Uber-Dove Vlieghe Ignites Fresh Pound Sterling Rally, Confirms Interest Rate Rise Necessary

- Written by: Gary Howes

-

A member of the Bank of England's rate-setting body has hammered home the message that interest rates are to rise for the first time in a decade in late-2017.

A November interest rate rise at the Bank of England is almost assured after one of the most recognised doves on the Bank of England's Monetary Policy Committee surprised markets by advocating for an interest rate rise in the near future.

Monetary Policy Committee member Gertjan Vlieghe has long been seen as the most cautious member of the MPC when it comes to raising interest rates, but that he is now also seeing a rate rise as being appropriate cements the message that a rate rise is coming.

Vlieghe told an audience at the Society of Business Economists' Annual Conference in London that "we are approaching the moment when bank rate may need to rise" and the "appropriate time for a rise in bank rate might be as early as in the coming months."

His comments are seen by some as a 'volte-face' in stance and clear the way for an almost-unanimous vote for a rate rise, most likely in November.

Indeed, it could come as early as October but we would assume that the MPC wants to see the updates to economic projections that will be issued by the Bank's economists prior to raising rates.

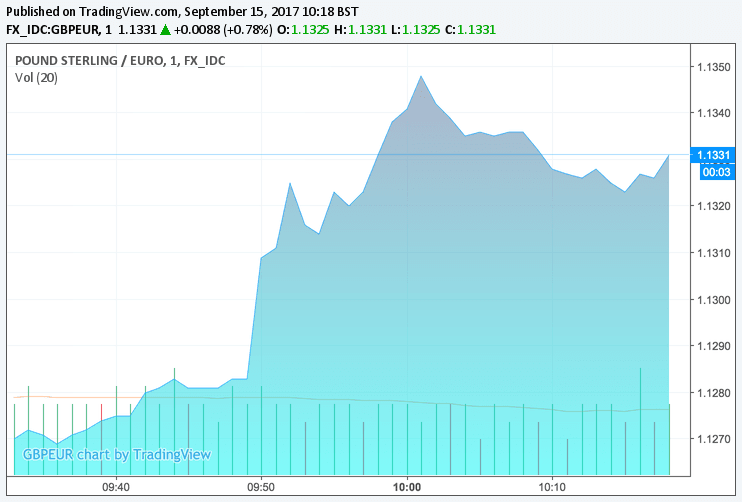

Pound Sterling jumped notably higher on the comments.

"The prospect of a rise as soon as November has been welcomed by investors, who have long been seeking a driver for the pound. The news has propelled sterling out of the weakened state it has been in over the summer after the BoE previously dismissed a rate rise. Investors will be looking to see how the pound reacts to further hints as November approaches," says Paresh Davdra, CEO of RationalFX.

The Vlieghe speech follows a similar communication issued by Bank of England Governor Mark Carney Governor hours earlier when he said in an interview that the possibility of the first U.K. interest rate hike in a decade had "definitely increased".

Vlieghe notes wage growth is not as weak as it was earlier in the year and some pay-related surveys also suggest a modest rise in wage pressure in recent months.

“If near-term Labour market trends continue, expect upward pressure on medium-term inflation,” says the economist. “There are some early signs of stronger consumption growth in Q3.”

Vlieghe adds that the equilibrium real interest rate up from the very low levels in the post-crisis period.

The economist strikes an optimistic tone saying he has "been struck particularly" by the economy's robust performance lately. Despite the slow start to 2017 he observes the acceleration in employment as being key to his newfound hawkish thinking.

"Wage growth is not as weak as it was earlier in the year: over the past 5 months, annualised growth in private sector pay has averaged just over 3%... if these near-term labour market trends continue, I would expect this to lead to somewhat more upward pressure on medium-term inflation."

“Sterling is the star of the day, gaining another 1.1% to the dollar and 2.5% up since yesterday’s BoE announcement, in part on the back of MPC member Vlieghe’s comments,” says Cristian Maggio, Head of Emerging Markets Strategy at TD Securities.

This leaves MPC members Tenreyro or Ramsden as the only candidates that potentially remain outside “the majority” says Maggio, “suggesting that November’s rate decision could be a fairly confident 7-2 or 8-1 vote for a hike.”

Pound surge continues after BoE dove Gertjan Vlieghe strikes hawkish tone. Sterling now above $1.35 pic.twitter.com/THBkeZKolF

— Jamie McGeever (@ReutersJamie) September 15, 2017

Some big technical levels have been sliced by the move and this really does reinforce the sudden shift in fortunes for Sterling.

Expect momentum and the technical outlook to turn positive as a result.

"In light of the increased probability of the BoE proceeding with an initial rate hike sooner than previously expected, we have revised up our forecasts for the pound, against both the Dollar and the Euro," says Asmara Jamaleh at Intesa Sanpaolo.

Jamaleh forecasts GBP/USD at 1.32, 1.35, 1.36, 1.37 and 1.38 on a 1m, 3m, 6m, 12m, and 24m horizon with EUR/GBP down to 0.89, 0.86, 0.87, 0.88 and 0.88. (This is GBP/EUR at 1.12-1.16-1.15-1.14).

Elsewhere, Oliver Harvey, Macro Strategist with Deutsche Bank says "it is too soon to fade the rally in GBP" referencing the prospect of some traders looking to sell Sterling on expectations for potential weakness in the future.

"Yesterday's meeting was even more hawkish than we expected and we have subsequently changed our rate call for a hike in November. With this still less than 100% priced, and given the build up in short positioning over recent weeks, we wouldn’t fade the rally in GBP just yet," says Harvey.

Get up to 5% more foreign exchange by using a specialist provider by getting closer to the real market rate and avoid the gaping spreads charged by your bank for international payments. Learn more here.