UK to Get a Pay Rise in 2018 say Bank of England; this is Positive for British Pound’s Outlook

A much-watched survey from the Bank of England suggests UK pay increases could hit 3.5% in 2018, this would be an all-out positive for the value of Pound Sterling. Here's why.

The Bank of England have just released their Agents’ summary of business conditions report - the report offers a snapshot of investment intentions amongst British businesses and is a key reference for policy makers at Threadneedle Street.

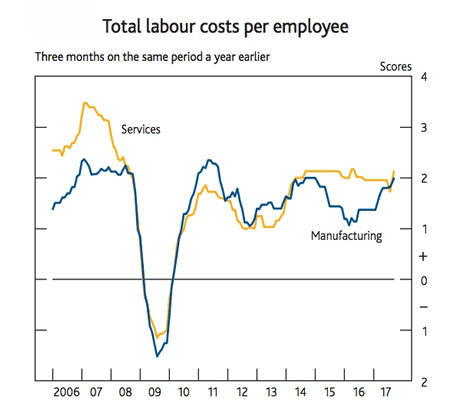

One development jumps out: expectations for pay settlements could be clustered around 2.5-3.5% in 2018, an advance on the 2-3% in 2017.

If correct, pay is going to continue rising just as inflation is forecast to ease back which would suggest real pay should be on the rise once more next year.

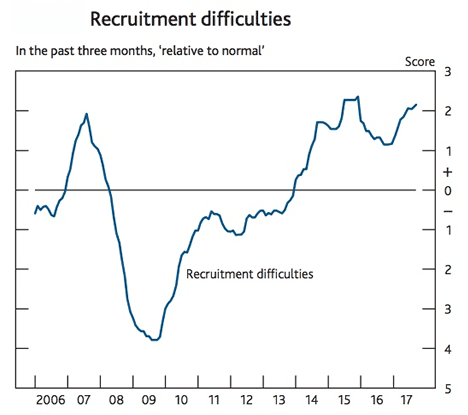

“Employment intentions pointed to modest growth in staffing over the next six months. Recruitment difficulties had increased and were above normal in a range of activities. That had contributed to a slight increase in pay growth, with expectations that settlements next year could be clustered around 2½%–3½% rather than 2%–3% during 2017,” reports the Bank of England.

As UK unemployment continues to decline, the availability of staff in the market tightens and companies are forced to offer higher wages to attract and retain talent.

The Bank has long warned this dynamic would inevitably come about, and it appears we are finally seeing this.

#BOE regional agents report slight pick up in #pay growth amid increased recruitment difficulties. Expectations pay settlements could be clustered around 2.5-3.5% in 2018 rather than 2-3% in 2017 https://t.co/Y19mFAAdxR

— Howard Archer (@HowardArcherUK) November 8, 2017

The observation appears to justify the Bank of England’s decision to raise interest rates at their November 8 meeting. Importantly for the British Pound, it confirms that the likelihood of two further interest rate rises over the next 24 months are indeed likely.

Rising pay will inevitably generate inflation, and to fight inflation the Bank will raise interest rates. Higher interest rates = a stronger Pound as global capital flows into the UK to take advantage of the higher yield on offer.

Economic growth will however likely continue to be held back by uncertainty regarding Brexit.

“Economic uncertainty was the biggest drag on investment plans. Expectations about future trading arrangements and other factors related to the United Kingdom’s decision to leave the European Union, such as concerns around the future availability of overseas labour, were also reported to be restraining investment,” says the report from the Bank of England.

However, should UK and EU politicians negotiate in good faith we would expect a transition deal and the bones of a future trading relationship to become clearer over coming months which could chip away at uncertainty.

“We continue to think that the markets are underestimating how quickly rates will rise in the UK, says John Higgins, chief markets economist at Capital Economics. “As the economy weathers the uncertainty over Brexit well.”

“Only one further 25bp increase is discounted in the overnight indexed swap (OIS) market between now and the end of 2018, whereas we anticipate that there will be three – taking Bank Rate to 1.25%,” says Higgins.

Forecasts from Higgins and the Capital Economics team now put the Pound-to-Euro at 1.2300 by the end of 2018, which is a level not seen by foreign currency buyers since before the Brexit vote in June 2016.

The Pound-to-Dollar rate, on the other hand, is forecast to sit around the 1.3500 level just more than a year from now. This is a level seen as recently as September.

Get up to 5% more foreign exchange by using a specialist provider by getting closer to the real market rate and avoid the gaping spreads charged by your bank for international payments. Learn more here.