Australian Dollar's RBA Gains Short-Lived as Downtrend Retains Stranglehold on this Unloved Currency

Above: RBA Governor Philip Lowe. Image © Crawford Forum, Reproduced Under CC Licensing

- RBA clearly more comfortable with Aussie Dollar's recent losses

- Australian Dollar worst performer over the past month

- Downtrend in AUD remains in control

The Australian out-performed rivals during the Asian session on Tuesday, September 04 thanks to a shift in stance to the currency's value at the Reserve Bank of Australia (RBA), however a subsequent retreat only serves to confirm to us the negative outlook facing this currency.

The RBA touched on the subject of the currency's value in a communication note released following the Board's September meeting.

For 25 consecutive meetings between April 2016 and June 2018 the RBA used the words "an appreciating exchange rate could [or would] be expected to result in a slower pick-up in economic activity and inflation than currently forecast".

That guidance was dropped at the July meeting when the RBA merely noted that the "The Australian dollar remains within the range that it has been in over the past two years on a trade-weighted basis".

Guidance shifted further today, with the RBA confirming that the Australian Dollar "has depreciated against the US Dollar along with most other currencies."

"Not surprisingly, the Australian Dollar has popped slightly higher post the meeting," says Leila O'connell with Westpac. In short, when a central bank is concerned that a currency is expensive markets will hit the sell buttons having judged that the central bank will guide policy in such a direction as to deliver a weakening in the currency.

When a central bank is happy with valuations, traders are happy to accumulate that currency as the threat of some kind of intervention is greatly diminished.

Westpac believe the Aussie is now at levels considered to be cheap to fair-valued by their studies.

While the initial reaction is judged to be positive, we note the Aussie is coming back under pressure through the opening of the European session.

The Pound-to-Australian Dollar exchange rate is quoted at 1.7845, having been as low as 1.7780 in the wake of the RBA decision.

The US Dollar is higher with AUD/USD quoted at 0.7199, having been as low as 0.7176.

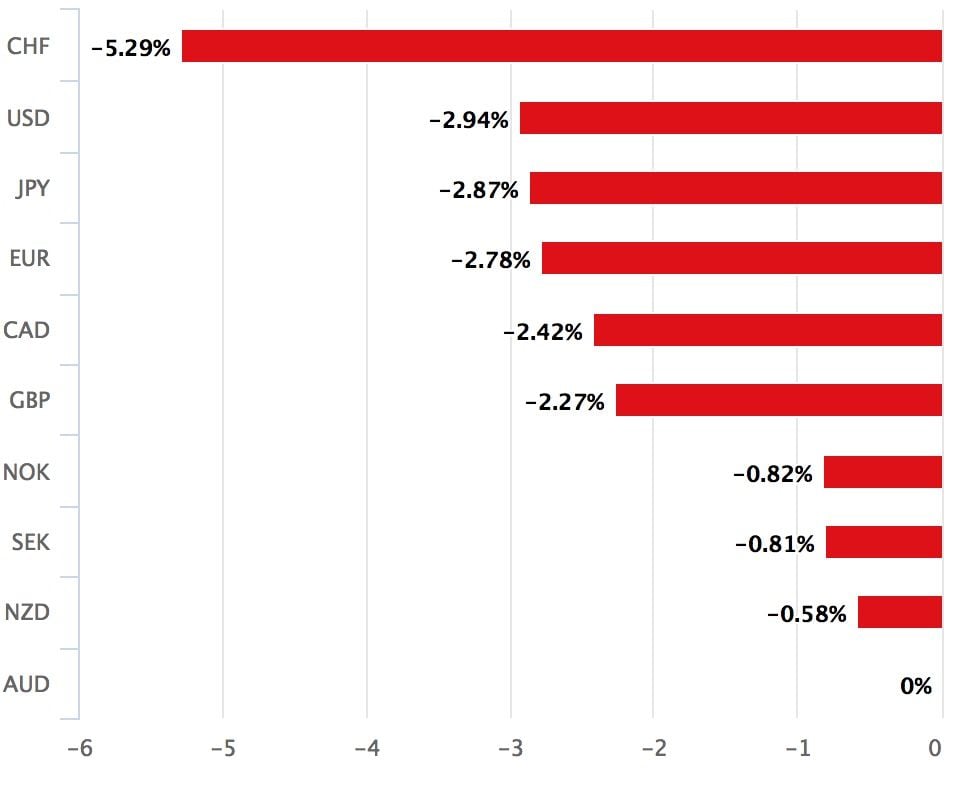

Whatever the RBA says, it will be hard to fight a growing trend of weakness in this antipodean currency; it is easily the worst performing major over the course of the past month. Over the path of 2018 only the New Zealand Dollar and Sweden's Krona have done worse.

The trend is hard to fight, and this is why our week ahead forecast suggests further losses are likely.

The pair has now recovered back above the 50-week moving average on the weekly chart despite temporarily breaking below the level in August.

The long up week candle is a sign the uptrend is likely to continue.

The daily chart shows how the short-term trend has probably reversed after the young uptrend formed two consecutive higher highs and higher lows and broke above both the 50 and 200-day moving averages, which are usually tough obstacles on charts.

Now that the pair has established a new short-term uptrend from a technical perspective it is more likely to extend that trend than not, so we are biased to forecasting higher prices.

A break above the 1.8054 would probably confirm such an extension to the next target at 1.8150.

Advertisement

Get up to 5% more foreign exchange for international payments by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here

ANZ Maintain Bearish Stance on Aussie Dollar

One of the antipodeans largest lenders has confirmed a bearish outlook on both the Australian and New Zealand Dollar's for the remainder of 2018 with further underperformance being eyed in 2019.

ANZ have recently told clients of their investment and corporate banking arms that they retain a bearish bias toward risk sensitive currencies as global sentiment is ripe for a turn.

Indeed, global conditions are a key factor to watch for both the Aussie and Kiwi going forward as both currencies have shown a strong correlation to overall investor sentiment as well as the performance of the Chinese economy - the leading export market for both Australia and New Zealand.

"Liquidity is already tight, sentiment towards US assets is near euphoric and volatility is low, a reversal in these will not be supportive of risk sensitive currencies," says Daniel Been, Head of FX Strategy at ANZ in Sydney.

And, the performance of China appears to be unlikely to aid the two currencies either.

"For the AUD and NZD, better news around China is nearly absorbed and over the rest of the year we remain bearish on both," says Been.

With regards to the Australian Dollar's outlook specifically, Been says:

"The AUD looks like it can’t catch a break. Widening interest rate differentials vis-à-vis the USD, an unsupportive risk backdrop and the US-China trade tiff have pushed the AUD lower over the year. In our view, these stories will weigh on the medium term outlook."

Advertisement

Get up to 5% more foreign exchange for international payments by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here