Budget 2024 is Poor Value for Pound Sterling

- Written by: Gary Howes

Why is the Pound down following the budget? Despite a surge in borrowing, OBR projections show the UK economy will experience weaker growth levels in the coming years than previously forecast. This represents incredibly poor value for UK taxpayers and international investors, whose confidence in the Pound relies on this.

Chancellor Rachel Reeves. Picture by Kirsty O'Connor / Treasury

The British Pound and bonds fell as markets gave the thumbs down to Chancellor Rachel Reeves' first budget.

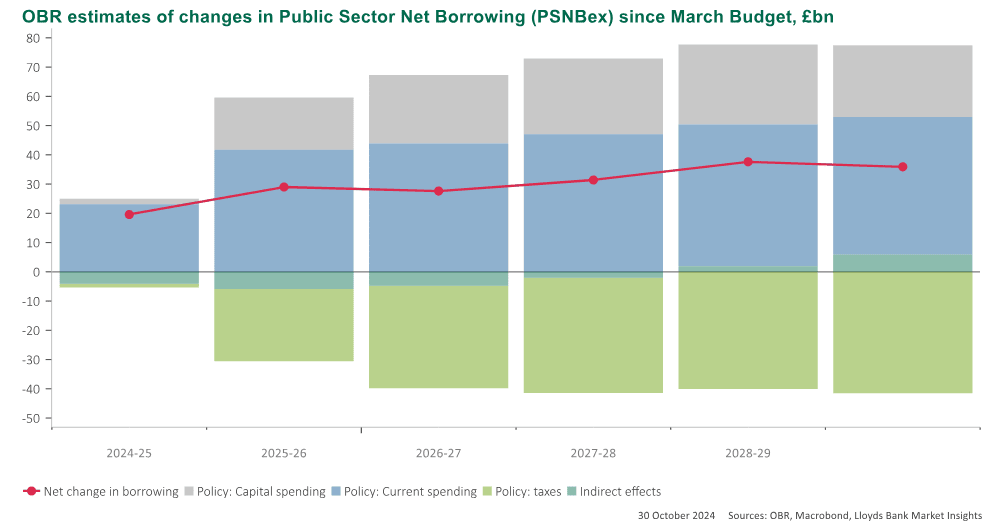

Reeves said the new Labour government would add at least £142BN in additional borrowing to the country's already substantial debt pile over the next five-year period.

However, this was not enough to meet the government's planned spending increase of £70BN per year over the next five years, and Reeves announced a significant £40BN increase in taxes to accompany the borrowing spree.

Two-thirds of the increased expenditures go toward day-to-day spending, while one-third goes toward investments. Reeves changed the fiscal rules that govern the government's spending and borrowing plans to give herself more room to increase the public debt.

Investor unease was evident as Sterling fell and bonds were sold: The Pound to Euro exchange rate fell 0.72% on the day to close at 1.1937, and the Pound to Dollar exchange rate was down half a per cent at 1.2961.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

"When the numbers were seen in plain view, UK markets reacted nervously. Having initially fallen, 10-year gilt yields jumped by as much as 20bps at one stage while sterling sold off," says Philip Shaw, an economist at Investec.

Investors would have welcomed the plans if they thought this increased spending would yield stronger growth.

