Canadian Dollar: Oil Headwinds for Now, But 2023 a Different Story

- Written by: Gary Howes

- CAD underperformance has oil price links

- As oil prices now recording losses for 2022

- But 2023 could see a significant rebound

Image © Adobe Stock

The "surprising decline" in oil prices is weighing on the Canadian Dollar says one of Canada's major banks.

Analysts at Bank of Montreal's investment banking unit say the trend lower in oil has contributed to the currency's recent decline but they anticipate an oil price recovery from current levels, and this would offer some support on the horizon.

"The surprising decline in the price of oil over the past week or so has mostly trickled through to FX in the ways we would expect," says Greg Anderson, Global Head of FX Strategy at BMO Capital Markets.

In a recent currency briefing, he says the Canadian Dollar's distinct underperformance can be linked to oil market dynamics: "2022's surprising crude realities are crushing exporter currencies."

The Canadian Dollar is the biggest loser amongst the major currencies when screened over a one-month period, but the Norwegian Krone - Europe's petro currency - is also a noted underperformer, confirming the oil linkage.

Compare GBP to CAD Exchange Rates

Find out how much you could save on your pound to Canadian dollar transfer

Potential saving vs high street banks:

C$4,450.00

Free • No obligation • Takes 2 minutes

Over the same period, the New Zealand Dollar, Pound and Euro are the top performers.

"So we are seeing a general rally in oil importer currencies against exporter currencies," says Anderson.

The Pound to Canadian Dollar exchange rate (GBP/CAD) has risen for five weeks in succession as it extends a trend of appreciation that has been in place since September.

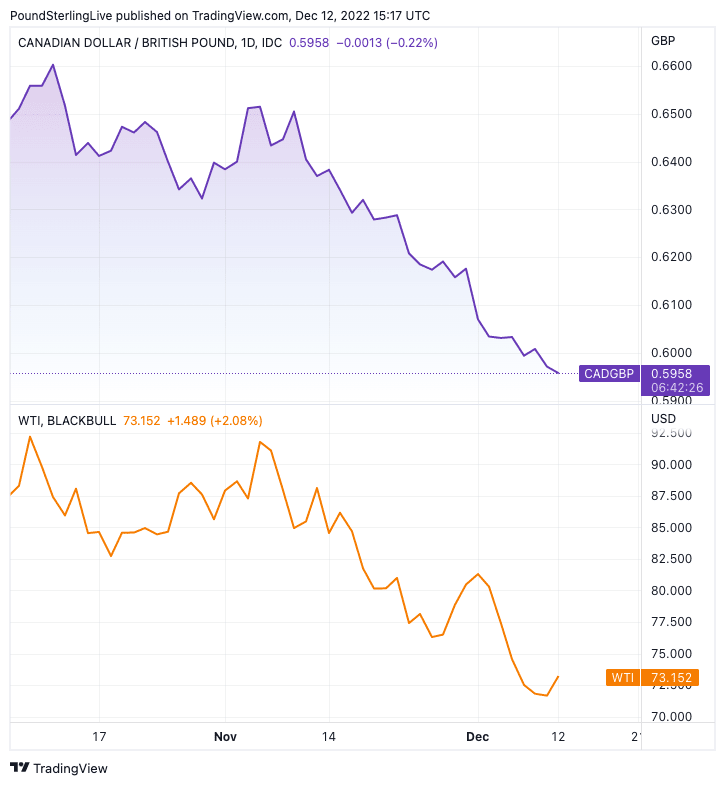

Above: CAD/GBP (top) and WTI oil (bottom. Price action suggests a correlation between the currency pair and oil.

"Canada's dollar was held hostage to oil market weakness as the price of crude teetered near 2022 lows around $70," says Joe Manimbo, Senior Market Analyst at Western Union. "Commodity currencies were the weaker performers to kick off a very big week, declines that reflected what markets see as a growing risk of a global economic downturn."

The developments have helped GBP/CAD spot to 1.6769 at the time of writing, taking international payment rates on a typical bank account to approximately 1.63 and rates at competitive payment providers to approximately 1.6720.

WTI crude oil prices surged on the commodity shock that followed Russia's invasion of Ukraine and peaked at $126.34 / barrel at one point in March. But it is now registering a loss of 3% for 2022, having fallen back to $72 at the time of writing.

Brent crude is now down half a percent for the year at $77.30. Western Canada Select - the Canadian benchmark - is down to $49.77 a barrel, having more than halved since levels as high as $109 in March.

"Given where we were 6M ago, that is a massive shock!" says Gallo.

Looking ahead, where oil markets go from here could bear some relevance to the Canadian Dollar's upcoming performance.

"We suspect that this low price is unlikely to last for long," says Anderson. "We expect it to recover back up into the $80s by mid January."

If CAD's ties with oil remain intact, it could make a recovery alongside.

Oil specialists roundly agree that one important key to the outlook is China.

"A China reopening could significantly tighten physical markets, as it could unlock 1.5-2 mb/d of incremental demand in relatively short order, which would be worth $20/b on Brent, by our estimates," says economist Amarpreet Singh at Barclays.

Fuel for the bulls comes from JP Morgan which has released its year-ahead forecasts for the oil market.

"China demand weakness affecting the near term, but demand growth to continue through 2024. Supply materially

underperformed, in OPEC+ and US. As such, we see our Supercycle in early innings with upside risk to $150/bbl in 2023-24 led by tighter spare capacity and potential supply outages," says Christyan F Malek, head of oil and gas research at JP Morgan.

JP Morgan is fundamentally bullish on the outlook for crude oil over the medium term as large parts of the listed producer space need +$75/bbl to break even.

Low OECD inventories and limited spare capacity should ensure demand outstrips supply.

China continues to ease Covid restrictions as it looks beyond its zero-Covid world, however, elevated cases and a slow unwinding means it will only be in 2023 that a full rebound will shape up. (If you are looking to protect or boost your international payment budget you could consider securing today's rate for use in the future, or set an order for your ideal rate when it is achieved, more information can be found here.)

Compare GBP to CAD Exchange Rates

Find out how much you could save on your pound to Canadian dollar transfer

Potential saving vs high street banks:

C$4,450.00

Free • No obligation • Takes 2 minutes