USD/JPY: is Resumption of the Uptrend Finally Beginning Again?

USD/JPY has bounced strongly over the last few days, the question now is, could this be the start of a resumption of the previous up-trend, or is it merely a dead-cat bounce to be ignored?

“There are increasing signs that there could be a near-term recovery preparing,” says Richard Perry market analyst at Hantec Markets in his analysis of the pair.

“A second positive candle in the past three sessions has started to lay the groundwork for a possible bounce,” he continues.

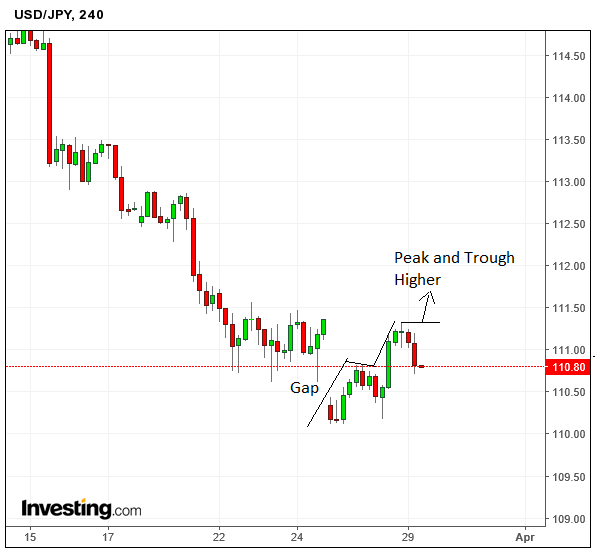

The progression of peaks and troughs which was previously down, is beginning to turn higher, notes Hantec’s Perry – reviewing a simple but effective method for determining the trend - at least on the one-hour chart anyway.

We would prefer to see a change in the sequence of highs and lows on the four-hour chart below, which is our preferred timeframe for monitoring reversals of the short-term trend.

The pair has formed a higher high and higher low but not a sequence; it is possible it might have only formed a three-wave a-b-c correction on the 4-hour chart rather than a reversal.

For us to confirm a reversal of peaks and troughs we would want to see a break above the 111.32 highs as this would establish a sequence of two or more higher highs and lows.

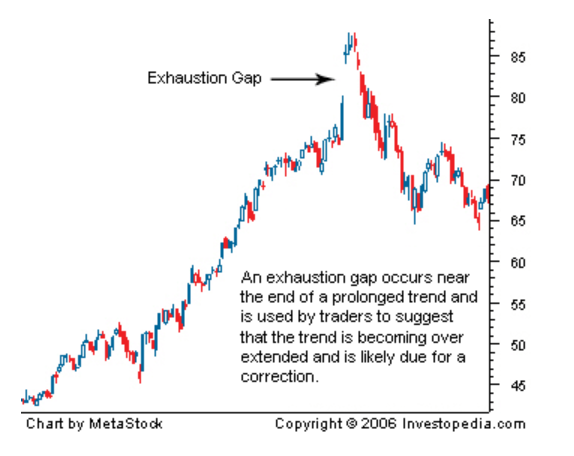

We also note the gap down at the start of this week which looks very much like an exhaustion gap to us and is further evidence the down-trend has finished.

Below is an illustration of such a gap signalling exhaustion of an uptrend.

Perry also notes key resistance at 111.60 would need to be broken for him to be convinced bulls had gained the upper hand, reasoning that, “For now this is a consolidation, with the momentum indicators mildly ticking higher, but certainly more needs to be seen to consider a technical rally being underway.”

He sees a break above 111.60 as key, opening the way to 112.50.

Commerzbank were bearish but are now neutral the pair, after witnessing the recent recovery.

Calling on Elliot Wave analysis, a form of cycle analysis, they also note that this could be an important reversal moment for the pair, which could see the short-term trend transition from bear to bull.

“The Elliott wave count on the daily chart suggests that this is the end of the down move and that we have failed to close below the 200-week ma at 110.16. For caution we will exit our short positions,”

The end of the down move means the pair could be finishing its wave-4 correction from the December 15 highs and beginning a final wave-5 higher, which will probably reach and surpass the 118.67 wave-3 highs.

Longer-term Commerzbank are bullish saying the market has based and is likely to move higher up to 118s and then 125s.