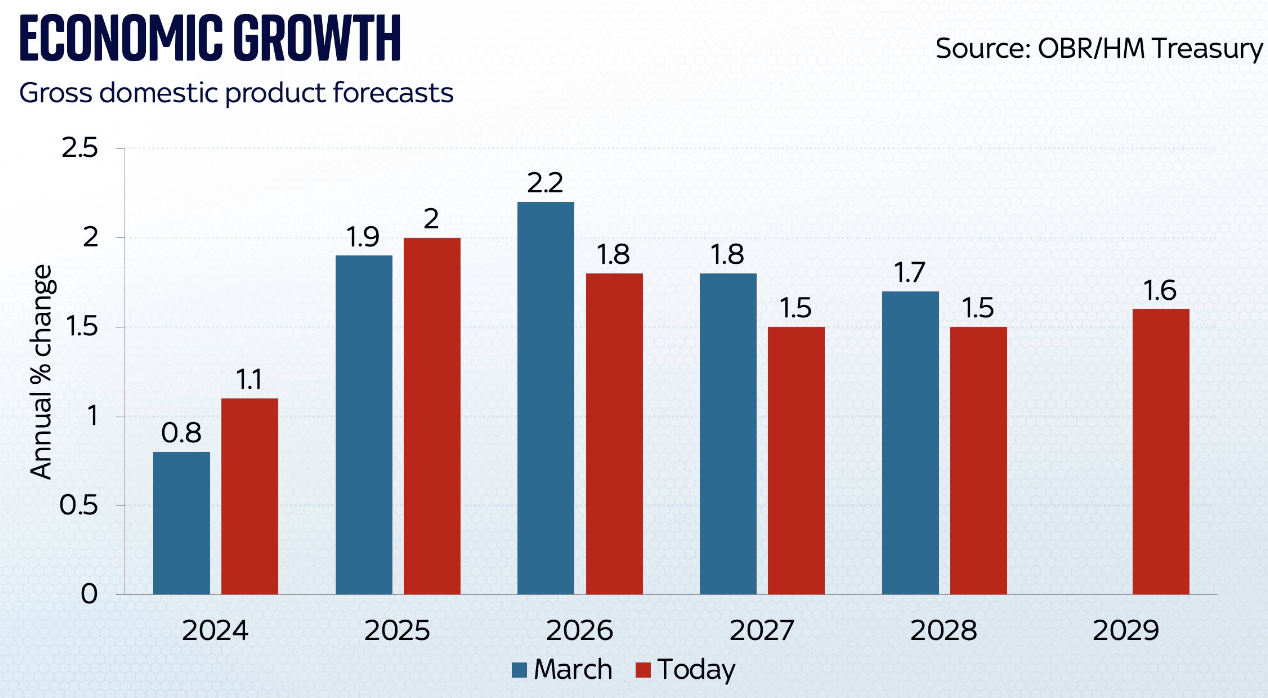

However, new projections from the independent Office for Budget Responsibility show the UK economy will actually experience weaker growth levels in the coming years than had been previously forecast.

This represents an incredibly poor return for UK taxpayers and international investors whose confidence the Pound relies on.

Above: Debt will now be much higher than previously planned.

The combination of a surge in borrowing and weaker growth helps explain a negative market reaction that involved a falling Pound and rising bond yields.

Regular readers will know that rising UK bond yields are typically supportive of the Pound.

Those readers who were with us in 2022 and remember Liz Truss will also know that there is reason for concern when bond yields and the Pound part company and head in opposite directions.

Investor nervousness was evident in the spike in the yields offered by UK government bonds, which in turn pushed up borrowing costs and mortgages.

Above: Despite rising debt, the UK gets an economic growth downgrade.

UK borrowing will now sit some £30BN higher per year for the next five years than was the case prior to Labour's budget.

Reeves changed the government's borrowing rules in order to give herself at least £50BN in additional borrowing potential, which she said would allow her to borrow more money to invest.

Borrowing to invest is typically good for growth as it can boost productivity.

However, markets appear concerned that much of this additional borrowing would be sunk into new government quangos that simply prove inefficient and swallow up capital without boosting growth.

🎯 GBP/EUR year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. 📩 Request your copy.

An example of an inefficient public body is the NHS, where successive governments have increased spending only to receive worse outcomes, signalling a chronic deterioration in productivity.

But it is the impact on UK businesses that will swelter under monumental tax increases that is where the real concerns for the UK's growth outlook lie.

The government announced an historically significant boost to taxation to the tune of £41.2BN in order to fund the significant spending increase.

National Insurance paid by businesses on employee payrolls will rise by 1.2 to 15% and the threshold will be cut from £9100 per annum to £5000.

"That is a £25bn tax rise, proportionally hitting harder those employing lower paid workers. Probably three-quarters or so of the increase will flow through to lower pay," says Paul Johnson, Director at the Institute for Fiscal Studies.

This, coupled with a 6.7% increase in the National Living Wage, means many firms will find it more challenging than ever to invest and recruit in the short term.

The OBR's growth forecasts show the economy will grow by 1.1% in 2024 and 2.0% in 2025, but from here, it is downhill. The forecast for 2026 is 1.8% in 2026, 1.5% for 2027, 1.5% for 2028 and 1.6% for 2029.

This represents a 0.3 ppt upgrade for 2024 and a 0.1 ppt upgrade for 202. It's a downgrade of 0.4 ppt in 2026, 0.3 ppt in 2027 and 0.2 ppt in 2028.

A surge in borrowing alongside downgrades to growth represents a poor return for investors in UK Plc and the Pound is reflecting this.

"The Budget is a calculated risk which could backfire, leaving the UK's fiscal position in a worse mess than when it started," says Philip Shaw, an economist at Investec.