Why Inflation Data Presents a Lose-Lose Scenario for Pound Sterling

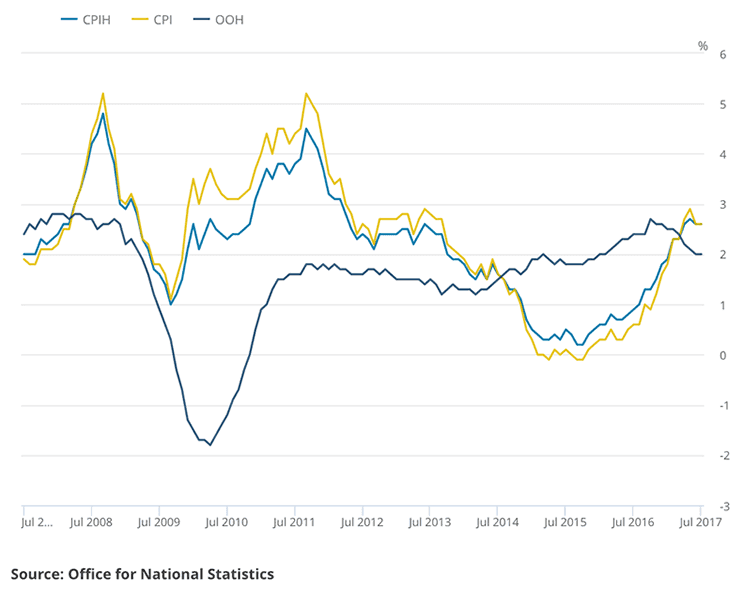

UK inflation data released by the ONS on August 15 has come in below economist forecasts and are suggestive that the recent trend of accelerating prices might be at a turning point.

This should be good news for the consumer - and by extension the economy - who has witnessed their pay-packet undermined by rising prices over recent months.

The key data to watch from a currency perspective was always going to be core CPI - this is the inflation generated by domestic demand and reflects organic strength in the economy.

Core CPI was forecast at 2.5% but came in at 2.4%.

The headline CPI figures was forecast to read at 2.7%, up on last month's 2.6% but again read at 2.6%.

The latest data might suggest the UK's bounce in inflation might actually peak before it reaches 3% - a level seen by many economists as being the top in the current round of increases.

The impact on Sterling exchange rates has been negative, and arguably would have been negative if inflation had beat expectations!

The rule of thumb is falling inflation = a weaker currency as it lessens the need for central banks to raise interest rates.

The Bank of England might not have an inflationary headache on its hand and might not have to raise interest rates in the near-future; hence Sterlings fall.

The Pound to Euro exchange rate has reversed earlier gains and now sits at 1.0993 while the Pound to Dollar exchange rate is decisively below the key 1.30 level at 1.2925.

But, we suspect if inflation had beaten expectations the Pound would still have suffered.

Why? Inflation data currently presents a lose-lose narrative for Sterling - inflation is still outstripping pay growth and that it came in below analyst forecasts will be of little comfort for consumers.

Much of the recent slowdown in the economy is because consumer purchasing power has been diminished by rising prices.

Therefore, signs that inflation might have peaked should be good for the economy and good for the Pound in extension.

But, today’s inflation data reinforces an unrelenting negative narrative on Sterling where the currency reaction was always likely to be down.

Analyst Jordan Rochester at investment bank Nomura suggests that there is always likely to be a lose-lose on inflation data owing to an entrenched Brexit bias in the markets:

"Look back at market commentary when UK inflation was rising and you would see the prevailing view was that it was ‘bad for real incomes and so sell GBP’. But when CPI turned lower last month the market train of thought switched to ‘falling inflation means the BoE won’t hike; sell GBP again’.”

The Pound simply can't win.

If inflation had beaten expectations it would likely have been sold on the view that inflation is out of control and the economy is going to suffer as a result.

For now it looks like the overarching theme on markets is to sell the Pound.

Is the fall in value of Sterling impacting your international payments? Get up to 5% more foreign exchange by using a specialist provider by getting closer to the real market rate and avoid the gaping spreads charged by your bank for international payments. Learn more here.

FSB Blames Inflationary Pressures on National Living Wage Increase

It might not just be a devaluation in the value of Sterling that is driving UK inflation higher.

The Federation for Small Businesses has said the recent rise in the living wage has heaped pressure on small business owners who have had to pay themselves less and raise prices.

The ONS has on Tuesday, August 15 announcement that the Consumer Prices Index (CPI) remains above the Government’s 2% target at 2.6% and the Retail Prices Index (RPI) has increased to 3.6%.

“Operating costs for small firms are now at their highest in four years. Increasing inflationary pressure has coincided with a bruising business rates revaluation and rising employment costs. Our entrepreneurs are paying themselves less and further increasing prices in an attempt to handle the strain. Four in ten small firms raised prices in response to April’s National Living Wage increase,” says Mike Cherry, National Chairman at the FSB.

However, other factors are in play.

A hike in rail fares in line with today’s RPI will put further pressure on the consumer pocket, leaving all concerned with less to spend and invest.

Cherry has called on the Government should consider whether this inflationary measure is fit for purpose in the twenty-first century.

“The Chancellor needs to give very careful consideration to the upcoming Budget. With small firms feeling the squeeze, any increase in insurance premium tax, fuel duty or other stealth taxes will be bad for investment and job creation. We need to see all tax reliefs maintained, not least entrepreneurs’ relief, which represents an important incentive for our business owners,” says Cherry.