GBP/AUD Week Ahead Forecast: RBA Risks Split 50/50

- Written by: Gary Howes

- Uncertainty is high as to how RBA will act

- Rate hike could prompt GBPAUD decline to 1.86

- Break below here presses pause on GBPAUD uptrend

- But GBPAUD still prefered given lacklustre Chinese data

Image © Adobe Images

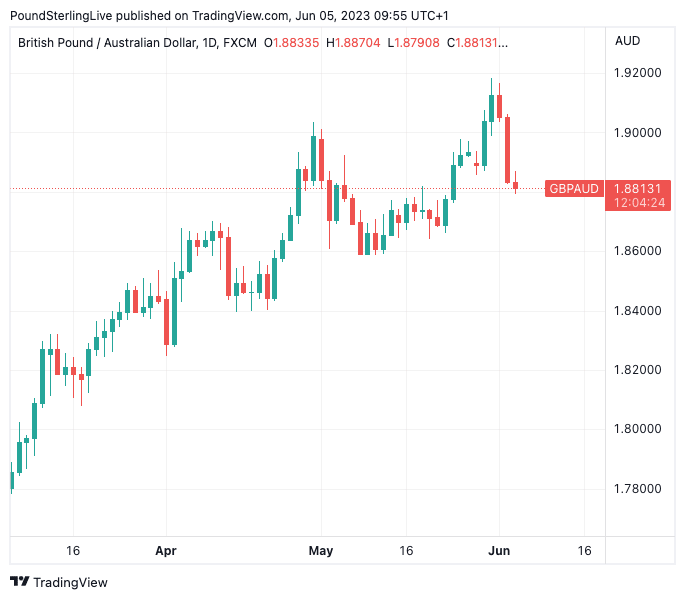

The Pound to Australian Dollar exchange rate (GBPAUD) remains in a multi-week uptrend, however, near-term turbulence inspired by Australia's central bank can offer opportunities in either direction.

The Reserve Bank of Australia (RBA) will deliver its latest interest rate decision Tuesday and markets are split as to whether another interest rate hike will be forthcoming.

The odds of a hike rose last week after Australia's Fair Work Ombudsman decided on a minimum wage increase of at least 5.75%.

The decision was judged as inflationary by markets that bid the Aussie Dollar higher alongside the rise in expectations for further rate hikes implied by the wage decision.

"The inflation fight for the RBA is far from over as markets learned last week with CPI jumping more than expected in April. The Friday decision from the Fair Work Commission increasing the minimum wage to 5.75% adds to the sticky price problem for the RBA," says Bob Savage, Head of Markets Strategy and Insight at BNY Mellon.

The Pound to Australian Dollar exchange rate (GBPAUD) fell half a per cent on the day the wage decision was announced, but had been trading at a new multi-month high at 1.9183 ahead of the announcement that Australia's minimum wage would be increased to $882.80 per week or $23.23 per hour.

Market pricing implies investors are split on whether or not to expect another hike, meaning there is a high 'surprise factor' embedded in the RBA's decision that can have the ability to deliver AUD volatility.

Analysts at RBC Capital Markets say they now see a 25 basis point hike at the RBA in June as a result of the minimum pay award.

Should the RBA hike, and maintain guidance that further hikes are necessary if the data warrants, then the Australian Dollar can extend recent gains, putting GBPAUD under pressure.

"The Australian dollar could catch a bid if the Reserve Bank of Australia raises interest rates for a second consecutive month on Tuesday," says Robert Howard is a Reuters market analyst. "The AUD rose by more than 1% against the U.S. dollar after the RBA unexpectedly upped its cash rate to 3.85% last month."

GBPAUD pullbacks look to be finding support in the 1.86 area and the market could therefore look to fade any Aussie Dollar strength in this region.

Should 1.86 hold then near-term advance could be possible with a test of the 2023 highs in the approach to 1.92 being possible over the coming days.

