Pound Sterling Firms: Rising Incomes and Falling Inflation Boost UK Q1 Economic Growth

- Written by: Gary Howes

Image © Adobe Images

The British Pound firmed ahead of the weekend, helped in part by news UK's economy grew more than was previously estimated in the first quarter of this year as the impact of rising incomes and falling inflation took hold.

According to new statistics, UK Gross Domestic Product (GDP) expanded 0.7% quarter-on-quarter in Q1, exceeding the first ONS estimate for 0.6%. On a year-on-year basis, the economy expanded 0.3%, which was more than the previous estimate of 0.2%

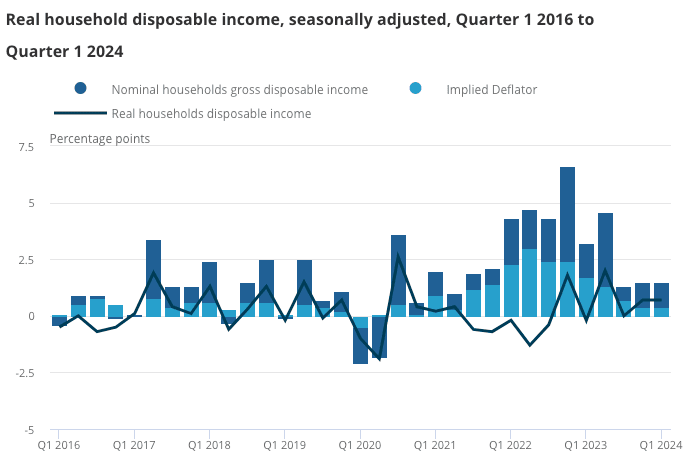

"As the fall in inflation has outstripped that in wage growth, real household disposable incomes (RHDI) have been rising, supporting the economy," says Ellie Henderson, an economist at Investec.

The ONS said RHDI growth at 0.7% quarter-on-quarter, matching the pace of expansion of Q4 – "a robust pace of income growth," says Henderson.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

"The economy rebounded strongly from last year's recession," says Rob Wood, Chief UK Economist at Pantheon Macroeconomics, warning that the Bank of England might forgo an interest rate cut in August owing to strong economic growth.

Pound Sterling has been through a soft patch over recent days, but these data are helping the currency firm against both the Euro and Dollar ahead of a risk-filled week that will include French and UK elections. "These GDP data come ahead of a potentially volatile week for European currencies," says Russell Gous, Editor-In-Chief of TopMoneyCompare.com.

Wood says the UK economy will continue to deliver robust growth, which will potentially delay a Bank of England interest rate cut. "Growth even further above potential in H1 2024 may give the MPC some pause for thought, and supports our call that rate-setters will wait until September before cutting Bank Rate for the first time," says Wood.

The Bank of England's June meeting minutes indicated enough members of the MPC were wavering on a decision to keep interest rates on hold to suggest they are close to cutting. The odds of an August cut are deemed to be around 50/50, according to market pricing.

However, a strong economy with rising real incomes will mean demand will stay strong enough to frustrate further declines in inflation.

"Looking ahead, our story for 2024 is all about the consumer. We expect real household disposable income to rise 2.2% in 2024 as inflation slows and wage growth remains strong. Cuts to National Insurance Contributions and the government uprating benefits in line with last year’s inflation also add 0.8pp to real disposable income growth in 2024. That income growth should flow through one-for-one to consumer spending," says Wood.