BoE's Mann: More Unwelcome Pound Sterling Depreciation Likely Unless Bank Acts More Forcefully

- Written by: Gary Howes

"If the Fed tightens at the currently expected pace, and the ECB musters an increase soon the scenarios outlined above suggest additional depreciation pressure on Sterling that could add to inflation particularly in the near term"

Above: File image, Catherine Mann. Image: OECD.

The Bank of England's Catherine Mann says the British Pound is at risk of falling further and pushing UK inflation even higher unless a more activist approach to interest rate management is adopted.

The external member of the Monetary Policy Committee voted to hike interest rates by 50 basis points at the June policy meeting but was outvoted by her peers who opted for a 25 basis point hike.

But Mann says the Bank does not have the luxury of adopting such a cautious approach to raising interest rates given the U.S. Federal Reserve is on the move and is raising rates in a more aggressive fashion.

In a speech to a Market News International Connect event Mann says what the Fed does matters greatly for the global and UK economies, particularly as it moves exchange rates and exports inflation.

"While the MPC sets policy according to domestic macroeconomic conditions, as a so-called small open economy, the UK does not exist in a vacuum," says Mann.

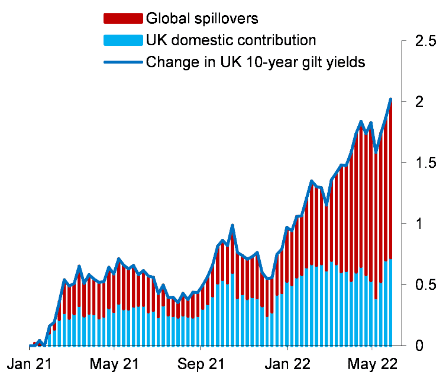

Her research finds that for the UK, data and surveys already show a rising importance of global spillovers for domestic financial conditions.

Above: International spillovers into UK interest rates (gilt yield). Source: Bloomberg and Bank calculations. Latest observation: 02 June 2022.

"The global factor is disproportionately associated with US macroeconomic and financial conditions, due to the sheer size of the US economy, the outsized importance of the Dollar as a reserve and invoicing currency, and the role of US government securities as safe haven assets," she says.

A strengthening Dollar means imported goods become more expensive in terms of the foreign currency, ensuring this global financial channel will tend to have an inflationary effect in the non-US economy.

This is particularly true in the current climate where global energy and commodity prices are elevated.

Mann's economic modelling shows that for the UK, using historical data, a tightening of U.S. monetary conditions has been inflationary rather than disinflationary.

The findings come after the U.S. raised interest rates by 75 basis points on June 15 and indicated that further subsequent 75bp hikes are coming.

The Bank of England for its part only raised rates 25bp but opened the door to a more aggressive path saying it was now entering a phase of being more reactive to incoming data.

Mann's modelling finds that to stabilise prices and alleviate the inflationary pressure coming through the exchange rate, Bank of England policy makers would need to roughly go along with the tightening from the Federal Reserve.

She acknowledges that by doing so the Bank would exacerbate the fall in economic output, explaining why the Bank of England's MPC has thus far opted to pursue a cautious approach to rates.

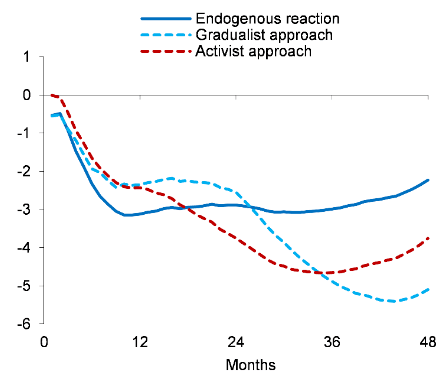

However her modelling finds reacting with gradual increases - as the Bank is currently doing - leads to higher costs in output in the second year and an inflation undershoot as policy is assumed to be constrained for a longer period of time.

But, by acting aggressively early on Mann says policy makers would be able to cut rates more aggressively further out, thereby limiting the overall negative effect of the rate hikes.

Above: Dynamic multipliers of UK variables implied by a US monetary policyshock and a suitably calibrated response of UK monetary policy – Level of UK real activity. Source: Bank calculations. Notes: Shows the impulse response of the level of UK real activity in reaction to a U.S. monetary policy shock which increases the U.S. 3-months Treasury bill rate by 100 basis points conditional on different paths of UK monetary policy.

"Immediately reacting to the jump, holding to cement the inflation deceleration, and then reversing in order to moderate the deterioration in output (which comes through the interest rate, global demand, and trade channels) comes at little additional inflationary cost," says Mann.

In short, central banks must be nimble and be prepared to act agressively early on and react with swift cuts when the time allows.

Mann says the Pound will be at risk of further inflation-boosting declines unless the Bank reacts more forcefully at upcoming meetings.

"If the Fed tightens at the currently expected pace, and the ECB musters an increase soon the scenarios outlined above suggest additional depreciation pressure on Sterling that could add to inflation particularly in the near term," she says.

A more robust policy move by the Bank would however reduce the risk that domestic inflation - which she says is already embedded - is further boosted by inflation imported via a Sterling depreciation.

Mann says she supports a strong response in the near-term followed by a policy rate reversal in the medium term when the domestic supports to demand fade and when weakness in external sources of demand bite.

"In my view this monetary policy path supports an inflation-output combination superior to that of the historical reaction," she concludes.