Pound Softer After Pill's Rate Cut Comments

- Written by: Gary Howes

Above: File image of Huw Pill, Chief Economist at the Bank of England. Image © Sérgio Garcia/Your Image for ECB

The Pound rose after the release of above-consensus wage data, but it then turned tail and lost ground following Huw Pill's latest speech.

Forget today's labour market data release; the odds of a June interest rate cut at the Bank of England have risen following the intervention of a key member of the Bank's Monetary Policy Committee.

MPC member and the Bank's Chief Economist, Huw Pill, said an interest rate cut this summer was likely and that the Bank could cut rates before inflation had fallen comfortably back to the 2.0% target.

Pill is important as he is part of the core set of internal members of the MPC and is considered one of the 'swing' voters required to create a majority required to push through a cut at the June meeting.

He told a gathering held by the Institute of Chartered Accountants in England and Wales: "It's not unreasonable to believe that through the summer we will begin to see enough confidence in the decline in persistence that bank rate will come under consideration."

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

"It's important to recognise we can cut bank rate, while still leaving some restriction in the system," he added. This means he is willing to cut interest rates even if all the economic evidence has not necessarily fallen into place.

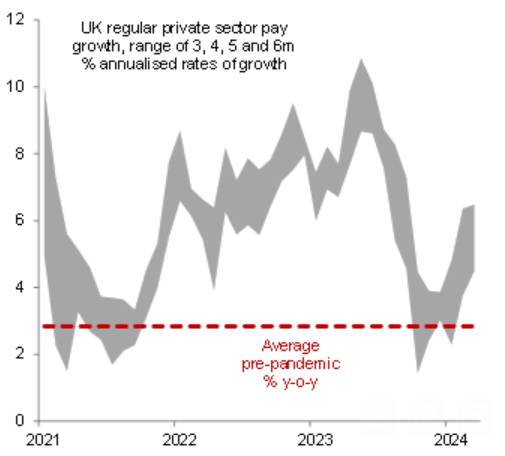

Pill's intervention comes on the day it is reported UK wages printed at a stronger-than-expected level in March (6.0% 3M/Y), which is entirely inconsistent with inflation falling to 2.0% sustainably.

In fact, as pointed out by George Buckley at Nomura, even a modest monthly rise in pay in next month’s April data could see the 3 m/m annualised pay rate rise to above 7%.

"It is probably safe to say that the recent direction of travel shown in the chart below is not one that some on the MPC will be comfortable with," says Buckley.

Image courtesy of Nomura.

But the Bank of England appears determined to press forward with a cut, with Deputy Governor Dave Ramsden voting to do so as early as last week.

"There has been an easing of the labour market but it still remains pretty tight by historical standards," Pill said today.

In April Pill said he was in no rush to cut interest rates as nothing had really changed in terms of the economic backdrop.

His April comments helped to stimulate a recovery in the Pound as the odds of a June cut receded somewhat. His latest outing is having the exact opposite effect on the UK currency.