UK Manufacturing Activity Stumbles But Doesn't Fall in February

A leading survey of manufacturing sector purchasing managers in February showed a mild pullback in results as activity lost some momentum, however, economists do not seem concerned, retaining a broadly optimistic long-term outlook.

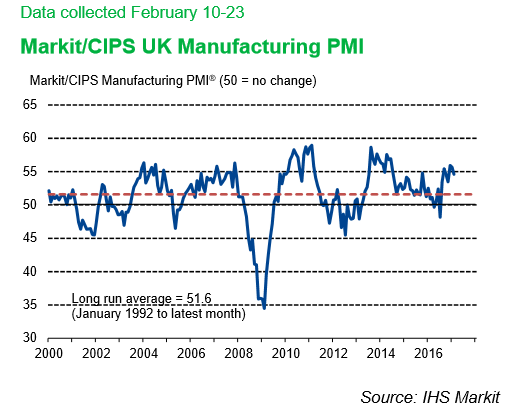

UK Manufacturing PMI came out at 54.6 from 55.7 previously when a lesser fall to 55.6 had been expected.

Despite the fall economists remained confident about the sector.

“The survey still suggests that the sector carried a decent amount of momentum into 2017,” said Capital Economics’ Scott Bowman, who also said he expected the sector to show greater growth in 2017 compared to 2016.

Markit's official report said that the weak pound had increased exports offsetting a slowdown in domestic demand.

“Companies indicated that growth of new business from the domestic market slowed, but noted that this was partly offset by a sharp acceleration in the rate of increase in new export business.”

The survey showed respondents were very optimistic about the future.

“The ongoing upturn meant manufacturers maintained a positive outlook. Almost 50% expect output to be higher in one year’s time, compared to only 6% anticipating a decline. Optimism was linked to forecasts of improved demand, increased capital investment, company expansion plans and new product releases.”

Rob Dobson, Senior Economist at IHS Markit, said, “The latest PMI signals that the UK manufacturing sector continued its solid start to the year. Although rates of expansion in output and new business lost impetus in February, growth remained comfortably above the long-run averages.”

Nevertheless, a decline in New Orders, which are a forward-looking indicator, does raise concerns about how sustainable the uptrend is.

“The slowdown in new order growth and a drop in backlogs of work suggest output growth may slow further. However, elevated business optimism, continued job creation, a recovery in export orders and rising levels of purchasing all suggest that any easing will be only mild.,” remarked Dobson.

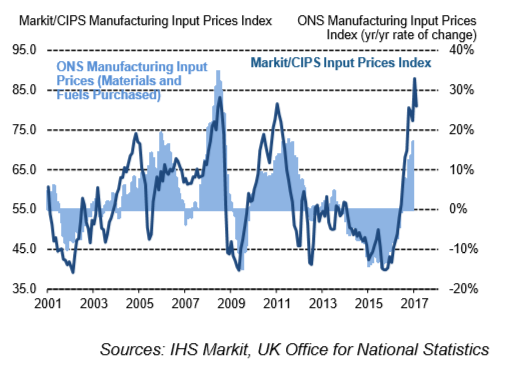

The weak pound has helped manufacturers sell their wares abroad, but it has also increased the cost of components imported and used in manufacturing processes in the UK.

The Input cost as it is called, measures the rise in these component costs, and it has risen steeply recently.

This could start to offset the positives from the weak Pound as it raises the selling prices of goods.

Even British-made goods may also become increasingly unaffordable to UK shoppers.