US Defence Spending Increase Ties Trump's Hand on Infrastrcture Spending, Markets Could be Disappointed

Ahead of his much-anticipated talk before President Donald Trump has said he intends to increase US defence spending by 54bn Dollars for the fiscal year starting in October 2017.

The spending increase will be done by diverting funding from other departments, most notably the environment and foreign assistance.

This will take defence spending back above pre-sequestration levels, which means it will be above the level it was before the US capped its levels of debt.

At the same time, Trump’s press secretary Sean Spicer has said that the government needs to “tighten its belt”.

OMB Director Mulvaney said that they would propose a 10.5% decrease in non-defence discretionary spending for FY2018 with potential cuts in foreign aid, and the budgets of the State Department and the Environmental Protection Agency being likely.

These are significant cuts and already draws questions on whether any real increase in government spending can be achieved.

In the current fiscal year the US is spending $48 billion on foreign aid and 27% of that is for security/military aid.

The entire budgets of the State Department and the EPA are $31.5 and $8.5bn, respectively.

Analyst Lewis Alexander at Nomura says total non-defence discretionary expenditures have already been cut substantially in recent years. For example, in FY2016 non-defence discretionary spending was 3.3% of GDP, compared to an average of 3.8% for the years 1965-2006.

So, something else must give and there are now concerns that Trump’s infrastructure spending programme will be cast aside in favour of defence.

Impact on the Economy of Boost to Defence Spending

From a markets perspective, how would the prioritisation of spending on defence impact on the economy?

First, it will help defence companies like Lockheed Martin, Boeing and BAE Systems as has been amply demonstrated by the recent spike in their share prices - but beyond these corporations any 'trickle down effect' looks limited.

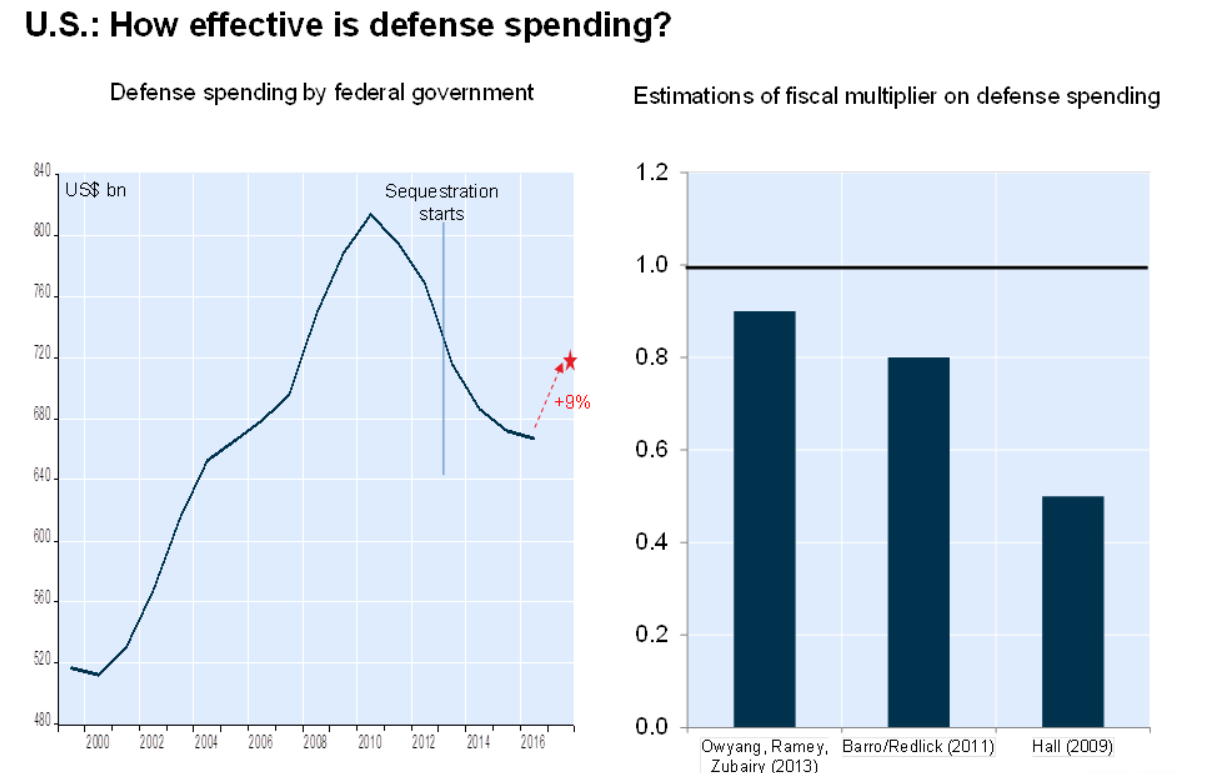

Krishen Rangasamy, an analyst with National Bank Financial says that the “fiscal multiplier” for defence spending is, even by best estimates, below one.

This means that every Dollar of taxpayer money spent on Defence leads to less than a Dollar increase in GDP, or economic growth.

This compares negatively to infrastructure spending where the fiscal multiplier is well above one.

“Fiscal multipliers for defence spending have typically been estimated at less than 1, meaning that such outlays are likely to crowd out private spending, restraining growth as a result. One can only hope compensating cuts to non-defence spending does not include infrastructure whose fiscal multiplier is well above 1 according to the Congressional Budget Office,” said Rangasamy in a note seen by Pound Sterling Live.

In addition, Rangasamy notes that tax cuts – when they are targeted at corporations and wealthy individuals tend also to have a below one fiscal multiplier.

“Multipliers are also the smallest when the economy is close to potential, as is currently the case. All told, we won’t be holding our breath for the 4% U.S. GDP growth that was promised during the election campaign,” said Rangasamy.

This would be negative for the Dollar which is looking for big announcements that can spur growth and according to analysis using fiscal multipliers this big chunk going to defence is not likely to be enough.

Just how much increased spending can go to infrastructure is now in question considering the already sizeable boost given to defence.

Recall, it looks like cuts the low-hanging fruit that Trump wants to cut funding for have already been taken.

"Given the focus on offsetting the increase in defense spending with cuts elsewhere in the budget, we doubt that any infrastructure initiative will substantially increase government spending, especially given the reticence congressional Republicans have shown towards publicly financed infrastructure spending," says Nomura's Alexander.

No doubt the speech will attract a lot of attention but at this point, most do not expect Trump to provide much additional clarity on the likely course of key policies initiatives.

To the extent that he focuses on economic policy, Nomura expect the president to reiterate what he has done already and to focus on some aspects of fiscal policy.

"It seems unlikely that we are going to get a comprehensive fiscal plan," says Alexander, "we expect the president propose changes in the composition of federal spending and potentially some sort of infrastructure initiative."

The analyst does not expect the president to offer new details on his objectives for tax reform. Importantly, whatever Trump proposes will still have to work its way through Congress.