Pound Sterling: Big Drop In Inflation Triggers Falls Against Euro and Dollar

- Written by: Gary Howes

Image © Adobe Stock

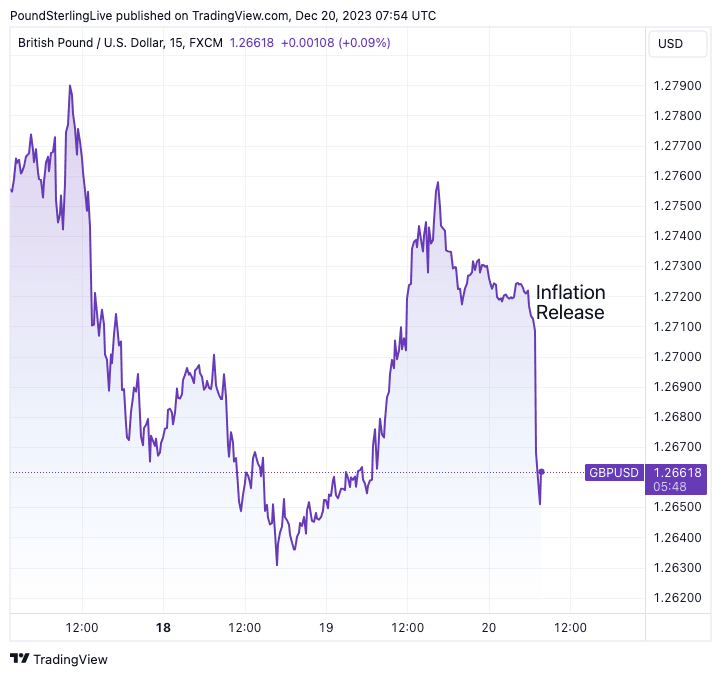

The British pound fell after it was reported UK inflation slowed by a far greater rate in November than had been expected by financial markets.

The Pound to Euro exchange rate dropped 0.40% to 1.1545 after the ONS said inflation fell from 0% month-on-month in October to -0.2% in November, which was lower than the 0.2% increase the market expected.

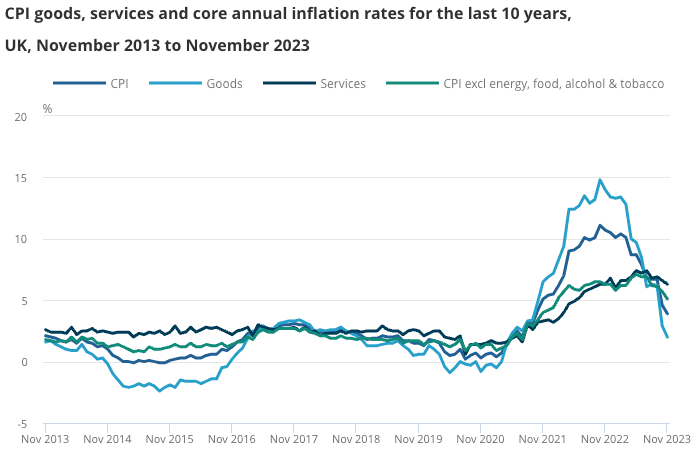

Markets ratcheted up expectations for Bank of England rate cuts in 2024 after CPI inflation printed at 3.9% year-on-year in November, down from 4.6% in October, whereas the market anticipated a reading of 4.3%.

The Pound to Dollar exchange rate fell 0.38% to 1.2660 (see below chart) as investors bet there was now enough progress in inflation to allow the Bank of England to become more comfortable with the idea of cutting interest rates in 2024. "With more rate cuts priced in, GBP, to no surprise, is falling," says Thanim Islam, Head of FX Analysis at Equals Money.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

"This really pushes back on the idea that UK inflation is stickier than elsewhere; it really isn't," says Viraj Patel, a strategist at Vanda Research, who says a May rate cut is now 'live'.

The services sector inflation level, which the Bank of England is particularly watchful of, eased from 6.6% y/y to 6.3% in November.

Core inflation, another area of interest for the Bank as it strips out volatile energy and food and gives a better reflection of domestic inflation pressures, rose 5.1 y/y, down from 5.7% and below the expectation of 5.5%. To put this downside surprise into context, the lowest estimate out of 28 economists surveyed by Bloomberg was 5.2%.

BREAKING: "I can't believe it... This is just a shockingly low print"

— Bloomberg UK (@BloombergUK) December 20, 2023

As UK inflation unexpectedly drops to a two-year-low of 3.9%, Mark Cudmore offers his instant analysis https://t.co/gdZOdgEPEc pic.twitter.com/Klza68uqIS

The outcome resulted from an unexpected -0.3% m/m core inflation reading in November, down from 0.3% in October and below the consensus for 0.2%.

While the Pound has taken a near-term hit, the fall in inflation is all the better for UK consumers and bolsters the UK's economic outlook. This should be a supportive development for Pound Sterling in the medium term.

Track GBP with your own custom rate alerts. Set Up Here.

Jake Finney, economist at PwC, says the decline in inflation provides strong evidence that disinflationary pressures are building in the UK.

"Headline, core and services inflation are all now materially below the Bank of England’s expectations in their last November Monetary Policy Report. Next month's inflation data is likely to follow a similar trend," he says. Economists still expect headline inflation to increase slightly early in the new year as the CPI basket is re-weighted and the household energy price cap is increased by 5%.

Reacting to the positive inflation surprise, the overnight index swaps (OIS) market showed investors added to rate cut bets for 2024 and 2025.

Above: Rate cut expectations have increased significantly today. Chart updated 09:14 GMT, 20/12/23. Source: Refinitiv. Courtesy of @Capital Edge

The OIS market implies investors are now looking for roughly five cuts in 2024, with the bank rate falling from 5.25% to around 4.0%, followed by four more cuts in 2025 to a year-end rate of c3.0%.

"Following the big downward shift in BoE rate expectations in recent months, the OIS market is now roughly in line with our own year-end calls for 2024 and 2025 which we have held since June," says Kallum Pickering, Senior Economist at Berenberg.

"Although Bank of England (BoE) policymakers are at pains to push back against growing rate cut bets for 2024 while inflation is still well above target, the direction of travel for prices now seems clear," he adds.

Despite the fall in inflation, some economists warn market expectations for the timing of the first rate cut in May, as well as the total for 2024, are excessive.

"We expect the Bank of England to face more intensive debate about when it can cut interest rates, but to try and push against this whilst it waits for reassurance that the inflation battle really has been won," says Victoria Clarke, UK Chief Economist at Santander CIB.

Santander says the Bank of England will only gain the comfort it needs to start cutting interest rates in summer 2024, implying rate cut expectations must reverse at some point.

If they do, the Pound can recover.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes