Swiss Franc Facing Heavier SNB Intervention in 2022, Economists Say

- Written by: James Skinner

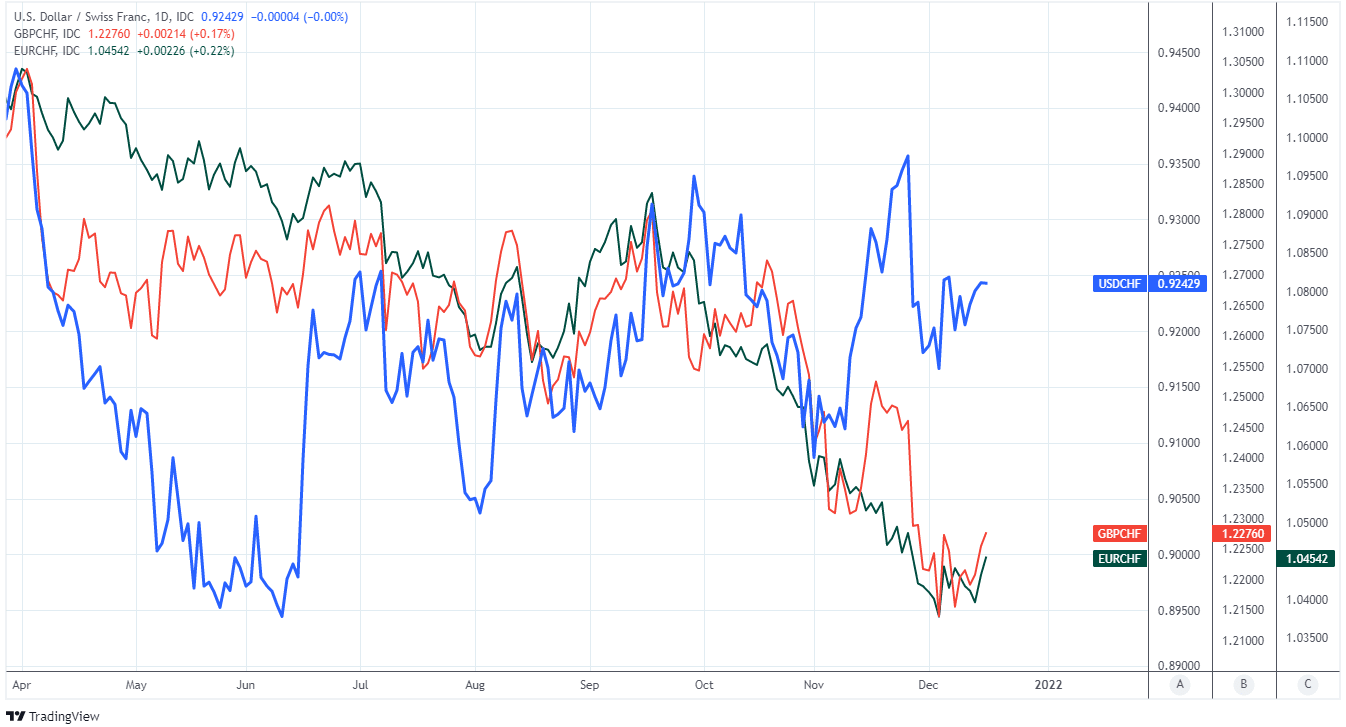

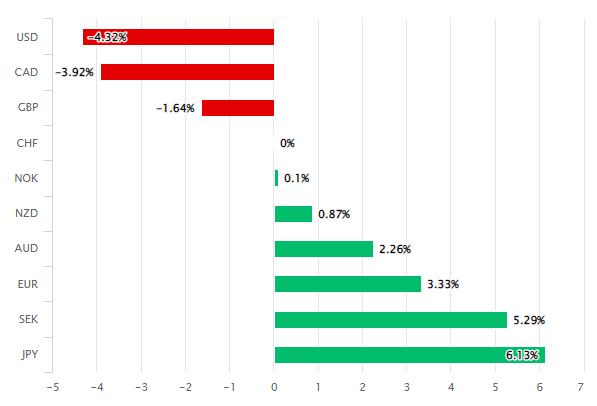

- CHF falters vs. majors but remains recent outperformer

- SNB intervention threat lingers amid few signs of action

- Some forecasters eyeing heaviery intervention in 2022

- As EUR/CHF expected to attempt new post-2015 lows

Above: SNB, Bern. © Guido Gloor Modjib, reproduced under CC licensing conditions

The Franc eased lower against most currencies in the wake of December’s Swiss National Bank policy assessment but its recent appreciation is a long way from over, according to some economists, who say the SNB may have to intervene heavily next year to frustrate the Franc’s ascent.

Switzerland’s Franc slipped against all major currencies except the Japanese Yen and Chinese Renminbi following Thursday’s SNB decision although the declines may have had more to do with an evident pick up in risk appetite on international markets than the central bank’s policy assessment.

The SNB lifted some of its forecasts for Swiss inflation for the same supply chain related reasons as inflation forecasts have risen in all other jurisdictions of late, while also raising its projection for Swiss GDP growth.

“It still forecasts inflation of just +0.6% in 2023,” says David Oxley, a senior Europe economist at Capital Economics, in a note following Thursday's decision.

“The Omicron-related bout of upward pressure on the Swiss franc since mid-November will at least have given policymakers something additional to ponder this time around. But tellingly, the Bank did not change its description of the franc,” Oxley added.

Above: Swiss Franc performance against G10 currencies in 2021. Source: Pound Sterling Live.

