HSBC Forecast Modest New Zealand Dollar Weakness in 2022

- Written by: Gary Howes

- No lift-off for the Kiwi next year

- Excitement of RBNZ hikes to fade

- NZD/USD point forecasts for 2022

- GBP/NZD point forecasts for 2022

Image © Adobe Stock

Don't look for a New Zealand Dollar rally in 2022 shows research from global lender and investment bank HSBC, which finds that expectations for interest rate rises at the Reserve Bank of New Zealand have already been absorbed by the market.

In a research pieced detailing their 2022 currency outlook, HSBC finds that there are certainly positives for investors to consider when approaching the New Zealand currency and this should keep it relatively supported, but it is not set to fly off the shelf.

HSBC says the currency has found support of late as the Reserve Bank of New Zealand (RBNZ) has been at the forefront of 'hawkish guidance' for much of 2021, i.e. signalling the need to raise interest rates, whereas other global central banks have been far more reticent.

This pushes up yields paid on New Zealand government and corporate bonds, creating an attractive return for International investors.

The New Zealand Dollar outperformed during the August-early November period as investors calibrated for higher rates at the RBNZ.

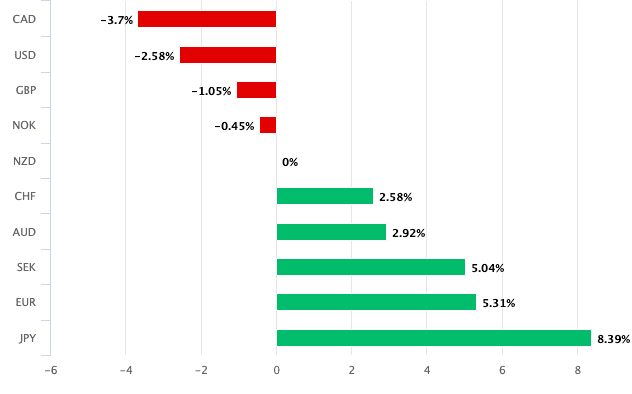

Above: Despite a strong performance in the third quarter, NZD is a middle performer for 2021 as a whole.

- GBP/NZD reference rates at publication:

Spot: 1.9260 - High street bank rates (indicative band): 1.8585-1.8720

- Payment specialist rates (indicative band): 1.9080-1.9163

- Find out about specialist rates, here

- Or, set up an exchange rate alert, here

But, it looks all but set to end 2021 as a middle-of-the-road performer as investors anticipate other central banks will play catch up in 2022, meaning the NZ Dollar could lose some support via the interest rate channel.

"On balance, we continue to expect the NZD to weaken modestly against a generally robust USD," says Paul Mackel, Global Head of FX Research at HSBC.

Mackel says there are nevertheless some reasons to be upbeat on the currency, including the economy's remarkable resilience to the recent lockdown, notably in the labour market where the unemployment rate dropped to its previous record low level of 3.4% last seen in the final quarter of 2007.

"Inflation continues to track above the RBNZ’s target range, including at the core level, and is also coming in higher than the central bank forecasted," adds Mackel.

Above: The NZD will find support from economic fundamentals says HSBC.

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

Consensus amongst economists meanwhile shows expectations for a strong upswing in activity from the fourth quarter of 2021 onwards as the economy continues to reopen.

In addition, "decelerating world activity has been a headwind for the NZD, but with global growth set to stabilise in H2 22 this should be less of an issue," says Mackel.

Despite these positives HSBC says the New Zealand Dollar is expected to remain modest as future RBNZ rate hikes are well anticipated by the market.

Furthermore while the market is priced for a sequence of rate hikes over the coming year, "it looks for nothing thereafter," says Mackel.

"The excitement of rate hikes is set to fade, if it has not done so already," he adds.

Above: Money markets are pricing in rate hikes one-year ahead, but beyond that there is little to offer by way of rate support for the Kiwi.

With regards to the pandemic situation, while the acceleration of the Covid vaccination programme is seen as supportive of the economy HSBC finds there is still uncertainty as to how consumers will adjust to “living with COVID-19” rather than the zero-COVID policy of the past.

"As we expect the USD to be broadly stronger in 2022, some modest NZD weakness from current levels seems likely overall," adds Mackel.

HSBC forecast NZD/USD at 0.71 by the end of the first quarter of 2022, an upgrade from 0.68 previously. By year-end 2022 they see the exchange rate at 0.68, up on the previous forecast for 0.67.

Utilising their forecasts for NZD/USD and the GBP/USD, gives a Pound to New Zealand Dollar cross rate forecast of 1.87 for the end of the first quarter 2022 and 1.91 for year-end 2022.