Pound Sterling: A Last Hurrah for Record Wage Growth

- Written by: Gary Howes

- UK wages grow at record rates

- GBP rallies but then pares advance

- Ensuring inflationary pressures to remain elevated

- But job losses mount and unemployment rate rises

- Points to future softening in wages

Image: Dave Collier, sourced: Flickr, licensing: CC 2.0.

The British Pound jumped against the Euro and Dollar after UK wage data came in stronger than expected, although gains soon faded amidst signs of rising unemployment that confirm the Bank of England might be able to pause its interest rate hike cycle in the final quarter of the year.

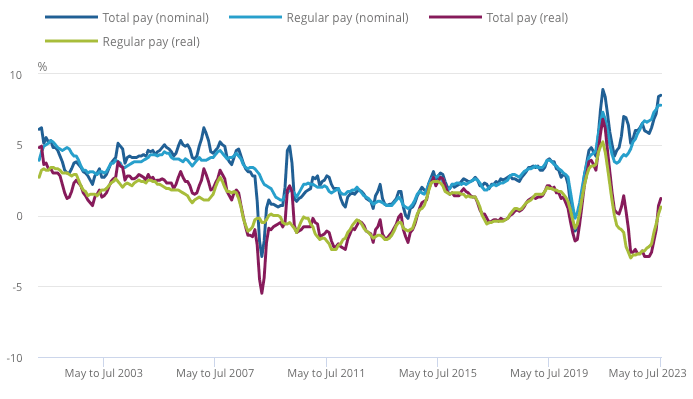

The annual growth in employees' average total pay (including bonuses) reached a new record at 8.5% in May to July 2023 reported the ONS, a figure that exceeds consensus expectations for growth of 8.2% and represents an increase on the upwardly revised 8.4% for the three months to June.

Pound Sterling and UK bond yields were higher in the immediate wake of the numbers, a signal that the market has raised expectations for the scale of further interest rates still required to bring inflation lower in the UK.

The Bank will be particularly concerned about a wage-price spiral emerging, whereby wages beget higher prices charged by businesses which in turn begets further wage increases, ensuring inflation remains well above the Bank's 2.0% target.

"The persistence of excessively vigorous wage growth in July probably means the MPC can’t stop raising Bank Rate at this month’s meeting," says Samuel Tombs, Chief UK Economist at Pantheon Macroeconomics.

The Pound to Euro exchange rate rose as high as 1.1668 as an initial response to the developments before the gains were pared to 1.1642, suggesting the market reaction will ultimately remain relatively limited.

The Pound to Dollar exchange rate rose as high as 1.2529 before paring the advance to 1.25.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

"The Pound shrugs off hot wage growth data," says Raffi Boyadjian, Lead Investment Analyst at XM.com. "Even 2023’s star performer – the pound – hasn't been able to put up much of a fight against the greenback in this latest round as the Bank of England has hinted that UK rates are close to peaking."

Pound Sterling's inability to hold the highs could be explained by the backwards-looking nature of the pay data, with the ONS reporting a sizeable one-off bump in pay to public sector workers (particularly the NHS).

Simon French, Economist at Panmure Gordon, says the most timely evidence for the Bank of England suggests a considerable softening of nominal wage inflation. "All the headline measures are picking up big moves in the rearview mirror."

The annual wage growth (which excludes bonus payments) came in at 7.8% in July, which was both unchanged in June and in line with consensus.

Above: Average weekly earnings annual growth rates in Great Britain, seasonally adjusted, January to March 2001 to May to July 2023.

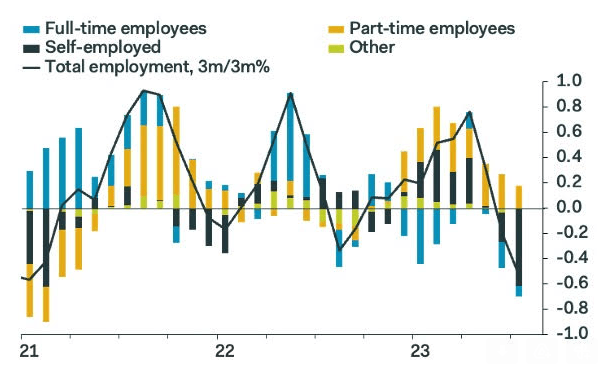

Elsewhere, the headline unemployment rate rose to 4.3% in July said the ONS, up from 4.2%, in a sign of steady easing in the labour market that suggests the trend of elevated pay increases will likely not be sustained.

The Bank of England - which signalled last week that the end of the interest rate hiking cycle was close - will also consider that unemployment declined 207K in the three months to July, which was a jump on the previous reading of -66K and the expected decline of 185K.

"These numbers show some signs the UK labour market could be softening a touch, with a modest increase in unemployment. Add that to recent weakness in UK PMIs, and impending job losses from Wilko’s high profile closure and you can see why suggestions are starting to emerge that the Bank of England can pause future interest rate rises," says Nicholas Hyett, Investment Manager at Wealth Club.

The Pound's initial spike in response to the headline wage figures therefore looks at risk of fading based on the details contained elsewhere in the report.

Above: Employment is cooling. Image courtesy of Pantheon Macroeconomics.

The number of job vacancies in the economy meanwhile declined further by 64K to 989K.

Samuel Tombs, Chief UK Economist at Pantheon Macroeconomics, says the end of the tightening cycle is not far off now as labour market slack is continuing to increase at a faster rate than the Bank of England expected in last month's Monetary Policy Report, consistent with wage growth slowing markedly towards the end of this year.

The Bank will note the unemployment rate is now already above its 4.1% forecast for the third quarter and in line with its estimate of its equilibrium rate, 4.25%.

In addition, Tombs notes the three-month average vacancy-to-unemployment ratio—commonly referenced by the MPC as the best indicator of labour market tightness—declined to 0.71 in July, from 0.72 in June and a peak of 1.05 in August 2022.

In fact, it is now almost back to its average level in 2019, 0.63.

"We still expect wage increases to slow soon, averaging 0.4% per month in the second half of this year, and for the MPC to hike Bank Rate by 25bp this month and then calls it quits, leaving it at 5.50% until starting to reduce it from Q2 2024 onwards," says Tombs.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes