BoE's Cunliffe Knocks the Wind Out of Pound Sterling Bulls

Deputy Governor of the Bank of England, Sir Jon Cunliffe, has tacitly expressed a preference for keeping interest rates unchanged.

The move aligns the Deputy Governor with Governor Carney and confirms a core alliance that will stand against those members of the Monetary Policy Committee agitating for an interest rate rise.

The debate over raising interest rates is a core matter for the British Pound's outlook as conventional wisdom suggests that currency's tend to rise when their central bank is raising interest rates.

The Pound was seen mixed following the development.

An inflation rate of 2.9% which would normally trigger a rate hike, however due to soft wage growth and Brexit uncertainty the BOE has held back.

Cunliffe's argument is that the Pound - weak ever since the Brexit referendum - is responsible for high inflation and that wage pressures remain too low to safely raise rates.

Inflation at above the 2 percent target is “not a comfortable place,” Cunliffe told the BBC. “We do have to look at what’s happening with domestic inflation pressures and on the data we have at the moment, that gives us a bit of time to see how this evolves”.

This puts Cunliffe in the Carney camp of BOE doves (doves are those who are against lifting interest rates) rather that with the hawks (who do wish to raise interest rates), and his support means it will probably be difficult for the hawks to win a majority at the next BOE meeting in August.

This is likely to put downwards pressure on Pound Sterling which is highly correlated with interest rates, because higher rates draw more international capital to the UK.

“The Bank of England’s next interest rate decision is scheduled for August 3rd. This will be an exciting vote, but I don’t think there’s enough support for an interest rate hike among the Monetary Policy Committee,” said the Guardian’s Graeme Wearden commenting on the news about Cunliffe.

Wearden then goes on to estimate how each member of the committee will vote in August to ascertain whether the hawks or doves are likely to win.

Arch-hawk Kirstin Forbes has already seen her term at the Bank expire so that will be one less voting for a hike but, “as things stand, we can expect Ian McCafferty and Michael Saunders to vote for a quarter-point rate rise again (as they both did at June’s meeting),” says Wearden.

Andy Haldane, BoE chief economist, “could also join them, following his hint last week that rates should rise later this year,” he adds, however he held off in June due to his concerns about low wages and Brexit uncertainty, which are unlikely to have alleviated by August.

“At least four MPC members are firmly in the no-change camp. It’s also hard to see Ben Broadbent, the other deputy governor, defying Carney,” added Wearden, on the Guardian’s Business Live Blog.

Finally, Gertjan Vlieghe, the former hedge fund economist, “is another likely dove (he’s argued that it’s better to tighten too late than too early),” said the journalist.

The most recent addition to the MPC, is economist Silvana Tenreyro, whose term starts in July, however, her position is not known.

Previously analysts have argued she is likely to side with doves initially.

“If Hogg hasn’t been replaced by August, then there could be a 4-4 split, giving Carney the casting vote,” concludes Wearden.

The Bank Doesn't Matter for the Pound Anyway

We report today that there is some scepticism amongst financial market professionals as to just how important the Bank really is when it comes to driving Sterling values.

Simon Penn, a trader at UBS, meanwhile says that to raise interest rates now would actually have an all-out negative impact on the Pound.

“It could be argued that raising rates would only make matters worse, causing the economy to slow more sharply and therefore undermining rather than supporting the Pound,” says Penn.

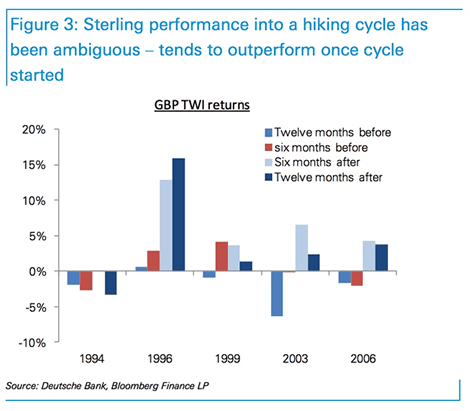

And analyst Oliver Harvey at Deutsche Bank says his findings show Sterling performance around Bank of England hiking cycles has been “ambiguous at best”.

Since the inflation targeting regime was adopted in 1992, Harvey finds the Pound has weakened into hiking cycles three times out of five. By contrast, Sterling tends to outperform after the cycle has already begun.

Outlook for Pound Negative

Banco Intessa San Paulo Economist Luca Mezzomo also sees a negative outlook for the Pound.

First, he notes how Sterling has actually risen broadly in 2017, against the odds, as the economy has held up better-then-expected following Brexit.

Recent data, however, indicates this uptrend is not likely to continue, after Q1 GDP came out much lower than expected, at 0.2% versus 0.7% forecast.

This is due to falling consumption as a result of declining real earnings, because of high inflation eating into people’s pay packets.

Mezzomo thinks there is a high chance the August Inflation Report (IR) will show downward revisions to growth forecasts and upward revision to inflation, as those in the May report have already proven overly optimistic.

In the May report, for example, the BOE forecast inflation at 2,8% by the end of 2017, but it has already risen above that to 2.9% by May, and this high inflation, “in the presence of still moderate wage growth – points to a persistently weak consumption trend later in the year,” said Mezzomo.

In its May IR the BoE only marginally revised down estimated growth in 2017 from 2.0% to 1.9%, while revising up its forecast for the 2018-2019 biennium from 1.6% to 1.7%.

“However, the latest data, combined with political developments, suggest a slightly pejorative revision (downwards for growth, upwards for inflation) – at least for this year – in the IR due to be published on occasion of the next BoE meeting on 3 August,” said Mezzomo.

This downwards revision is likely to weigh on the Pound, and make it even less likely the hawks of the BOE will succeed in getting a majority to vote to raise interest rates.

Mezzomo also sees a further risk from the BOE’s base-line expectation of a rather optimistic “smooth Brexit” scenario.

“The central bank has made it clear that its analyses are built on the assumption of a 'smooth Brexit'. At the same time, the BoE expects the slowdown in consumption to be offset by export and investment growth, which should be supported by the combination of a weaker exchange rate and an improvement of the global growth picture,” says Mezzomo.

Nevertheless, Mezzomo also sees the unclear election result as increasing the chances of a smoother rather than a harder Brexit, and suggests the benign opening shots of negotiations reflect this:

“An initial indication in this direction came with the official opening of negotiations with the EU on 19 June, as the United Kingdom accepted the EU’s condition of taking on the issues of the exit bill (estimated at around 100 billion euros) and of the rights of EU citizens living in the United Kingdom, and vice versa, before starting to discuss the terms of future trade relations,” said the Intessa San Paulo analyst.

However, he is also of the view that the most benign outcome for the economy and therefore Sterling – that of remaining in the Common Market - is increasingly unlikely given one of the first bills to be put before Parliament will be for immigration control which will discount continued membership of the trading block, as one of the keystones to membership is freedom of movement.

Therefore, the slightly improved but still highly uncertain Brexit outlook could still be a weight on the Pound, and Mezzomo finally concludes that, “in light of the uncertainty produced by the electoral result, and considering the possibility of the BoE revising down slightly its growth projections in the August IR, while raising its inflation forecasts (at least for this year), the Pound could weaken further in the near term.”

He sees downside limited to the mid-upper end of the GBP/USD 1.20-1.25 range, and EUR/GBP to the 0.88-0.90 band, as “easing risk of a hard Brexit and/or a no-deal exit, reduces the negative fallout on the British economy.”