Labour Manifesto to Give "Significant" Boost to UK Economic Growth say Capital Economics but Taxation Assumptions to be Tested

- Written by: Gary Howes

Above: Jeremy Corbyn, Labour leader. Pic: Labour.org.uk 2017.

If implemented, the Labour manifesto for the 2017 general election could boost UK GDP growth – by increasing investment spending.

But the growth will come at the cost of higher debt which would potentially result in higher interest rates.

This is the main finding of economist Scott Bowman at Capital Economics - the independent economic research consultancy.

Bowman and his team have looked at Labour’s manifesto proposals and finds the big difference between the Labour manifesto and the Conservative Government’s policy relates to intended investment spending.

Labour has committed to an extra £250bn over the next 10 years.

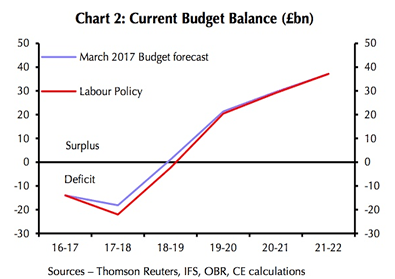

Labour would plan to borrow only around £10bn less in 2021-22 than in 2016-17 – about

£25bn more than forecast in the March Budget.

“Accordingly, fiscal policy would provide much less of a drag on the economy over the next five years – a total tightening of around 0.8% of GDP versus 1.9% under the Government’s plans,” says Bowman.

In contrast to recent elections, the two main parties’ fiscal plans are materially different with the Labour party making a strong pitch to the left-wing elements of the party.

Highlights of the manifesto include nationalising water supply and train companies and taking a significant rump of ownership in energy supply companies.

The funding of these initiatives is less clear.

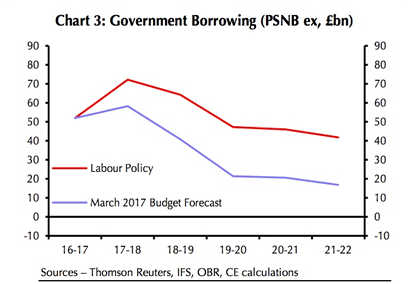

Labour say their manifesto’s commitment to an extra annual £49bn of “current” (day-to-day) spending by 2021-22 would be fully paid for by £49bn of revenue increases.

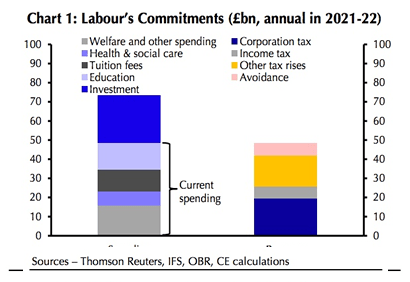

“Accordingly, the plan implies that borrowing (excluding investment) after five years would be the same as that contained in the OBR’s forecasts based on current government policy, although the path there might change,” says Bowman.

Capital Economics say Labour’s Fiscal Credibility Rule – to balance day-to-day spending with total revenue after five years – would allow for an outright loosening of fiscal policy of up to 0.7% of GDP.

“This could provide a significant boost to GDP growth, with the OBR rule of thumb suggesting that 1% of GDP in investment spending raises GDP growth by 1%. And it might also boost the economy’s long-run potential growth rate,” says Bowman.

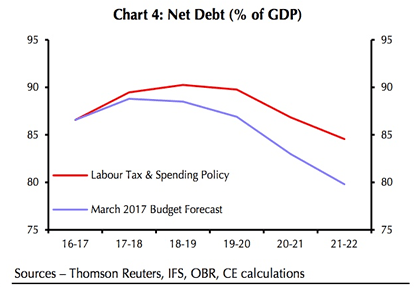

However, the analyst notes a side-effect of these tax and spending plans is that net debt would be around 5% of GDP higher in 2021-22 than in the March Budget forecasts.

Higher Interest Rates

Another point of concern relates to Labour’s nationalisation commitments which would add to this debt further by creating debt but not liquid assets to net off.

“These factors could result in higher long-term interest rates,” says Bowman.

However, considering the sanguine market reaction to US President Trump’s stimulus plans, Capital Economics doubt that the higher debt projections would result in a significant rise in borrowing costs.

“Nonetheless, if current opinion polls prove remotely correct, we’ll never know,” says Bowman.

Assumptions on Tax Revenues to be Tested

The basis that Labour's policies will do what they say on the tin is however based on a number of assumptions.

One key assumption is that the intended tax rises on individuals and companies will yield the income that is expected.

There are serious doubts that this will be achieved.

Labour announced that it plans to increase the rate of corporation tax from 19% to 26% by 2020/21.

This compares to the Government’s plans, which would see the corporation tax rate fall to 17% by 2020/21.

Labour has claimed that this would raise £19.4bn a year by 2020/21 – despite the fact that cutting the corporation tax rate from 28% in 2010-11 to 19% has, in fact, been associated with an increase in onshore corporation tax receipts of 44% since 2011-12.

“Expecting an increase in the rate of Corporation Tax to bring in more revenue is economically illiterate. The fact is that cutting the tax rate has coincided with a substantial increase in receipts for HM Treasury. To increase the rates so dramatically at precisely the time when the UK should be striving to establish its international competitiveness and when many other countries are cutting their headline rates – particularly the US – would be suicidal for the UK economy,” says Tim Knox, Director of the Centre for Policy Studies.

On income taxes, Labour claims that increasing income tax rates for those earning above £80,000 could raise up to £6.4 billion a year.

Labour is proposing to increase the rate from 40p to 45p for those earning between £80,000 and £123,000, and increase the rate to 50p for those earning more than £123,000.

“Labour’s plans to increase income taxes on those earning above £80,000 is unlikely to raise a significant amount of revenue," says Daniel Mahoney, Head of Economic Research at the Centre for Policy Studies. “For example, according to the Budget 2013, increasing the rate to 50p for those earning more than £150,000 would only yield the Treasury around £100m a year. Hiking income taxes on very high earning individuals can only raise minimal amounts of revenue or lead to a dangerous erosion of the tax base. It is widely understood that these taxpayers are the most mobile."

Mahoney argues lowering the 45p rate to £80,000 and increasing the income tax rate to 50p for those earning more than £123,000 could raise a modest amount of revenue but this is still likely to be small in macroeconomic terms.

“Labour has pledged around £50bn of spending commitments. Its pledge on income tax could only cover a tiny fraction of this, while damaging the UK’s attractiveness for investment," says Mahoney.