GBP/EUR Rate Faces "a Sharp Retracement" as UK Data Pulse Cools

- Written by: Gary Howes

Image © Adobe Images

Pound Sterling has likely peaked against the Euro and is pointed lower as the Bank of England has already ended its interest rate hiking cycle in the face of softening economic data.

This is the view of a number of economists and currency analysts we follow in the wake of UK job and wage data that revealed the labour market was cooling.

The ONS reported Tuesday the UK unemployment rate unexpectedly rose to 3.9% in March, whereas an unchanged reading of 3.8% was expected, while wage figures also came in below expectation.

Simon Harvey, Head of FX Analysis at Monex, says the evidence suggests to him headline wage growth is about to roll over as both underlying momentum trends lower alongside a drop-off in labour demand.

The Bank of England said on May 11 it would raise interest rates again if the data warranted, therefore, the softer-than-expected labour market report has given rise to expectations the Bank can afford to pause and allow the impact of already-delivered hikes to be felt.

Money market pricing reveals investors pared expectations for a 25 basis point hike in June to 73% following the labour market statistics, with the peak Bank Rate shedding 7 basis points.

This translated into a weaker UK currency with the Pound to Euro exchange rate (GBPEUR) edging just below 1.15 and the Pound to Dollar exchange rate (GBPUSD) extending its retracement to below 1.25 to 1.2490.

Based on the data and its implications for the Bank of England, further falls in the currency's value can be expected, according to some:

"For GBP, I expect this to lead to some downside in cable, and if met with persistence in Eurozone core inflation, a sharp retracement in GBPEUR. Didn’t believe the banks' more constructive GBP calls, they were chasing a fizzling out trend," says Harvey.

The major investment banks have rushed to upgrade their forecasts for the Pound following its strong outperformance in 2023 which has put it at the top of the league table.

Currency outperformance follows a run of expectation-beating economic data releases that defied a consensus amongst institutional forecasters for the economy to have already slid into a long-running recession.

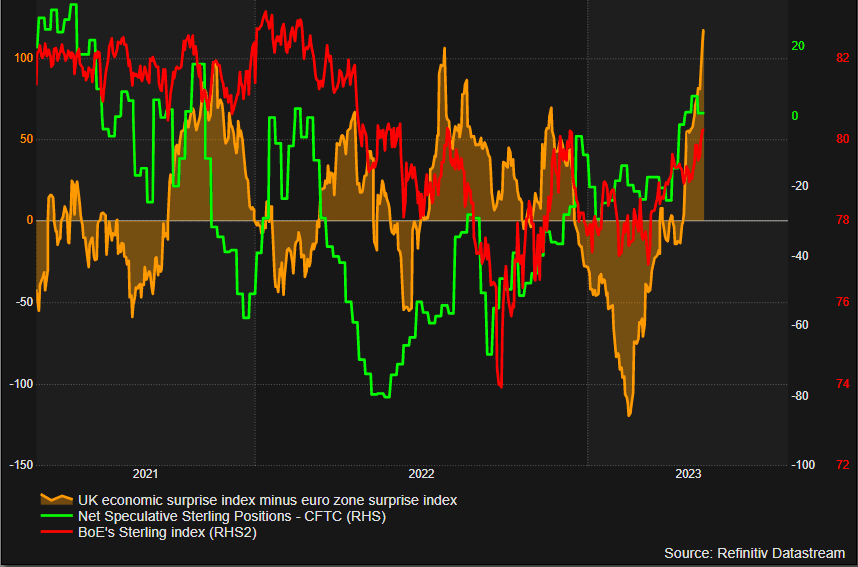

Above: GBP outperformance has been aided by a run of UK economic beats. If this ends, GBP's rally could fade.

The Bank of England has meanwhile had to raise interest rates higher than it was guiding through the course of 2022, offering upside support to UK bond yields and the Pound.

Samuel Tombs, Chief UK Economist at Pantheon Macroeconomics, says the labour market report bolsters the case for the Bank to hold back from hiking Bank Rate again next month.

He says private sector pay rates are cooling and forward-looking surveys suggest this can continue, particularly given the labour supply is rebounding.

The ONS reported "a record high net flow out of economic inactivity" between October to December 2022 and January to March 2023 with data suggesting many are opting to exit early retirement. Furthermore, next week should see the UK report a record net immigration figure for the past year of nearly a million people.

An end to the Pound's strong run is becoming increasingly likely heading into mid-year as the positive UK economic surprise story is now well understood and positioned for by investors.

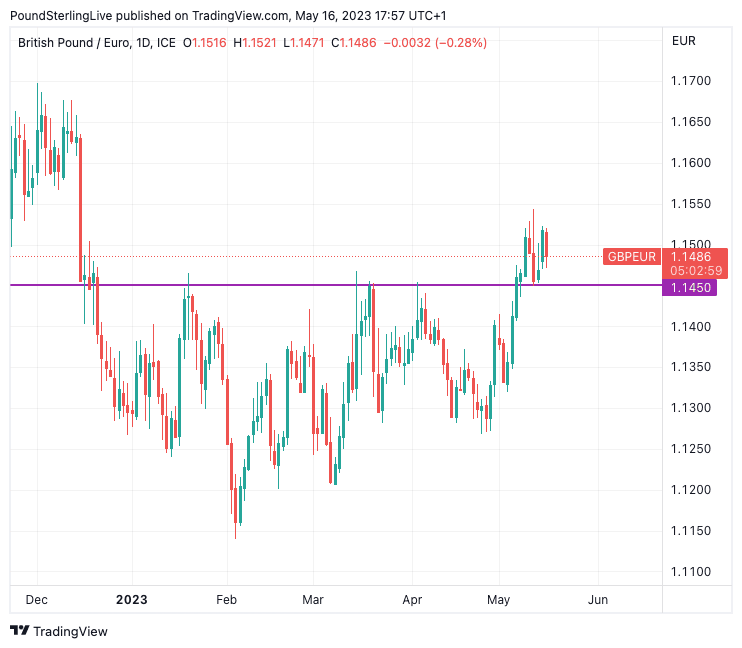

Above: GBPEUR at daily intervals showing an approximate line of support at 1.1450.

Should data underwhelm going forward the Pound could find itself yielding further value to the likes of the Euro and Dollar.

The GBPEUR exchange rate only recently rose to its highest levels of 2023 as a long-held range finally gave way with the upside break of 1.1450.

Those hoping for a stronger Pound with which to purchase Euros will now look to the support zone at 1.1450 to arrest any weakness.

The risk going forward is that this support ultimately breaks and sucks GBPEUR back into the sideways trending range that has dominated trade for much of 2023.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes