The Impact of Protectionism on Global Foreign Exchange Markets

If Donald Trump goes ahead with his most stringent version of trade protectionism, exemplified by his border tax policies, what impact will that have on different currencies?

Whilst there are some obvious losers, such as the NAFTA signatories, what about wider FX markets – who stands to lose, or possibly even gain from the imposition of a more protectionist US agenda?

The issue is especially prescient given the impending G20 meeting next week, and the fact, as pointed out by Morgan Stanley (MS), that early documents have removed any a reference to "resist all forms of protectionism", whilst maintaining the key phrase to, “"reaffirm previous exchange rate commitments.”

Global Trade Backdrop

One positive for almost all currencies – if that is possible in a relative value asset – is the current pickup in global trade overall.

LatAM and CEEMEA (Central Eastern Europe, Middle East and Africa) are the biggest winners in export terms but all regions are showing robust trade growth.

Of special advantage to emerging market FX is the noted rise in value as well as volume, as this benefits the exchange rate more.

MS view trade protectionism as a key risk factor potentially upsetting the current arrangement.

“Probably the biggest risk sweet spot in which currencies are trading is the possibility of trade protectionism, particularly from the US. In order to analyse which currencies would be most vulnerable, we create a framework which considers the likely channels through which protectionism would impact currencies,” said Morgan Stanley’s Hans Redeker.

Factors Impacting on Individual Currency Risk

The first and most obvious factor dictating how much a currency would stand to weaken from US protectionism is the amount it trades with the US.

“The direct channel of exposure would be felt by countries that have a higher proportion of exports going to the US as well as a higher proportion of exports as a % of GDP,” said Redeker.

The next factor would be countries that have an exposure to China since China would be the country most targeted by the Trump regime’s trade policies.

Within G10 this puts CAD, JPY, AUD, NZD in the ‘firing line’, while MXN, KRW, SGD are most exposed in EM.

The next factor MS see as significant is ‘commodity trade exposure’, which clearly involves AUD, CAD and NZD.

Increased protectionism would probably lead to a fall in commodity prices which would hurt these producers the most.

“This would impact commodity exporters even if they don’t trade directly with the US, such as commodity currencies in G10 (CAD, AUD, NZD, NOK) and MYR, RUB, CLP, PEN, ZAR, CLP in EM,” said MS’s Redeker.

Trump’s desire make manufacturing in the US great again, would also impact negatively on those countries which manufacture and trade the most with the US, which would include CHF, EUR and JPY in the G10, and in EM CNY, KRW, MYR, MXN.

“Meanwhile, SEK, CZK, HUF have high manufacturing exposure but would potentially be affected to a smaller degree due to not trading overly with the US, since most of their trade is with Europe,” commented MS.

The next variable is ‘Capital Account Vulnerability’, which refers to the balance of trade in financial assets and is likely to hit those countries which have seen large inflows from foreign investors wanting to buy their assets over recent years.

These include EUR, CAD in G10 and CNY, KRW, THB, BRL, MXN in EM.

Protectionism would probably increase the value of the Dollar, pressurizing those countries with a higher proportion of Dollar denominated debt, such as SGD, CLP, TRY, HUF.

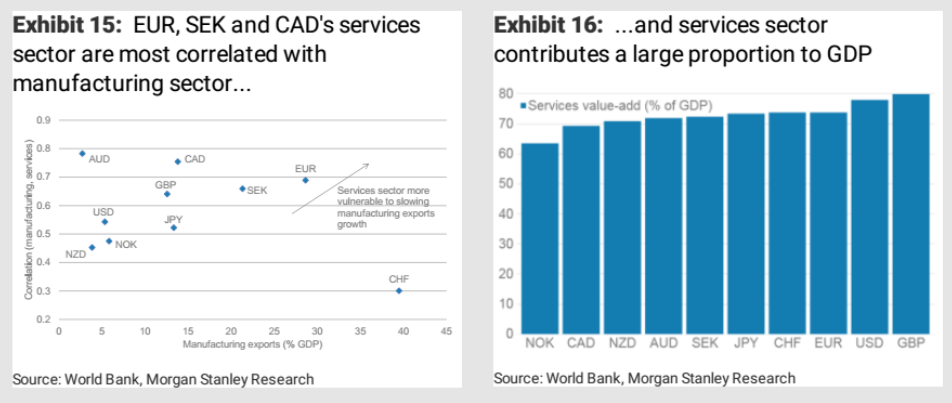

MS also broaden their analysis to include economies which has a large services sector but whose manufacturing is closely correlated with their services sectors such that a decline in the former would have negative knock-on effects to the latter.

