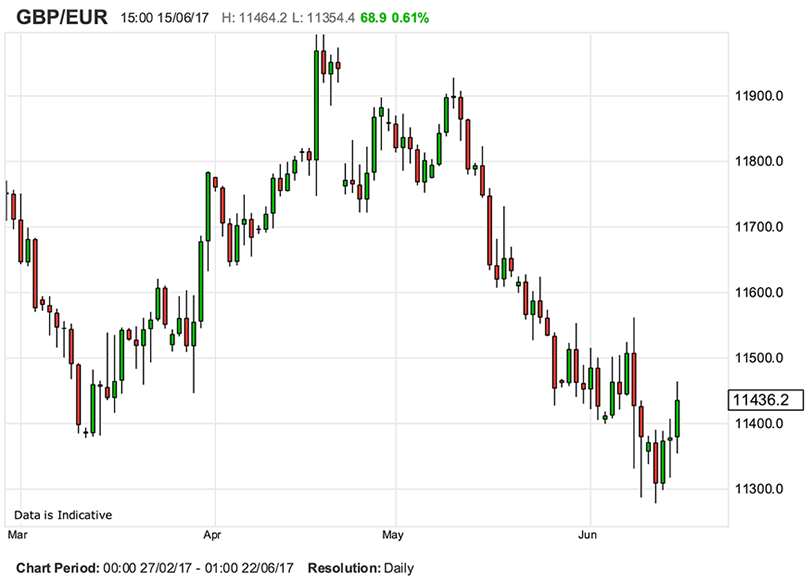

GBP/EUR Exchange Rate at "Reset Point"

- Written by: Gary Howes

- Quotes (17-6-17, markets closed):

- Pound to Euro Exchange Rate: 1 GBP = 1.1408 EUR

- Euro to Pound Sterling Exchange Rate: 1 EUR = 0.8766 GBP

Finally, the Pound has put an end to its run of weakness against the Euro. It has seen six weeks of declines, but thanks to developments at the Bank of England the week of June 12-16 June saw a small gain coming for the Pound.

A technical base formation viewable on the charts has allowed the market to buy the UK currency with a little more confidence and opens up the prospect for a potential move into the 1.15's and above.

As we noted mid-week, "the main problem for bears is the double layer of support in the 1.1280s composed of the bottom of a long-term range and the S2 monthly pivot, a line traders use to trade counter to the dominant trend, which in this case is down."

With a solid platform from which to work off, traders received a further shot of confidence in Sterling on Thursday, June 15 when the Bank of England voted 5-3 to keep interest rates unchanged.

This decision saw traders snap up Sterling as they saw the prospect of an interest rate rise looming on the horizon whereas previously they had only expected such a move to come as late as 2020.

“This flash of hawkishness from the Bank of England’s immediately gave a helping hand to the pound, which gets hot under the collar at the slightest hint of a rate hike,” says Connor Campbell, Financial Analyst with Spreadex, a spread-betting provider based in London.

A rate could rise could now come as early as this year, going into Thursday markets were pricing the first rate rise for as late as 2020.

“We continue to see rates being held throughout this year and next, but our reading of the minutes is that there is a material risk of the MPC raising the Bank rate by 0.25% in August, reversing the move it made a year previously and joining the Fed in raising rates at least once,” says Philip Shaw at Investec.

Investec say they struggle to see a sound rationale for tightening policy given that they cannot be sure the consumer downturn is transitory, that weakness is not confined to households (construction currently looks fragile) and wage growth is falling.

Markets shared their surprise.

“Sterling rose sharply in response, as did gilt yields. Equities fell further in an already nervous session, with retailers suffering from a triple whammy of poor sector news, a weak retail sales release and the risk of higher rates over the summer,” says Shaw.

Some analysts had argued that it is the stronger Pound that the Bank is actually after.

"Recently, MPC signalling has been on the hawkish side to encourage the market to dampen inflation pressures on its behalf,” says Alan Wilson, senior investment manager of active fixed income at State Street Global Advisors.

Had markets got the hint they would have pushed up interest rate yields on bonds and encouraged Sterling to go higher in response.

“Nonetheless, this messaging has been completely ignored, with next to no rate hikes priced over the next year. As such, hawkish sentiment on the committee has advanced; given the precarious outlook for the domestic economy, the MPC cannot allow inflation to become entrenched,” says Wilson.

If the market has in fact got the hint then we could well see higher rates and a stronger British Pound.

“The Bank of England decision points towards a rate hike which could come as early as September,” says Carlo Alberto De Casa, chief analyst at ActivTrades. “The UK has experience a bad week in terms of macro-economic data – inflation was higher than expected. The Bank of England has sent a clear signal to the market after looking worried about inflation in its last report.”

We would therefore argue that the recent low set at 1.1278 is safe for now.

“While political uncertainty continues to weigh, the BoE’s newfound hawkishness further reduces downside risks for GBP,” says James Rossiter at TD Securities.

Rossiter says Pound Sterling may have reached a “reset point” in terms of market perceptions.

“We can easily point to many potential negatives for the currency, but many of these now look to be in the price. The GBP’s trajectory from here will hinge first on how the UK government’s policies evolve toward Brexit. Traditional macro drivers are not likely to be too far behind,” says the analyst.

HSBC say British Pound’s Downside Risks v Euro Have been Bolstered but Sanguine v US Dollar Short-Term

There has been some excitement on Sterling over the past 24 hours with traders buying the currency in response to the Bank of England’s June policy decision that showed an increase in the number of policy-makers willing to raise interest rates.

The move caught markets by surprise and gilt yields rallied as they brought forward expectations for an interest rate rise.

This rally in gilt yields helped push GBP higher.

Despite the developments, analysts at HSBC Bank are not convinced that chasing Sterling higher is the right strategy to pursue.

In fact, “our medium-term bearishness on GBP has been bolstered by the increased political uncertainty generated by the recent general election result,” say HSBC in a client briefing dated June 16.

However, expectations on Pound Sterling differ according to which currency it comes against.

With regards to GBP/USD the outlook is a little more benign we are told.

“Tactically our pessimism is a little more tempered, principally because there appears to be a sizeable constituency in the market content to buy GBP on a dip to around 1.27.”

The pull-back in GBP-USD since the 8 June election has been smaller than HSBC would have expected for a minority government outcome.

Nonetheless, strategists think the balance of risks are still to the downside and they prefer to be short GBP, especially against the EUR and JPY.