Here’s Why Economists Are Still Divided Over UK Growth in the Fourth-quarter and Beyond

The UK economy grew by a modest 0.4% in the recent quarter, tourist spending surged and the current account deficit narrowed but the 2018 outlook remains uncertain.

The UK economy picked up in the third-quarter, aided by higher consumer spending, but it is on course to slow by a fraction for 2017 overall and opinions are still divided on what will happen next year.

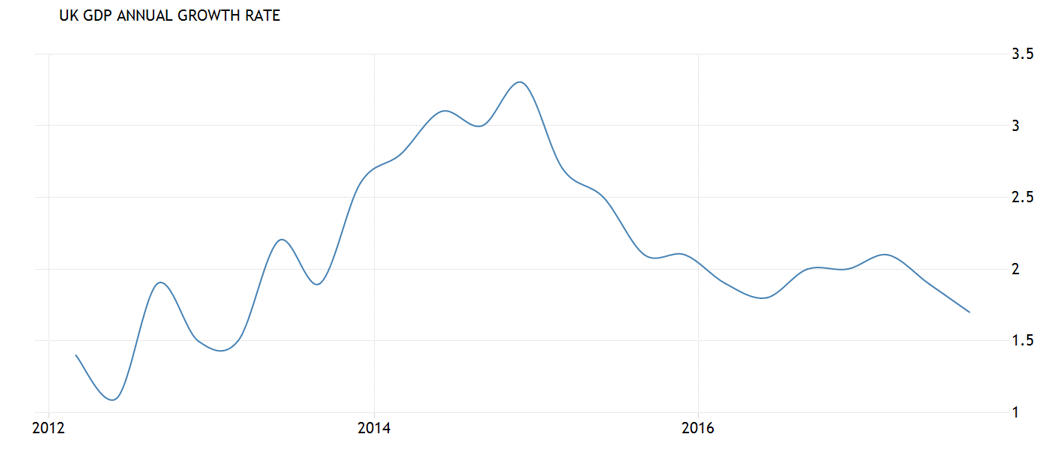

Third quarter GDP growth was an unrevised 0.4%, according to the Office for National Statistics, up from 0.3% in the first and second quarters. The annual pace of growth was 1.7%.

The increase was driven predominantly by household consumption, which rose by 0.5% when compared with the three months earlier, up from the 0.2% previously estimated.

However, this higher consumer spending came at the expense of the household savings ratio, which fell even further during the quarter, from 5.6% to 5.2%.

Separately, the ONS revised its estimate of business investment growth up to 0.5% for the quarter, from 0.2% previously.

Image Courtesy of Tradingeconomics.com

Long-term Decline?

Despite household consumption being the main contributor to the economy in the recent period, its influence over the numbers has been waning over time, says Philip Shaw, an analyst at Investec.

"This marks the slowest annual pace of growth in consumers’ expenditure since Q1 2012 when inflation was similarly above 3%."

High inflation has risen faster than take home pay in the last year and a half, eroding household's ‘real income’ and they are now making up for that shortfall by not saving as much.

"When measured on a per capita basis, real incomes were estimated to be 0.2% below a year earlier," says Shaw.

The three months to the end of September were the sixth successive quarter in which real disposable income has fallen in annual terms because of the effects of high inflation.

This income squeeze has resulted in the Office for Budget Responsibility forecasting a marked slowdown in growth for 2017 and 2018.

The OBR now projects the UK will grow by 1.5% for 2017 and 1.4% for 2018. Some private sector forecasters say this is too pessimistic.

Image Courtesy of Tradingeconomics.com

UK to Grow Faster than Market Expects in 2018?

Paul Hollingsworth, a senior UK economist at Capital Economics, foresees a similar 0.4% rise in the final three months of the year and a total growth rate for 2017 of 1.8%.

This is above the OBR forecast but 0.1% slower than the upwardly-revised growth of 1.9% seen in 2016. Hollingsworth is also optimistic about the future, expecting growth to improve in 2018 more than the market currently expects.

“With the squeeze on households’ real earnings set to abate, and a chance that Brexit uncertainty actually recedes, rather than build further, as negotiations progress, we suspect that the economy will actually gain a little momentum next year, and forecast growth of 2.2% in 2018,” he wrote in a recent note.

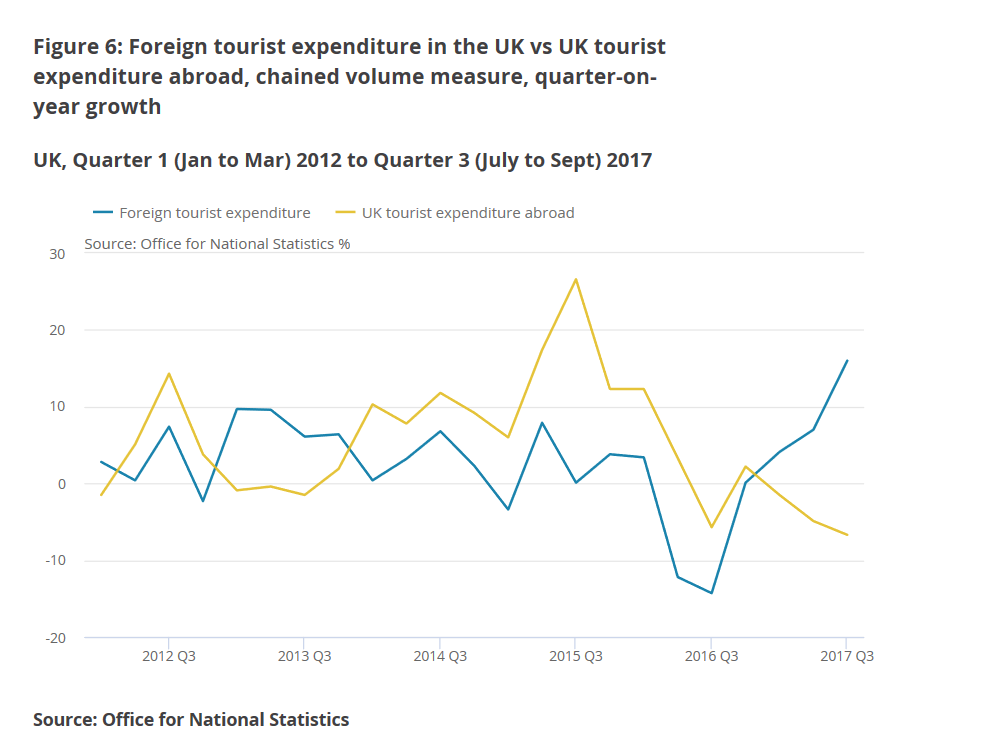

Tourist Spending Surges, Current Account Narrows

Spending by tourists in the UK surged during the third-quarter, according to the ONS, by a whopping 16.0% (in volume terms) when compared with the same period of 2016 - the highest year-on-year rise for seven years.

The steep increase coincided with a simultaneous fall of 6.7% in UK tourist expenditure abroad, a contrast that the ONS also puts down to the weak Pound.

Tourist spending figures follow current account data that showed the UK’s deficit narrowing from £-25.8bn to £-22.8bn during the same period. In GDP terms this was -4.5% of GDP, down from -5.1% previously.

The current account is an important indicator of demand for Sterling as it describes the difference between the amount of money flowing into the UK and the amount of money leaving.

A widening deficit indicates reduced demand for Sterling and a narrowing deficit suggests improving demand for the currency.

Get up to 5% more foreign exchange by using a specialist provider by getting closer to the real market rate and avoid the gaping spreads charged by your bank for international payments. Learn more here.