“From Exhibit 15and Exhibit 16, EUR, SEK and CAD would be most vulnerable within G10.

“Given EUR and SEK have low exposure to trade with US and China, CAD looks most vulnerable,” notes Redeker.

“Doing the same analysis for EM, SGD is the only currency which stands out as having high manufacturing exports and services value-add (% of GDP) and high correlation between the two sectors,” he concludes.

Conclusions About Impact of Protectionism on FX

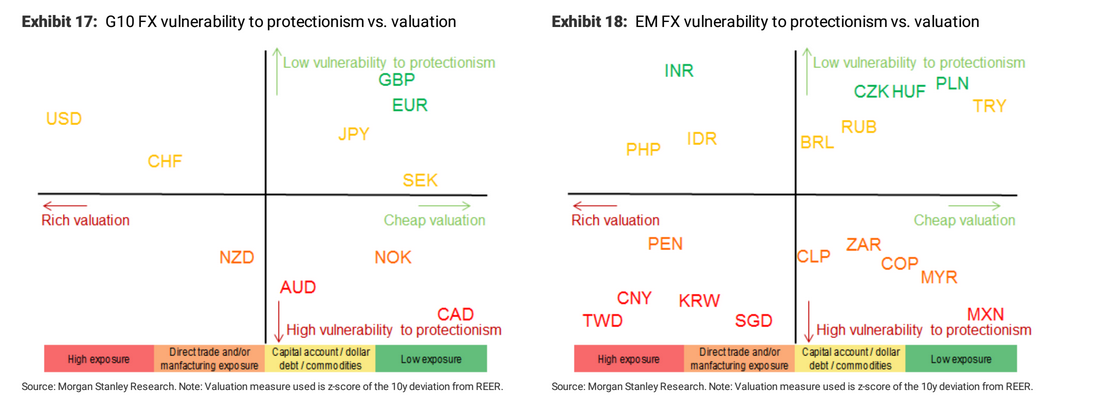

Taking all the variables into consideration, MS say that, within the G10, the Aussie and the Kiwi look very exposed to protectionism whilst the least exposed are GBP and EUR.

“In EM, low-yielding Asia such as SGD, TWD, KRW and CNY look most exposed, while CEEMEA countries (CZK, HUF, PLN, TRY) and INR look least exposed,” continues Redeker.

Overall, however, CAD is the most exposed of the G10 currencies, “consistently standing out in almost all the measures,” says Redeker.

The market may have priced in two interest rate rises by the Bank of Canada (BOC) in 2018 but if its exports take the expected hit from protectionism these are unlikely to materialise, “allowing CAD to weaken as these hikes get priced out.”

In reference to Asian G10, MS say, “JPY would be likely to receive support from safe haven demand, while AUD and NZD are vulnerable to second-round effects of falling commodity prices, not forgetting their rich valuations too.”

In Europe, “Switzerland, Norway and Sweden are also open economies, they would be less affected through the trade channel as their main trading partner is the EU,” note MS.

The Norwegian Kronor, however, would see the most downside being more commodity orientated than the others Scandies.

The Pound, meanwhile, is singled out as a good hedge against protectionism because most of its trade is with the EU, and it has little manufacturing and relies more on financial services.

MXN is the most vulnerable to protectionism of LatAM but MS say it has already priced in a very bearish scenario so more deep loses are unlikely.

The other LatAM’s are likely to be more affected by second round effects, such as for example the Chilean and Peruvian pesos due to reliance on minerals and mining.

CEEMEA is likely to be the least affected as already said since most trade with the European hub.

In Asia, obviously China will be the one most affected, but many of the others will also be directly affected due to links with bete noire China .

“Many other economies in the region have high export/GDP ratios, with SGD, TWD, KRW, THB and MYR remaining exposed with the latter three possibly also impacted by second round impacts of potential trade restrictions on China,” commented MS.

CNY, KRW and TWD are also on the monitoring list of the US Treasury report on currencies, with the upcoming assessment in the April Treasury report remaining a concern.

If branded with a possible currency manipulator label the retaliation from Asia would likely unwind the strong inflows into Asia YTD, particularly into Korea and Taiwan equities.

“These flows have supported the currencies, with TWD, CNY, KRW and SGD appearing rich on a REER basis,” concluded Redeker.