Carney + Vlieghe Double-Team on Rates Message, send Pound Sterling up Another 1.0% vs US Dollar and Euro

- Written by: Gary Howes

- Pound-to-Euro exchange rate: 1.1360, day's best: 1.1398

- Pound-to-Dollar exchange rate: 1.3583, day's best: 1.3617

The Bank of England’s Gertjan Vlieghe and Mark Carney have both appeared in the hours following the Bank of England’s September meeting and hammered home the point that interest rates are to rise.

Gertjan Vlieghe - one of the most cautious members on the Bank of England's Monetary Policy Committee - has surprised markets by advocating for an interest rate rise in the near future.

Vlieghe has long been seen as the most cautious member of the MPC when it comes to raising interest rates, but that he is now also seeing a rate rise as being appropriate cements the message that a rate rise is coming.

Vlieghe told an audience at the Society of Business Economists' Annual Conference in London that "we are approaching the moment when bank rate may need to rise" and the "appropriate time for a rise in bank rate might be as early as in the coming months."

Pound Sterling jumped notably higher on the comments.

The Vlieghe speech follows a similar communication issued by Bank of England Governor Mark Carney Governor hours earlier when he said in an interview that the possibility of the first U.K. interest rate hike in a decade had "definitely increased".

"The prospect of a rise as soon as November has been welcomed by investors, who have long been seeking a driver for the pound. The news has propelled sterling out of the weakened state it has been in over the summer after the BoE previously dismissed a rate rise. Investors will be looking to see how the pound reacts to further hints as November approaches,” says Paresh Davdra, CEO of RationalFX.

The comments come hours after Sterling rallied sharply in the wake of the Bank of England's September meeting where it was suggested interest rates would need to rise faster than markets are presently expecting.

"The majority of members of the (Monetary Policy) Committee, myself included, see that that balancing act is beginning to shift, and that in order to ... return inflation to that 2 percent target in a sustainable manner, there may need to be some adjustment of interest rates in the coming months," the Governor said in an interview at a school in London while launching the new ten pound note.

"Now, we will take that decision based on the data. I guess that possibility has definitely increased," he adds.

The comments confirm the Governor to be part of a group of MPC members who believe higher rates are warranted. Typically the Governor is always on the winning side of the vote; hence their importance.

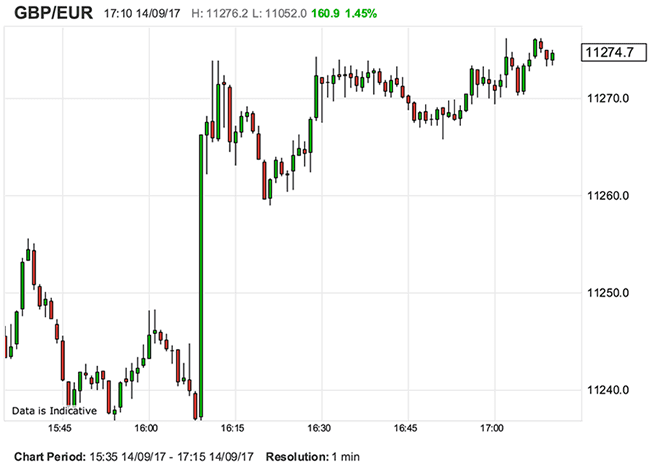

Above: Sterling gets a fresh leg up in late London trade as the Bank's message on interest rate rises are reinforced.

The comments come in the wake of the Bank of England's September policy update where it warned markets were too complacent in their pricing of future interest rate rises.

The comments appear to cement the communication that an interest rate rise is coming in November when the Bank delivers its next Inflation Report.

This will further underpin the Pound which has taken heart from signs the Bank is looking to raise interest rates in the near future.

The run higher in the British Pound continues as a result:

The strong showing by Sterling in the wake of rejuvenated interest rate hike expectations confirms the Bank of England is arguably THE key driver of Sterling value.

Brexit has been blamed for the decline, but the question being asked is just how much damage would Brexit have done without the assistance from the Bank of England? Of course it is hard to separate the two as the Bank builds and acts on assumptions tied to Brexit; but it does highlight just how much power over the currency the Bank does have.

“The surge in the Pound at the hint of a rate rise suggests that Bank of England policy since the Brexit vote significantly added to Sterling’s weakness in the past year,” says former Bank of England policy-setter Andrew Sentance.

It appears the Bank is now assisting in a recovery to fair values then.

Be Safe! This Might not be the Start of Some Major Recovery

While Sterling has moved higher, some seasoned market professionals are urging caution.

Brent Donnelly, a spot FX Trader with HSBC Holdings in New York has told clients in a morning briefing why he is not going to be looking to chase the Pound higher.

"At the risk of missing a major move higher in GBP, I am staying away. It is also not prudent to go short right now after such a hawkish announcement but note the huge levels in UK yields and GBJPY around here. I urge extreme caution on GBP bullishness," says Donnelly.

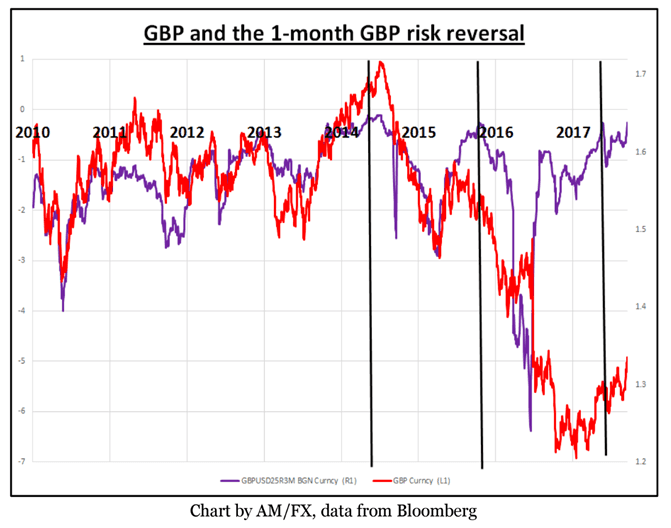

The trader has put together a chart showing the GBP/USD's performance versus one-month risk reversals.

In the above, the red line is GBP/USD, the purple line is the one-month risk reversal.

The black vertical lines show when the 1-month risky pushed up to current levels.

What happens to the Pound after it passes the black line?

"So really there is no call to action here. My only suggestion is that long GBP will be about as fun over the next few months as short GBP was over the previous few. And don’t be too shocked if the BoE never ends up hiking this year," says Donnelly.

Get up to 5% more foreign exchange by using a specialist provider by getting closer to the real market rate and avoid the gaping spreads charged by your bank for international payments. Learn more here.