But should 1.86 break we could see the GBPAUD's uptrend face a more prolonged setback, although it would take a deeper pullback over a number of weeks to convince the market that the broader multi-month trend is over.

Above: GBPAUD at daily intervals.

Should the RBA keep rates unchanged we would look for a test of the 2023 high near 1.92 to occur on the day, or if not, later in the week.

Analysts say 'carry' - the favouring of currencies where bond yields are highest - remains highly relevant for currency markets at the current time, and on this count the Pound is well supported.

Therefore the Australian Dollar could be penalised if the RBA doesn't offer it further support via higher interest rates.

"The markets price a 50% chance of a 25bps hike from the RBA on Tuesday, though the analyst consensus is for the Australian central bank to hold rates at 3.85%," says BNY Mellon's Savage.

"Weakening demand will put significant downward pressure on inflation and eventually ease the demand for labour and therefore the more persistent pressure on services inflation," says Bill Evans, Chief Economist at Westpac. "There is too much uncertainty for the RBA Board to raise the cash rate again".

Compare GBP to AUD Exchange Rates

Find out how much you could save on your pound to Australian dollar transfer

Potential saving vs high street banks:

A$4,875.00

Free • No obligation • Takes 2 minutes

BNY's Savage says if the RBA does opt for a pause, it seems likely they will keep their forward guidance that "members also agreed that further increases in interest rates may still be required, but that this would depend on how the economy and inflation evolve."

This guidance could limit some Aussie Dollar weakness.

China meanwhile remains a key pillar of Australian Dollar performance and disappointing Chinese data means the rebound in the world's second-largest economy continues to disappoint against the lofty expectations at the start of 2023.

"The ability for the RBA to have credibility with a pause rather than a skip will continue to rest on the data – not just domestically but also in China," says Savage.

"Any new surge of policy there to stoke more demand for steel or other commodities will matter significantly to how inflation plays out in Australia," he adds.

