inflation had risen above 6% and the market began speculating on an acceleration by the Federal Reserve (Fed) of its plans to begin withdrawing the extraordinary monetary policy support provided in early 2020.

{wbamp-hide start}

{wbamp-hide end}{wbamp-show start}{wbamp-show end}

Since then the main Kiwi exchange rate NZD/USD has been unable to recover above 0.6850, having been repeatedly overcome by selling pressure on each approach of the level during late December and in price action that has proven uplifting of GBP/NZD.

That was very much the New Zealand Dollar story for 2021 overall with the Kiwi appearing to be overcome by the U.S. Dollar strength that resulted from the Fed’s hints in June that a withdrawal of monetary stimulus was entering the pipeline.

“NZD offers value at current levels, especially against low-yielders like EUR and CHF. It also scores well on MRSI alongside CAD and NOK, which also screen well against some funders to start the year,” says Mark McCormick, global head of FX strategy at TD Securities.

The New Zealand Dollar ended the 2021 year around the middle of the major currency rankings and was a comparative laggard during the early days of January despite the Reserve Bank of New Zealand also having begun to lift its own interest rate from 2020’s crisis-inspired low of 0.25%.

Above: NZD/USD at daily intervals with GBP/NZD. NZD/USD struggles to overcome resistance from 23.6% Fibonacci retracement of October decline.

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

Financial markets have subsequently wagered that New Zealand’s main interest rate is likely to rise from 0.75% to more than 2% over the coming year while many analysts have tipped the Kiwi as an attractive bet as a result, although GBP/NZD has remained ascendant.

GBP/NZD would likely continue to remain buoyant for as long as the recent and ongoing softness in the influential NZD/USD rate continues, and could be set to remain above 1.98 handle even if the Kiwi does find its feet again over the coming weeks.

The Pound to New Zealand Dollar rate always closely reflects the relative performances of the main Sterling pair GBP/USD and NZD/USD, and would remain afloat above 1.98 unless NZD/USD is able to overcome December’s highs near 0.6850 during the days and weeks ahead.

That’s unless the market’s recent and ongoing enthusiasm for Pound Sterling fades in the interim, either for coronavirus-related reasons or because the market rethinks its recently upgraded assumptions about the outlook for Bank of England (BoE) interest rates.

“The stronger pound has been encouraged by the BoE’s hawkish decision to follow through and start raising rates last month despite the heightened Omicron uncertainty at the time. The subsequent further scaling back of market fears over Omicron disruption and the BoE’s more hawkish reaction function has encouraged the UK rate market to price in three 0.25 point hikes by this summer,” says Lee Hardman, a currency analyst at MUFG.