UK Current Account Deficit Stats Confirm UK's Exports of Goods at Record High

- UK current account deficit falls faster than expected

- Fourth consecutive quarter of decline

- Value of exports increases by £1.4 billion in first quarter

Image © Adobe Stock

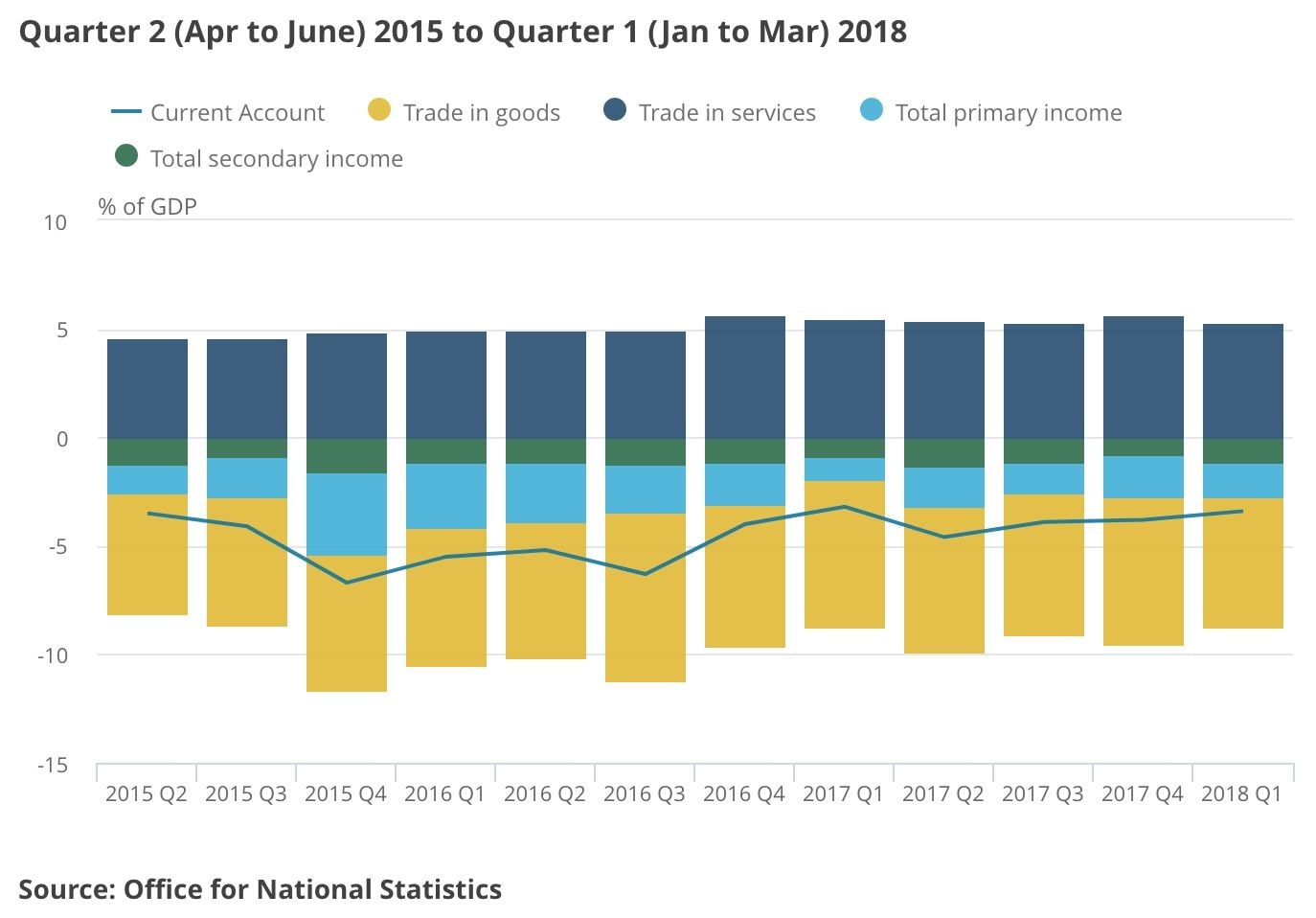

The UK's current account deficit stood at £17.7BN (3.4% of GDP) in the first quarter of 2018, a figure that was lower than the £18BN markets had been anticipating thanks in part to the UK exporting a record amount of manufactured goods.

The data represents a narrowing in the current account deficit of £1.8BN from a revised deficit of £19.5BN (3.8% of GDP) in Quarter 4 (October to December) 2017.

The current account is essentially the UK's bank balance with the rest of the world which reflects the earnings and outgoings derived from trade as well as the earnings from foreign assets. The shrinking of the deficit represents the fourth consecutive quarter of narrowing for the current account deficit.

