Pound Sterling Falls as Rising Unemployment Trumps Strong Wage Increases

- Written by: Gary Howes

Image © Adobe Images

Investors were dealt a difficult hand by the ONS today as the May labour report showed hot wage pressures accompanying rising unemployment. In the hours following the release, the Pound's verdict on the apparent contradiction is becoming clearer: rising unemployment is what ultimately counts.

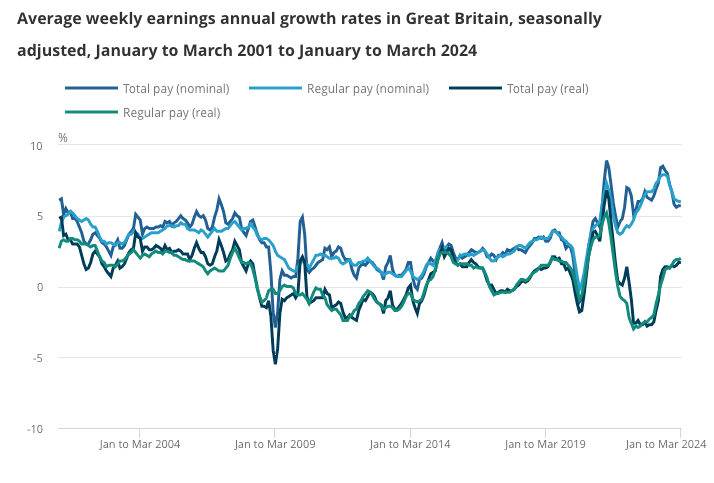

The Pound to Euro exchange rate rose to 1.1642 after the ONS said UK wages, with bonuses included, rose 5.7% 3M/Y in March, which was well ahead of the consensus estimate for a 5.3% reading. When bonuses are excluded from the wage data, the figure is even higher at 6.0%.

This is before April's minimum wage hike even happens. These figures signal wage pressures continue to run ahead of inflation, which could mean domestically generated inflation in the UK will remain elevated for some time, potentially delaying interest rate cuts.

But, in the hours following the release, the Pound's gains have flipped into losses, and the pair is now down 0.20% on the day at 1.1614.

The Pound to Dollar exchange rate rose to 1.2558 before sliding back to 1.2519, as there are signs of growing labour market weakness elsewhere in the day's data releases: the UK economy lost 177K jobs in the three months to March, up from 156K in the previous period. The unemployment rate rose to 4.3% from 4.2%.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

This suggests that the scope for pay to run at inflation-generating levels is limited, and investors are betting it will ultimately cool sharply as a result. In short, businesses won't need to hoard labour if there are more job seekers on tap.

For now, foreign exchange markets are choosing to look through the hot wage figures, and this is reflected in the relatively subdued response by the Pound.

"This presents mixed signals for the Bank of England to digest ahead of any planned rate cutting in June –restrictive policy is starting to affect the jobs market even if pay growth, which in essence is inflationary, continues to remain strong. The focus will be on the inflation data next week – if it manages to fall, as expected, towards 2% then one should expect that these earnings and unemployment figures will be given lesser weight in their decision making," says Charles Hepworth, Investment Director, GAM Investments.

According to Francesco Pesole, FX Strategist at ING, although the latest UK wage figures growth was stronger than expected, this can be explained by unusually large public sector pay settlements (+6.3%).

"Private sector wage growth (+5.9%) was more in line with what had been expected, and it's this that the Bank of England is paying closer attention to," says Pesole.

The ONS also notes that March is the peak bonus month.

The Bank of England will nevertheless be keen to see next month's earning data and assess the impact of the recent sharp rise in the minimum wage. This spike is expected to be another one-off event, which might not be enough to convince the Bank to delay cutting interest rates until August.

But Rob Wood, Chief U.K. Economist at Pantheon Macroeconomics, says he is sceptical that employment is falling rapidly as today’s labour market data would have us believe. The ONS itself has warned the reliability of its survey has deteriorated markedly and Wood notes it has tended to revise higher first estimates.

In addition, he does not see the surge in redundancies required to signal a marked deterioration in the labour market is underway.

He also warns that wage pressures will remain elevated for some time as April's increase in the 9.8% National Living Wage will add momentum to wages in the coming months. He explains that employers tend to respond to the uprating by raising wages for employees that are paid slightly more than the legislated minimum.

"Year-over-year pay growth will keep slowing, but likely only gradually until June. We expect a more decisive decline in the second half of the year when pay deals are set in the context of below 2% inflation," says Woods.

April's CPI inflation print - due next week - is expected to show inflation has fallen to 2.0% or below, as the impact of a cut to household energy bills is reflected in the data. This could materially cool inflation expectations, which economists believe will allow the Bank to cut interest rates on a number of occasions this year.

It is these expectations for multiple rate cuts that are currently weighing on the Pound.