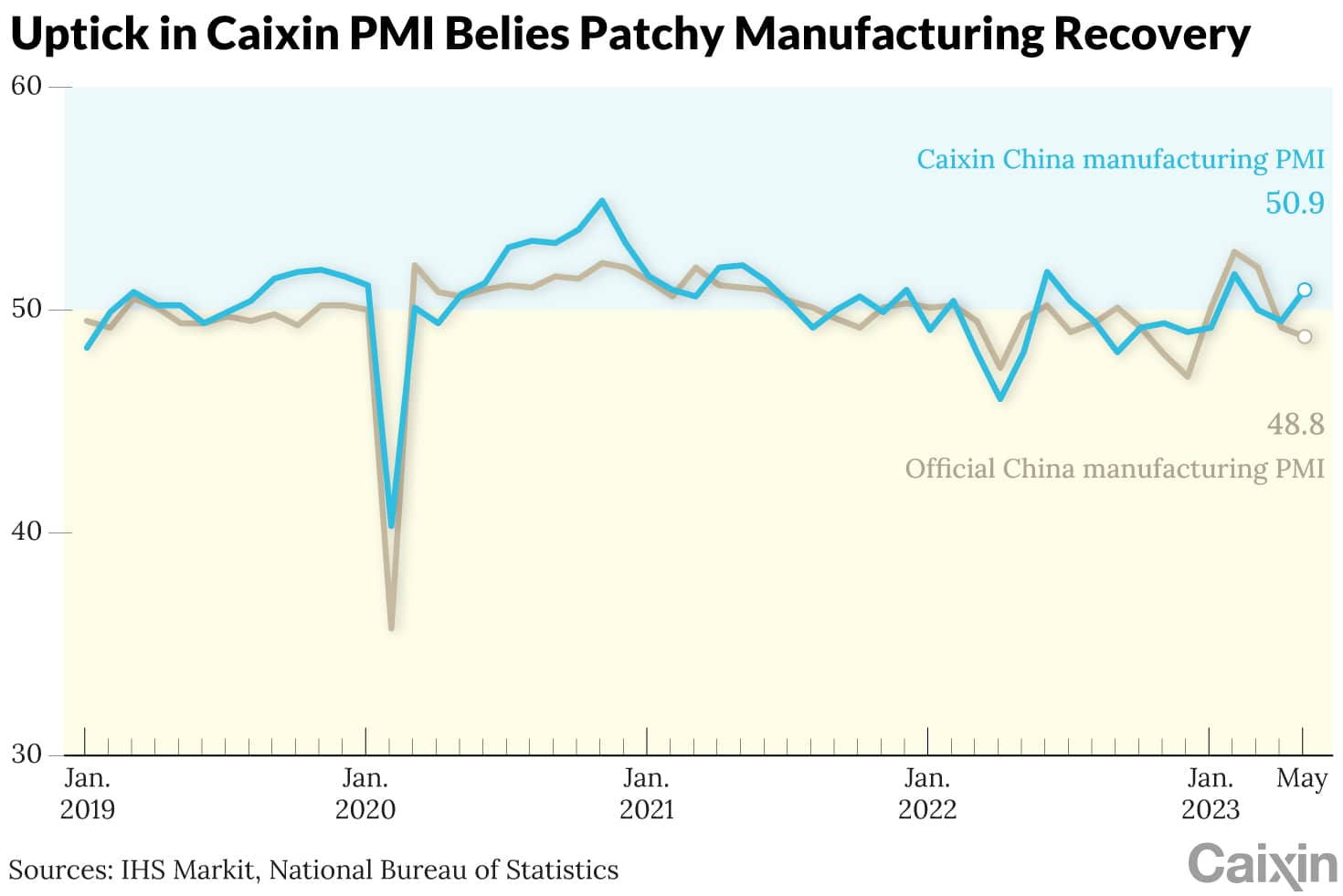

The Australian Dollar was aided late last week by a Chinese manufacturing survey for May showing the sector returned to growth, but other data point to a shaky recovery that could limit the upside potential in China-linked assets.

The Australian Dollar is considered one such China-linked asset given China's enormous appetite for Australian exports, particularly raw materials.

A benchmark indicator for the health of the raw material sector is copper, which rose in value after China's Caixin Manufacturing PMI lifted to 50.9 in May from 49.5 April, beating expectations for another 49.5 reading.

"The Aussie firmed on a more upbeat Asian session, as copper prices have also been on the mend from the lows of late and after China's Caixin Manufacturing PMI rose," says John Hardy, Head of FX Strategy at Saxo Bank.

The Caixin PMI release follows weaker-than-expected official PMI numbers that track activity among larger companies. On May 31 China's official manufacturing PMI read at 48.8 in May, down from 49.2 April and the 49.5 estimate held by the market.

China's property slowdown is one particular area of concern for Australia, given it is a key source of demand for Australian raw material exports.

A separate report released yesterday showed Chinese property market growth momentum weakening considerably.

The China Beige Book reported that Chinese property prices accelerated in the housing market in April but sales slowed.

"In commercial property, both pricing and transactions weakened sharply," the report said. "Poor results in construction and reduced fiscal activity sent copper producers’ May earnings and production into contraction."

The Markit iBoxx index for China high-yield real estate bonds is meanwhile back down to near where it was trading in November when Beijing announced support for the sector through a "16-point plan."

In the secondary-home market, business activity "has been cooling since April, with a fall in the number of listed-for-sale homes, lower asking prices and fewer transactions," Fitch Ratings said in a release Monday.

"This slowdown follows a strong rebound in 1Q23, suggesting homebuyer confidence remains fragile amid an uncertain economic outlook and weak employment prospects," it added.

Compare GBP to AUD Exchange Rates

Find out how much you could save on your pound to Australian dollar transfer

Potential saving vs high street banks:

A$4,875.00

Free • No obligation • Takes 2 minutes