Cautious Bank of England to Crimp Pound Sterling in H1 says Crédit Agricole

- Written by: Gary Howes

- Crédit Agricole cautious on GBP

- Says BoE caution could weigh

- But 2nd half of year will be better

Image © Adobe Stock

Foreign exchange analysts at a major investment bank are warning Pound Sterling might face headwinds in the wake of the Bank of England's February policy decision and it will only be in the second half of the year that conditions turn more favourable for the UK currency.

The Bank of England is widely expected by markets to raise interest rates by 25 basis points, but Crédit Agricole says what comes after might not help the currency extend its 2022 rally against the Euro and other currencies.

"The BoE will strike a cautious tone at its February policy meeting, even as it delivers another 25bp hike to address the mounting cost-push inflation," says Valentin Marinov, Head of G10 FX Strategy at Crédit Agricole. "We remain cautious on the GBP in the near term".

The Pound to Euro exchange rate has risen 0.67% in 2022, while the Pound to Dollar exchange rate is effectively flat on the year but had enjoyed a strong advance in the first half of January.

- Reference rates at publication:

GBP to EUR: 1.1967 \ GBP to USD: 1.3424 - High street bank rates (indicative): 1.1732 \ 1.3148

- Payment specialist rates (indicative): 1.1907 \ 1.3357

- Get a market-beating rate quote, here

- Set up an exchange rate alert, here

Heading into this week the Pound was in fact the leading performer in the G10 space but this outperformance was disrupted by unruly market conditions which serve as a reminder of the myriad contributors to a currency's valuation.

But it is the expectation of higher rates at the Bank of England that are arguably the most important driver of the Pound at present, and the December rate hike when combined with expectations for another in February have proven a potent source of support.

A rate rise in February is now fully accounted for by markets, therefore what matters for the currency will be where the Bank signals rates are going over current months.

Striking a hawkish tone (i.e. confidence in the economic outlook and signalling more rate rises) would be supportive of the Pound.

But a more dovish tone whereby caution is signalled could weigh on the currency.

Image courtesy of Wells Fargo.

Crédit Agricole says the caution they expect from the Bank of England will be stoked by the "combined impact of the pandemic, the cost-of-living crisis and Brexit will continue to fuel stagflationary headwinds that will buffet the UK economy in Q1 and even Q2."

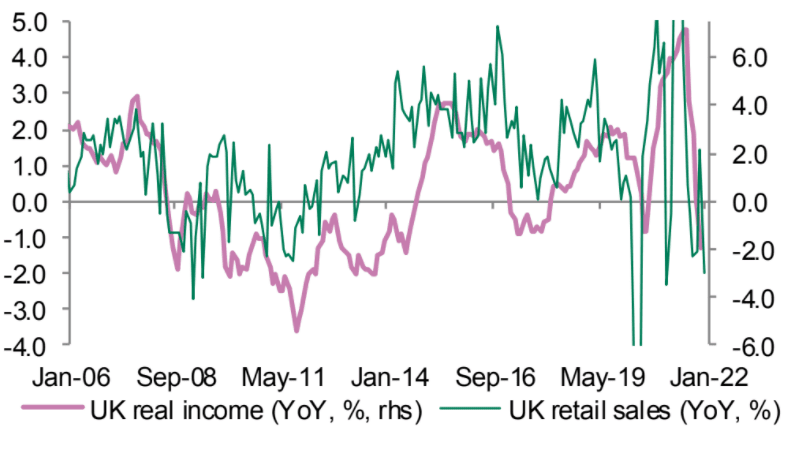

"Indeed, the erosion of UK households’ real purchasing power could hold back domestic demand while shrinking profit margins as well as labour and product shortages could hurt the business outlook," says Marinov.

The market anticipates a further three rate hikes in 2022 and this is arguably currently incorporated into the current value of the Pound.

If this pricing were to fall back then it stands the value of the Pound reverses.

Cautiousness from the Bank of England could be reflected in less upbeat UK growth and inflation forecasts, which are due to be released at next Thursday's Monetary Policy Report.

Crédit Agricole says this could weaken the case for three additional rate hikes in 2022 expected by the markets at present.

"Adding conviction to this view will be any signals that the MPC will use quantitative tightening in lieu of rate hikes," says Marinov.

{wbamp-hide start}

{wbamp-hide end}{wbamp-show start}{wbamp-show end}

Quantitative tightening is the process whereby the Bank reduces the size of its balance sheet by selling bonds.

The Bank's balance sheet expanded as it purchased bonds under its quantitative easing programme in an effort to provide 'easy' money to the economy during the Covid crisis.

Reversing that process can be deflationary and therefore help the Bank fulfil its mandate of bringing inflation back down to its 2.0% target.

But this implicitly takes pressure off the Bank to raise interest rates further, given it has another tool in its toolbox.

Above: "Falling UK real incomes to weigh on domestic demand." - Crédit Agricole. Image source: Crédit Agricole CIB, Bloomberg.

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

Therefore, the terminal rate of the current hiking cycle is lower than it would be if the Bank did not have quantitative tightening at its disposal.

Crédit Agricole therefore see it as a headwind to the Pound.

But it is worth remembering quantitative tightening was communicated back in August 2021 and markets have had a great deal of time to account for it.

The relatively soft performance of the Pound in the latter part of 2021 could well be associated with the quantitative tightening message from the Bank: could it therefore already be 'in the price' of the Pound?

By contrast, the U.S. Federal Reserve is only starting its discussion on quantitative tightening and this could well prove a headwind to the Dollar if it means the terminal Fed funds rate is lower than would have been the case without quantitative tightening.

But the second-half of 2022 should be profitable for Sterling bulls says Crédit Agricole.

"In the long term, we expect the above headwinds to start abating and the UK economic recovery to gain momentum. This should allow the BoE to embark on a more meaningful tightening cycle in H222 and into 2023," says Marinov.

Economists at the investment bank also anticipate UK cost-push inflation to ease which could boost UK real rates and yields and thus Sterling.

"In addition, foreign investors could rediscover the appeal of UK assets and, with GBP/USD trading below its long-term fair value (and our Q423 forecast) of 1.43, any inflows from abroad could be unhedged and support the GBP. At the same time, returning corporate demand could prop up EUR/GBP," says Marinov.

Pound Sterling Live has reported this week that the UK currency has been caught up in the churn created by a global market sell-off, but the relative outperformance of the FTSE is providing support.

While U.S. stock markets fell further on Tuesday there was a distinct outperformance being displayed by the FTSE 100, signalling solid international demand for UK assets.

Above: The FTSE 100 (orange) has outperformed Germany's Dax (dark blue), the S&P 500 (light blue) and the NASDAQ 100 (yellow) in 2022.

The FTSE 100 has outperformed its major global peers and has fallen just 0.206% in January, whereas the NASDAQ 100 is down 14%, the S&P 500 is down 10% and the German DAX 30 is down 6.0%

Should demand for UK equities continue the British Pound might find itself further supported going forward.

"Rising real yields benefit FTSE 100, which is one of cheapest global indices by some distance," says Graham Secker, Equity Analyst at Morgan Stanley. "The UK index also offers good offence in an environment of higher real yields, with the UK's relative price performance closely tracking real yields over time."