The ONS reports the UK’s current account deficit narrowed primarily due to a narrowing of both the trade deficit and the primary income deficit, partially offset by a widening of the secondary income deficit in Quarter 1 (Jan to Mar) 2018.

The total trade deficit narrowed to £3.8 billion in Quarter 1 2018, from £5.7 billion in Quarter 4 2017 while the primary income deficit narrowed by £1.5 billion in Quarter 1 2018 to £8.1 billion from a revised deficit of £9.6 billion in Quarter 4 2017.

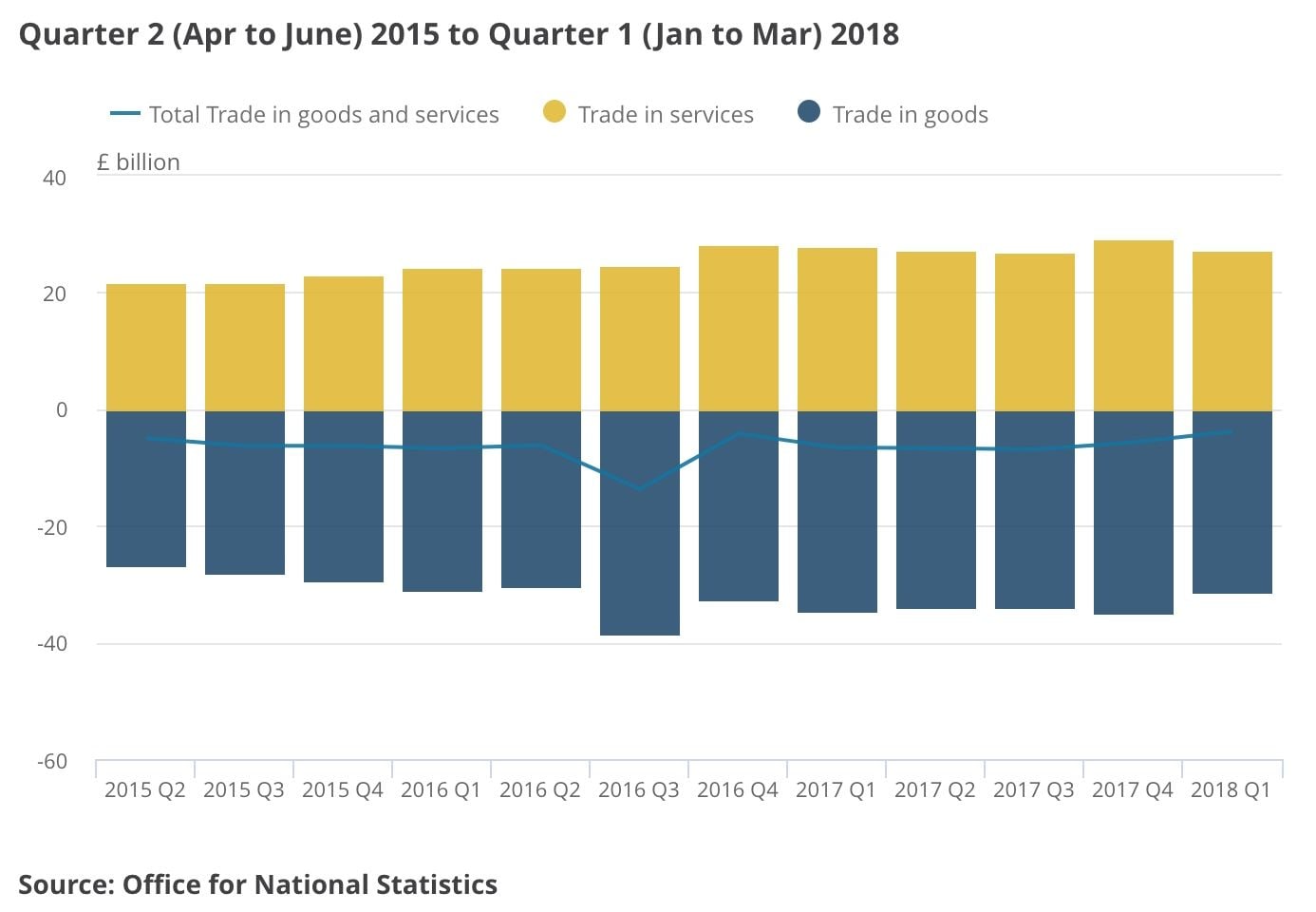

The ONS reports that the exports of goods has meanwhile reached record high: The trade in goods deficit in Quarter 1 2018 was £31.2 billion, compared with a deficit of £34.9 billion in Quarter 4 2017. The narrowing to the trade in goods deficit in Quarter 1 2018 was due to imports decreasing by £2.3 billion and exports increasing by £1.4 billion.

This followed a record annual figure for 2017 of £338.9 billion.