- Reference rates at publication:

GBP/CHF: 1.2316 - High street bank rates (indicative): 1.1880-1.1970

- Payment specialist rates (indicative: 1.2200-1.2250

- Find out more about specialist rates, here

- Set up an exchange rate alert, here

- Book your ideal rate, here

With inflation and growth forecasts aside, the SNB otherwise provided every indication that there remains little chance of its -0.75% cash rate being lifted at any point in the foreseeable future, and continued to characterise the Swiss Franc as “very strong.”

In addition, the bank stuck with a many times reiterated warning that it remains willing to intervene in the foreign exchange market to stem any unwarranted or too hasty appreciation of the Swiss Franc.

“We expect it to have to do so heavily next year,” says Melanie Debono, a senior Europe economist at Pantheon Macroeconomics.

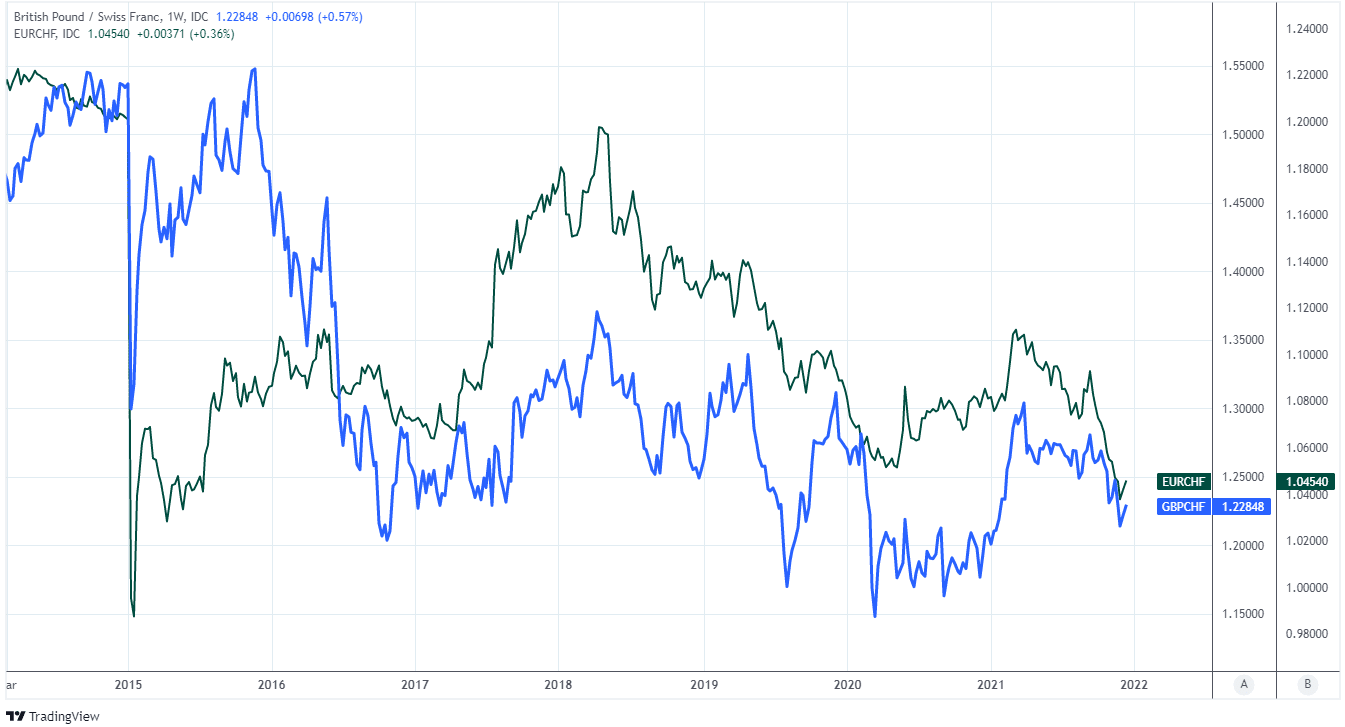

Thursday’s policy decision came just days after sight deposit data from the SNB suggested the bank may have intervened in the market for the first time in months after the EUR/CHF exchange rate broke beneath 1.04 during early December.

That particular currency pair accounts for around half of Switzerland’s overall trade-weighted exchange rate and when it falls fast or heavily, can reduce Swiss inflation pressures by cheapening the cost of imports, which then undermines the SNB’s efforts to lift inflation from near zero.

Above: USD/CHF, GBP/CHF and EUR/CHF shown at daily intervals.

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

“We expect further franc strengthening into 2022 as the return of the virus and expectations of tighter monetary policy elsewhere buoy safe haven demand and fundamentals work against the euro,” Pantheon’s Debono told clients on Thursday.

“With inflation falling and the currency strengthening, the Bank will not be happy in H1 2022. We look for it to bump up CHF sales to prop up the currency to the level it previously "targeted", that is, CHF 1.05 per euro,” she also said, after warning that EUR/CHF could fall to 1.02 next year.

Recent declines in the Euro stem from a deterioration of the continental economic outlook stemming from a reintroduction of coronavirus related restrictions on business activities and social contact in major and minor Eurozone economies alike.

They and widespread strength in the Dollar conspired to push EUR/CHF more than four percent lower during the final quarter and are among the factors that Pantheon Macroeconomics sees pushing EUR/CHF to 1.02 by the middle of 2022, likely eliciting large intervention from the SNB along the way.

“We think that the Bank’s recent inaction in the FX market speaks louder than words, and we doubt that it will make substantial interventions unless the franc rises to around the CHF 1.025 per euro mark,” says Capital Economics’ Oxley.

Above: GBP/CHF and EUR/CHF shown at weekly intervals.