Outlook for British Pound Improves as Headwinds Fade

The decision by the Bank of England’s Monetary Policy Committee to vote 5-3 to keep interest rates unchanged should trigger a positive shift in the markets’ perceptions of Pound Sterling we are told.

The UK currency rallied on Thursday, June 15 after three members of the MPC voted to raise rates; a move that came as a surprise to markets expecting the composition to remain at 7-1.

The Pound managed to lift itself up from recent lows against its major competitors and the question now becomes whether there will be some follow-through gains to be had over coming weeks.

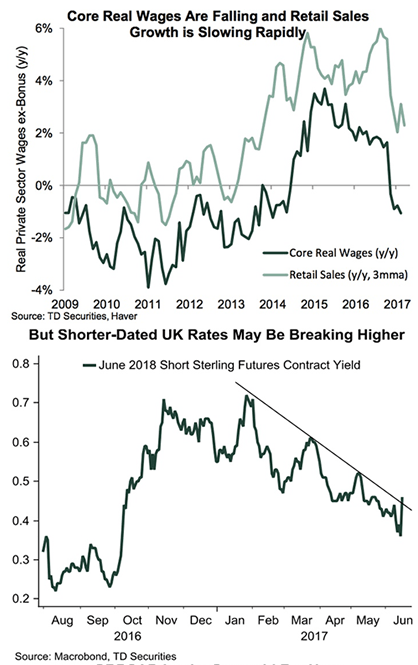

The developments at the Bank of England have lead markets to rapidly reassess when it is they see the Bank raising interest rates, with some saying a rate rise could come as early as August.

Bringing these expectations forward is positive for Sterling as jurisdictions with higher returns on capital tend to attract investment inflows which in turn boosts the value of the currency.

“We are now on a much more neutral footing toward Sterling,” says Richard Kelly, Global Head of FX Strategy at TD Securities.

The British Pound has been under pressure of late, particulalary in the wake of the UK's General Election in which the Conservative Party failed to secure a majority in the House of Commons.

Kelly notes the UK’s macro landscape remains rather mixed and political uncertainty remains a persistent concern.

But, “this is not without its potential silver linings, however, as the Brexit process now appears more open to interpretation. If confirmed, this reduces an important headwind for Sterling,” adds the analyst.

Markets have taken to betting against Sterling once again following the results of the June 8 General Election.

Markets believe the Conservative Party’s reduced majority in the House of Commons leaves the country open to indecision and a “muddled Brexit” which could ultimately see the country exit the European Union without a deal being reached.

TD Securities maintain, like most analysts we follow, that the currency’s trajectory from here will hinge first on how the UK government’s policies evolve toward Brexit.

Reset Point

However there is reason to believe markets might be too negative aligned against the currency, particularly following the Bank’s June meeting.

Downside risks for the GBP have since diminished further as the BoE turned considerably more hawkish at its June MPC meeting.

“Sterling may have reached a 'reset point' in terms of market perceptions. We can easily point to many potential negatives for the currency, but many of these now look to be in the price,” says Kelly.

Consolidation

However, don’t confuse improved sentiment with an all-out call for Sterling appreciation.

This is not yet likely says Kelly who reckons what we are more likely to see is Sterling cement itself within familiar ranges.

“We are not surprised to see cable hovering near the midpoint of its two–month 1.25/1.30 range,” says Kelly. "For now, we do not see many compelling reasons to think a breakout from here looks imminent.”

The British Pound will likely remain capped by lingering concerns over the country’s economy.

On the Dollar side of the equation, the Fed’s advanced tightening campaign, and political uncertainty that shows little sign of easing soon.

“The downside, however, is similarly constrained by the BoE’s nascent hawkishness, hopes for a softer Brexit, and our broader view that the era of USD strength may be complete,” says Kelly.

Concerning the Pound v Euro exchange rate, TD Securities believe the Pound will struggle to advance above resistance in the 1.1521/1.1494 zone.

Analysts think 1.1561 is actually a more clearly-defined threshold.

Above this puts the exchange rate firmly back into its post-referendum consolidation range.

Analysts do not think the range highs just below the 1.2048 mark are likely to come under significant threat at this point, “however, as we remain focused on upside risks for the EUR overall,” says Kelly.

There is a risk that the Pound to Euro rate gravitates towards the post-election low of 1.1279.

A move below this, which TD Securities expect to see in the weeks ahead, might suggest a move lower to test the next significant area of support in GBP/EUR that is seen around 1.1080/1.1050.

Sustained Trend Higher Unlikely

Recent events have reminded traders that the Bank of England remains a key driver of Sterling direction. Brexit has rightly stolen the limelight of late but we could well see more focus on the Bank and economic data going forward.

"It cannot be excluded that policy expectations and the GBP will become more sensitive to incoming data," says Manuel Oliveri at Credit Agricole.

Nevertheless, Oliveri is not optimistic on the Pound's chances of rallying as "intact political uncertainty is likely to prevent the GBP from facing more sustained upside in the short-term."

This is especially true as speculative positioning is broadly balanced.

"Hence, fresh buying interest is needed in order to trigger a sustained trend higher. Unless rate and/or growth expectations rise from here, demand for the currency is likely to stay muted," says Oliveri.

HSBC say British Pound’s Downside Risks v Euro and Dollar have been Bolstered

There has been some excitement on Sterling over the past 24 hours with traders buying the currency in response to the Bank of England’s June policy decision that showed an increase in the number of policy-makers willing to raise interest rates.

The move caught markets by surprise and gilt yields rallied as they brought forward expectations for an interest rate rise.

This rally in gilt yields helped push GBP higher.

Despite the developments, analysts at HSBC Bank are not convinced that chasing Sterling higher is the right strategy to pursue.

In fact, “our medium-term bearishness on GBP has been bolstered by the increased political uncertainty generated by the recent general election result,” say HSBC in a client briefing dated June 16.

However, expectations on Pound Sterling differ according to which currency it comes against.

With regards to GBP/USD the outlook is a little more benign we are told.

“Tactically our pessimism is a little more tempered, principally because there appears to be a sizeable constituency in the market content to buy GBP on a dip to around 1.27.”

The pull-back in GBP-USD since the 8 June election has been smaller than HSBC would have expected for a minority government outcome.

Nonetheless, strategists think the balance of risks are still to the downside and they prefer to be short GBP, especially against the EUR and JPY.