Desjardins: GBP/CAD Exchange Rate to Slide in 2023

- Written by: Gary Howes

Image © Adobe Stock

A leading Canadian lender and commercial bank says the Canadian Dollar will strengthen against the Pound and Euro over the duration of 2023, ensuring a recent trend of appreciation proves short-lived.

Desjardins Bank says a global recession is "at our doorstep" and this will be keenly felt by the UK and Eurozone, however, Canada will likely only experience a shallow recession.

The Pound has rallied against the Canadian Dollar since September as the Canadian Dollar, one of 2022's best-performing currencies until October, retreated broadly in tandem with its southern neighbour and amidst falling oil prices.

The Pound to Canadian Dollar exchange rate (GBP/CAD) was also caught by a broader recovery in Pound Sterling, which has responded positively to the new leadership in the UK and a broader global market rally.

But these dynamics are unlikely to hold say economists at Desjardins.

"The cost of living crisis, political uncertainty, higher interest rates and Brexit are already weakening the economy and causing the UK to lag behind other countries. And the government of new Prime Minister Rishi Sunak is taking a rather restrictive approach to fiscal policy. We therefore expect the recession to last until the second half of 2023 in the United Kingdom as well," says Jimmy Jean, Chief Economist and Strategist at Desjardins.

Compare GBP to CAD Exchange Rates

Find out how much you could save on your pound to Canadian dollar transfer

Potential saving vs high street banks:

C$4,450.00

Free • No obligation • Takes 2 minutes

By contrast, Canada's recession is expected to be shallower.

"Our outlook for next year continues to be for a short and shallow recession, albeit one that could stretch into the third quarter. Risks to the outlook also continue to be tilted to the downside, as households are increasingly coming up against the reality of higher costs of servicing their mortgages. This said, we are more optimistic about 2024, as eventual interest rate cuts spur renewed activity," says Jean.

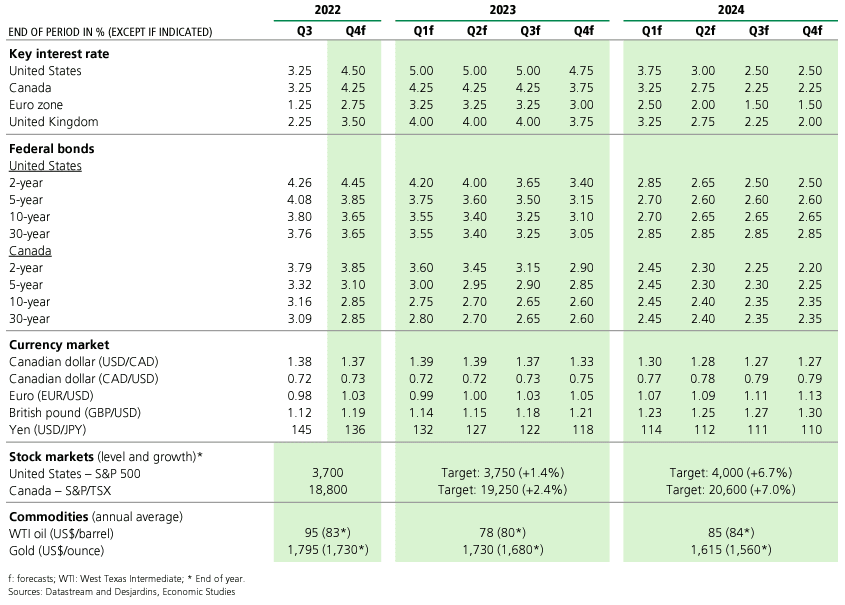

Economists at the Canadian bank also expect the rate hike announced by the Bank of Canada on December 7 to be the last of the tightening cycle, they forecast rate cuts starting at the end of next year.

Desjardins finds the Canadian economy should also be in a better position by the turn of the year than initially expected, lowering the overall depth of the upcoming recession.

"The Canadian economy never ceases to surprise. What looked like a sure bet on rapidly decelerating growth going into the end of 2022 has proven to be less of a certainty than we had earlier anticipated," says Jean.

Real GDP in Canada is forecast to come in at 0.2% in 2023, as three consecutive quarters of decline lead to a recovery in the final quarter of the year.

By contrast, the UK is forecast to see real GDP come in at -1.5% in 2023 and for the Eurozone the figure is -0.7%. For the U.S., growth of 0.1 is forecast.

The differing growth prospects translate into Canadian Dollar outperformance against the Pound and Euro, but the Dollar is expected to maintain strength.

Desjardins forecasts the U.S. Dollar-Canadian Dollar exchange rate to be at 1.14 by the end of March 2023, 1.15 by the end of June, 1.18 by the end of September and 1.21 by the end of the year.

They forecast the Pound-Canadian Dollar exchange rate to be at 1.58, 1.60, 1.62 and 1.61 at these points in time.

The Euro-Canadian Dollar exchange rate profile is meanwhile set out as: 1.38, 1.39 1.41 and 1.40.

(If you are looking to protect or boost your international payment budget you could consider securing today's rate for use in the future, or set an order for your ideal rate when it is achieved, more information can be found here.)