Pound Pulls Back as Bank of England Rate Hike Expectations Ease

- Written by: Gary Howes

Image © Pound Sterling Live.

The British Pound fell sharply in the wake of UK inflation numbers that prompted investors to reduce bets for the scope of future interest rate hikes at the Bank of England.

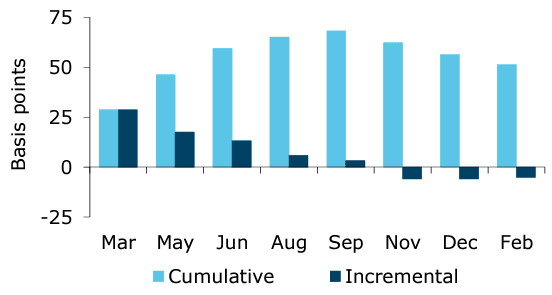

Ahead of the inflation release money markets showed investors were looking for an additional 68 basis points of rate hikes to be delivered through to September.

In practical terms, this would be consistent with two more rate hikes near-term and a holding of Bank Rate at 4.5% until it is cut again.

But inflation figures came in below expectations midweek, with a drop in core inflation garnering attention.

Core fell by 0.9% month-on-month in January exceeding the -0.5% figure the market was expecting and representing a sharp decline from the 0.5% growth seen in December.

Markets promptly lowered their expectations for cumulative remaining Bank of England rate hikes to 54 basis points as a result, representing a sharp reduction on the 68 points priced a day prior.

Above: Expectations for Bank of England Bank Rate changes as of Feb 16. ANZ Research estimates, Bank of England.

This is therefore still consistent with two more 25bp hikes, but importantly, it shows the direction of travel is lower and the odds of a 25bp hike in March being the last have grown.

Investors continue to anticipate rate cuts as the Bank reacts to falling inflation and slowing growth, with the first reduction falling around the third quarter of 2023.

"The dovish BoE reaction function means that they are likely to focus on the overall improvement, and the market has reflected that this morning. For the next few weeks, the Sterling reaction to data releases is likely to be skewed towards depreciation because of the BoE preference to slow," says Michael Cahill, an economist at Goldman Sachs.

The Pound fell 0.70% against the Euro to 1.1232 in the wake of the inflation figures as the investors also snapped up UK sovereign bonds (gilts) as their risk-reward profile improved on the back of expectations inflation would fall sharply in 2023. Against the Dollar the UK currency was counted 1.20% lower on the day at 1.2027.

"The pound has shed more than 2% this month against the greenback as the outlook for U.S.-UK monetary policy starts to shift in the former’s favor. Cooler than expected UK inflation this week suggested the finish line was drawing closer for the Bank of England’s aggressive rate hiking campaign," says Joe Manimbo, Senior FX Analyst at Convera.

Above: The difference between the UK's two-year bond yield and that of Germany has shrunk again (see the most recent red candle in top chart). This corresponds with the drawdown in GBP/EUR (bottom chart).

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

Investors are more inclined to invest in gilts when inflationary risks are seen subsiding as holding these assets becomes less prone to erosion by inflation.

Increased demand for gilts meanwhile lowered the yield the pay, which effectively brings down interest rates (the cost of money) across the economy.

As the above chart shows, however, falling yields relative to those elsewhere are consistent with a softer Pound and strategists at Citi predict GBP/EUR could be set to fall below 1.10 over the coming weeks.

The medium-term outlook for the UK economy and assets is however greatly improved by the prospect of lower inflation, which the Bank of England believes will fall back to the 2.0% target by 2024.

If a currency's value is ultimately a reflection of the economy, then the Pound's medium-term outlook is greatly improved, even if near-term downside pressures persist.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes