Goldman Sachs Raises Pound Sterling Forecast against Euro, Unchanged against Dollar

- Written by: Gary Howes

Image © Adobe Images

Wall Street's biggest banking name has raised its forecasts for the British Pound as it bets the Bank of England will have to radically alter its pessimistic forecasts in May.

Goldman Sachs says it is turning more constructive on the Pound's prospects amidst a broadly improved domestic environment, but it is still too soon to get outright positive.

"We no longer look for idiosyncratic GBP weakness, as investor sentiment on the fiscal side has improved meaningfully," says Michael Cahill, a foreign-exchange specialist at Goldman Sachs Research.

Upgrades to Goldman's forecasts for the Pound against the Euro and Dollar follow the Bank of England's Thursday 23 interest rate hike and guidance update, where it said the UK economy is still likely to have been broadly flat around the turn of the year, but is now expected to increase slightly in the second quarter.

This is a marked upgrade on the 0.4% decline anticipated by the Bank's economists in February.

Regarding the outlook, the Bank said it would lean heavily on upcoming data when determining whether to hike again in May, a message repeated by Governor Andrew Bailey in a speech to the London School of Economics on Monday.

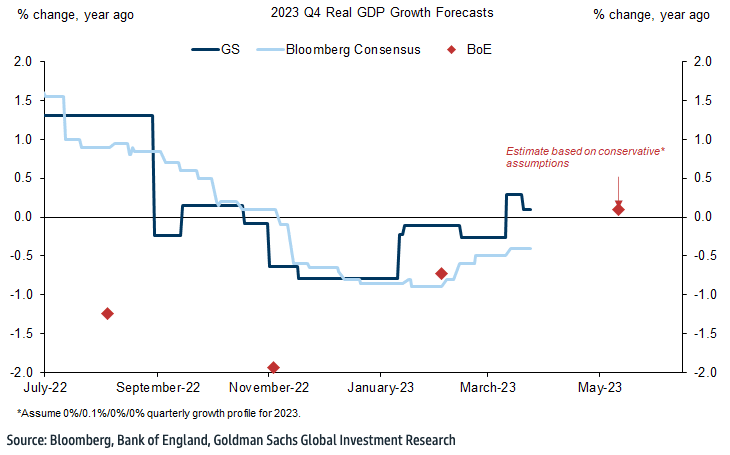

Above: "Even conservative assumptions suggest another meaningful upward revision to BoE growth forecasts in May" - Goldman Sachs.

The Bank of England's growth forecasts are important for the Pound's outlook according to Cahill, who argues the Bank leaned on bearish growth forecasts throughout 2023 to justify an "under-delivery" when it came to interest rate hikes.

The Bank has proven a 'reluctant hiker' over recent months as it tended to deliver smaller interest rate hikes than the market was expecting or delivered guidance that castigated the market for expecting too much by way of future hikes.

This under-delivery was often associated with a weak Pound. Indeed, data reveals the Pound has been dependable in falling in the wake of Bank of England decisions.

But this run was snapped on Thursday with Sterling actually recording a gain.

Goldman Sachs downgrades its six- and 12-month EUR/GBP forecasts to 0.88 (from 0.89 and 0.90 previously).

It keeps its three-month forecast unchanged at 0.89, "because BoE dovishness could continue for a bit longer."

This gives a Pound to Euro exchange rate forecast of 1.1364 for the coming six months, an upgrade from 1.11 previously and an unchanged 12-month target at 1.1236.

"We would consider turning even more positive on GBP if we became confident in a revised approach from the BoE," says Cahill.

The Pound to Dollar exchange rate forecast is set at 1.18 for a three-month horizon, 1.19 for a six-month horizon and 1.25 for a 12-month horizon.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes