Euro-Franc Parity: Unlikely says HSBC, but Goldman Sachs Disagrees

- Written by: Gary Howes

Image © Adobe Images

HSBC says it dosn't anticipate the EUR/CHF exchange rate falling back to parity, instead they now see looming Franc weakness.

However this view is not shared by analysts at Goldman Sachs who say in a new research briefing the exchange rate could fall to parity and even lower in above that would in fact be welcomed by the Swiss National Bank (SNB).

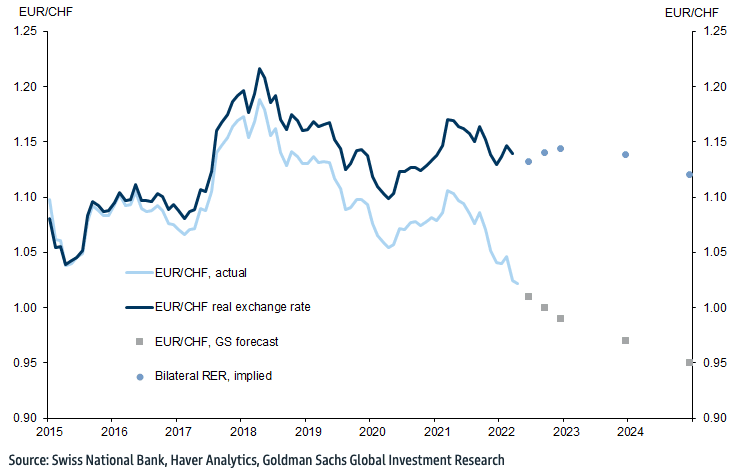

"We now forecast EUR/CHF to trade below parity in the coming year, and ultimately move towards 0.95," says Zach Pandl, Co-Head of Global FX Strategy at Goldman Sachs in New York.

The debate on the exchange rate's outlook comes as the Euro to Franc exchange rate records seven consecutive daily advances, taking it to 1.0487 where we find it today.

Above: Daily EUR/CHF chart showing a brief dip below parity and subsequent strong rebound.

But on March 07 the pair did briefly dip below the psychologically significant 1.0 level, although the dip was not sustained for long enough to record a daily close below here.

But Goldman Sachs sees the current bout of strength as ultimately temporary in nature and substantial fundamental forces will drag the Franc lower.

"The trend in our outlook is dictated by the widening inflation differential: in order to keep the real exchange rate stable, EUR/CHF will likely need to keep drifting lower," says Pandl.

He says this should not only be tolerated but actively encouraged by the Swiss National Bank (SNB).

The SNB is traditionally one of the most active central banks in terms of currency management, often fighting the market to keep the Franc's value at affordable levels to ensure Swiss exporters remain competitive.

Compare GBP to CHF Exchange Rates

Find out how much you could save on your pound to Swiss franc transfer

Potential saving vs high street banks:

CHF 2,825.00

Free • No obligation • Takes 2 minutes

Recent data on the SNB's currency holdings suggests authorities are becoming more active in the market.

"SNB sight deposits, used as a proxy for central bank FX intervention, jumped by CHF6.5BN as of 6 May, the largest weekly rise since May 2020," says Dominic Bunning, Head of European FX Research, HSBC Bank plc.

The developments continue a trend which has been emerging for some time says Bunning, with sight deposits rising gradually through late-March and early-April.

He says increased intervention in the market might be because 'hot money', or speculative trade, might be behind recent moves in CHF.

It is this kind of flow the SNB feels it can be more effective in fighting and containing the Franc's value.

This is opposed to currency moves that are genuinely driven by trade, which HSBC believes the SNB is less willing to counter.

HSBC says Switzerland's low inflation rates relative to the Eurozone will play a part in the currency's outlook.

Swiss CPI for April was lower than expected and still modest relative to other G10 economies, hitting just 1.5% year-on-year on the core measure.

"Lower inflation would only be exacerbated by a stronger currency, so the SNB may also now be more prepared to counter CHF strength," says Bunning.

Above: "Nominal CHF Supported by Inflation Divergence" - Goldman Sachs.

But the Goldman Sachs argument is the SNB will in fact guard against inflation, and not welcome it.

They will therefore not want the currency to depreciate substantially, as was the case for the yen recently.

SNB Governor Thomas Jordan said in a recent interview the central bank has room to leave the country’s currency to appreciate in nominal terms.

Higher global inflation is providing the SNB with space to do this, Jordan said.

"That the SNB deliberately allowed the currency to appreciate modestly in order to keep the real exchange rate stable and guard against inflation pressures," says Pandl.

"This is why we do not expect the Franc to be allowed to depreciate like the Yen, and think the SNB will closely follow any tightening action from the ECB," he adds.