The increase in exports of goods was due to exports of finished manufactured goods increasing by £0.8 billion to a record £47.6 billion, which has been a result of a rise in the exports of cars, along with exports of oil increasing by £0.4 billion to a recent record of £7.1 billion (partially due to an increase in the price of oil) and exports of unspecified goods increasing by £0.2 billion to £1.0 billion.

However, the trade in services surplus narrowed by £1.8 billion to £27.4 billion in Quarter 1 2018. This was due to exports decreasing by £1.4 billion and imports increasing by £0.4 billion.

The service sector accounts for over 80% of UK economic activity and the provision of services by UK companies to the rest of the world - for instance banking - is a major foreign currency earner.

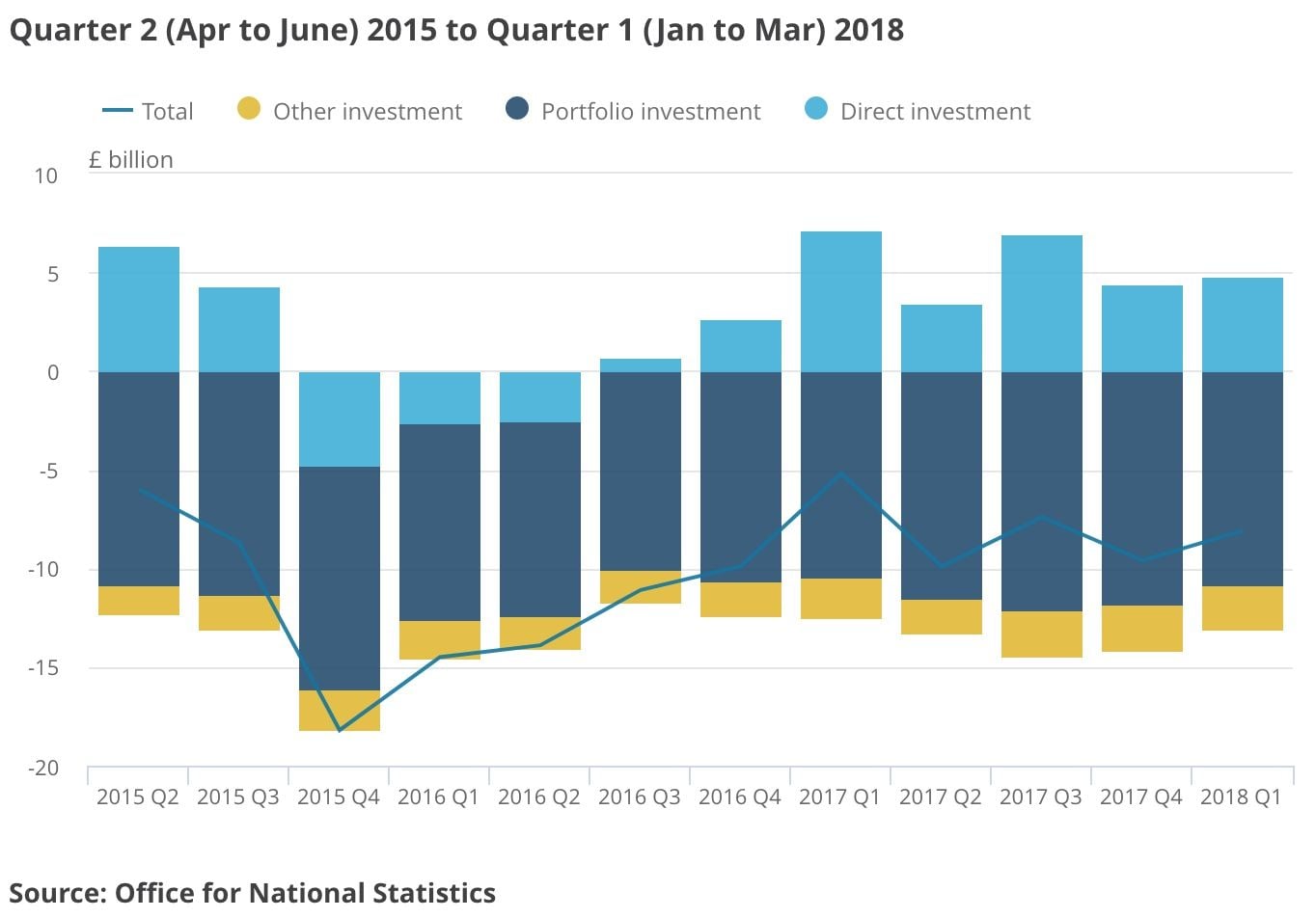

Meanwhile the income derived from the holding of assets in foreign countries by UK citizens increased with receipts rising by £2.5 billion, this was partially offset by payments to foreign holders of UK assets increasing by £1.0 billion.