Australian Dollar: Chinese Manufacturing Data Offers Temporary Relief

- Written by: Gary Howes

Image © Adobe Images

The Australian Dollar firmed as a Chinese manufacturing survey for May showed the sector returned to growth, but other data point to a shaky recovery that could limit the upside potential in China-linked assets.

The Australian Dollar is considered one such China-linked asset given China's enormous appetite for Australian exports, particularly raw materials.

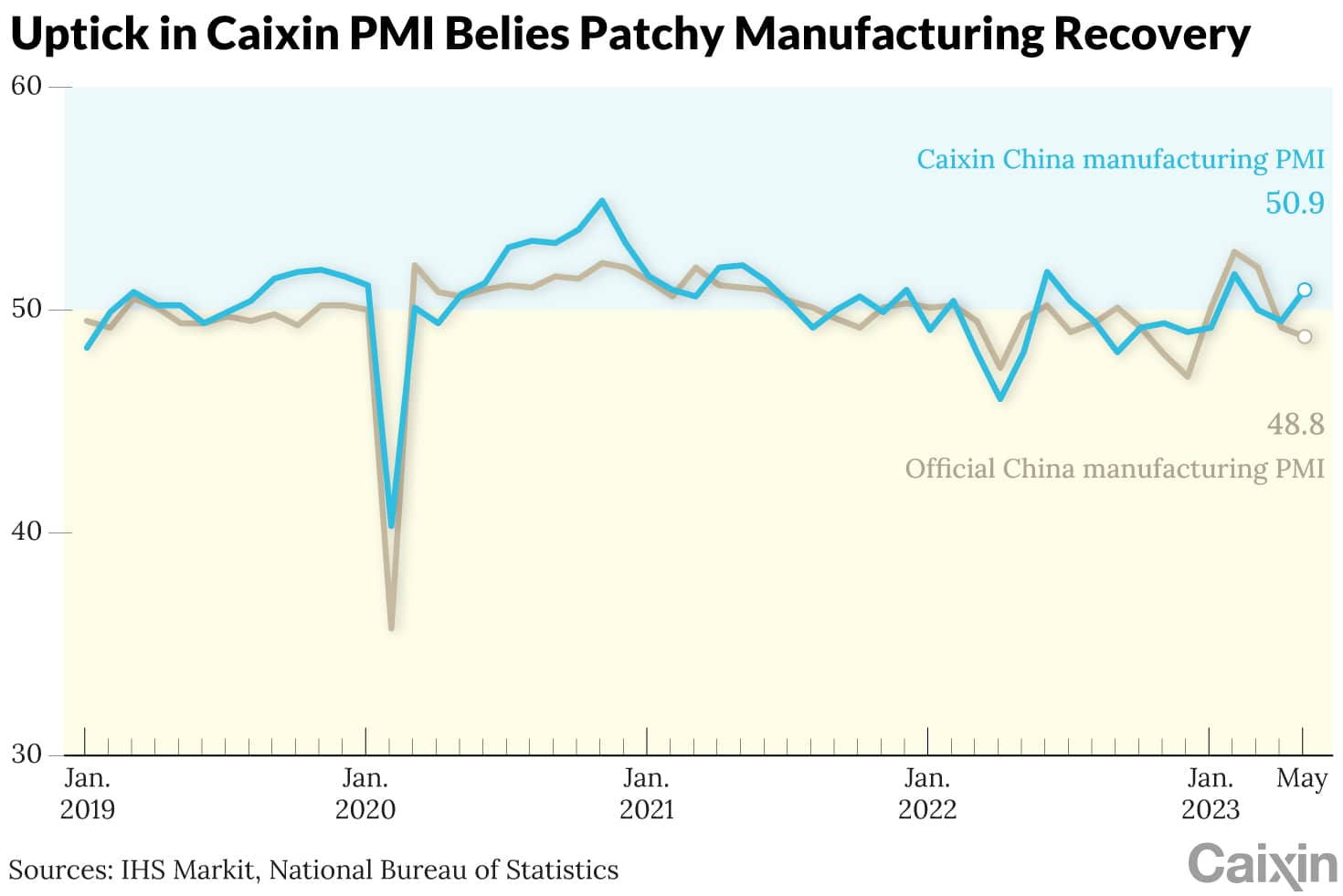

A benchmark indicator for the health of the raw material sector is copper, which rose in value after China's Caixin Manufacturing PMI lifted to 50.9 in May from 49.5 April, beating expectations for another 49.5 reading.

"The Aussie firmed overnight on a more upbeat Asian session, as copper prices have also been on the mend from the lows of late and after China's Caixin Manufacturing PMI rose," says John Hardy, Head of FX Strategy at Saxo Bank.

The data prompted a rebound in the Australian-U.S. Dollar exchange rate to above 0.65, the Pound to Australian Dollar exchange rate meanwhile retreated from recent multi-month highs to 1.9110.

The Caixin PMI release follows weaker-than-expected official PMI numbers that track activity among larger companies. On May 31 China's official manufacturing PMI read at 48.8 in May, down from 49.2 April and the 49.5 estimate held by the market.

"Contradictory reports released this week imply the outlook remains uncertain with more calls from market commentators for more government stimulus," says John Mayer, head of research at SP Angel.

This uncertainty will therefore likely mean any Australian Dollar strength will be limited in nature, meaning sellers of Aussie Dollars could prefer selling on any spikes in value.

The Chinese economy was expected to boom in 2023 as it was released from the shackles of Covid restrictions, an expectation that has since proven misplaced.

News of a full Chinese reopening boosted China-linked assets like the Aussie Dollar at the start of the year, but the subsequent disappointment has weighed.

China's property slowdown is one particular area of concern for Australia, given it is a key source of demand for Australian raw material exports.

A separate report released yesterday showed Chinese property market growth momentum weakening considerably.

The China Beige Book reported that Chinese property prices accelerated in the housing market in April but sales slowed.

"In commercial property, both pricing and transactions weakened sharply," the report said. "Poor results in construction and reduced fiscal activity sent copper producers’ May earnings and production into contraction."

The Markit iBoxx index for China high-yield real estate bonds is meanwhile back down to near where it was trading in November when Beijing announced support for the sector through a "16-point plan."

In the secondary-home market, business activity "has been cooling since April, with a fall in the number of listed-for-sale homes, lower asking prices and fewer transactions," Fitch Ratings said in a release Monday.

"This slowdown follows a strong rebound in 1Q23, suggesting homebuyer confidence remains fragile amid an uncertain economic outlook and weak employment prospects," it added.

Compare GBP to NZD Exchange Rates

Find out how much you could save on your pound to New Zealand dollar transfer

Potential saving vs high street banks:

NZ$5,350

Free • No obligation • Takes 2 minutes