Rouble in Retreat

The Rouble is at the start of a retreat according to commentary from various research departments.

The USD/RUB is currently trading at 58.12 but Nordea’s Olga Lapshina is constructive for the pair, making a call recently for the Rouble to weaken to 60.00 by the end of Q1 – that is the end of March, in roughly six weeks’ time.

Despite attempts by the Central Bank of Russia (CBR) to manipulate the currency down via direct intervention to a tune of 2bn Dollars per month, in order to keep Russian exports competitive, the currency has stubbornly appreciated over recent months.

Much of this has to do with a combination of rising oil prices, a hawkish central bank and the impact of the carry trade, of which it is a “Carry-Trade Star” according to Lapshina.

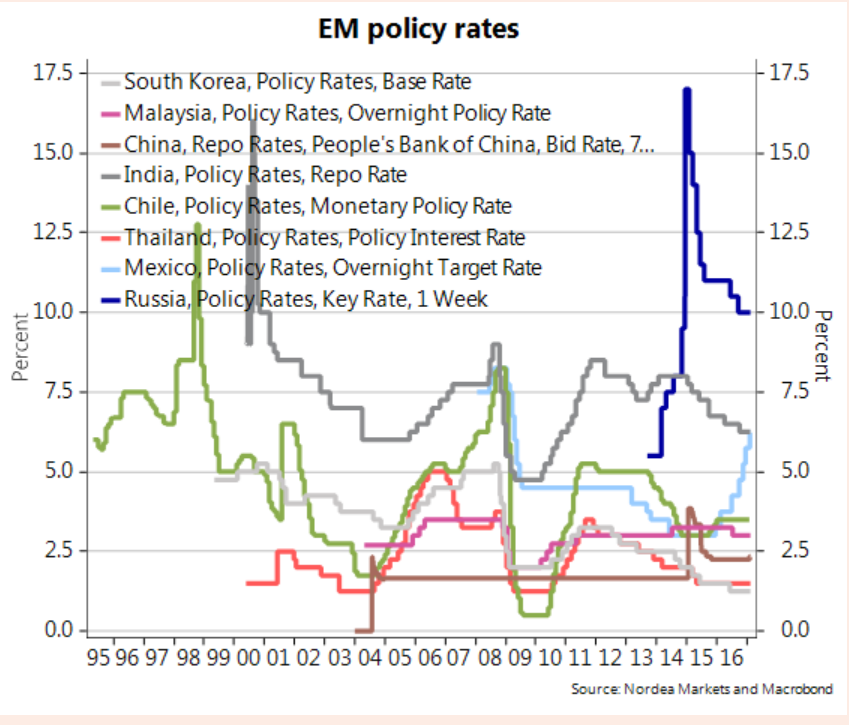

“The RUB has become an appreciation leader among emerging market (EM) currencies, ranked together with the Brazilian real as the most attractive currency for international investors in 2017 in a recent Bloomberg poll.

“The current CBR key rate level (10%) looks quite supportive for the RUB, a higher rate belonging only to the Brazilian Central Bank, which holds its Selic rate at 13%.”

The carry trade is an investment strategy in which investors borrow in a low interest rate ‘funding currency’ such as the Euro or the Yen and then invest the money in a high interest paying currency such as the Rouble or the Real.

If they borrow the Euro at 0.00% and they buy the Rouble and place the money in a Russian account they will earn 10.00%, resulting in a profit of 10.00- 0.00 = 10.00%.

Analysts argue that demand for the Rouble from investors practicing the carry trade is the reason for its recent unintuitive rise, despite the authority’s regular intervention to sell the currency.

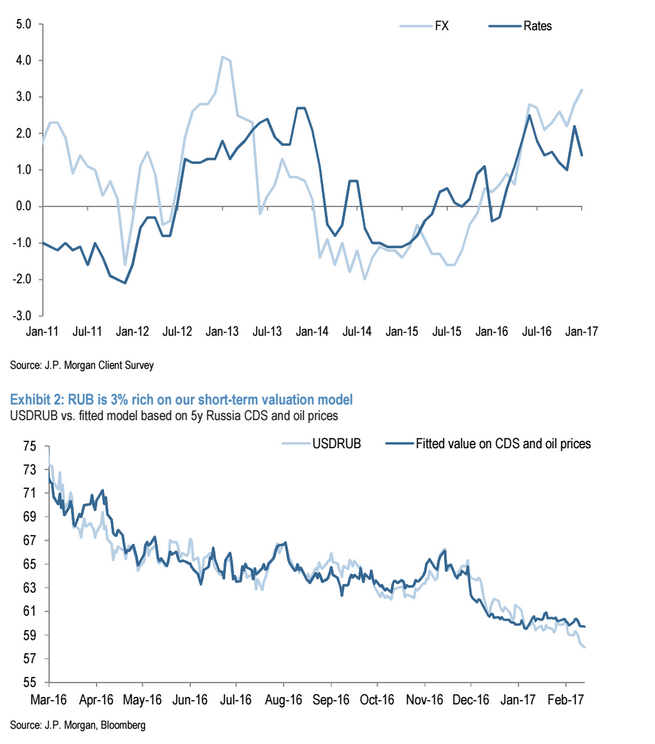

The appreciation has been so strong recently and so surprising to market participants - taking the USD/RUB down 10 Roubles in just over six months -that it wrong-footed analysts at J P Morgan who recently admitted to getting stopped out of their trade.

“We have been stopped out of our outright long position in USD/RUB as a result (entry: 60.20, exit: 58.0658, total return: -3.84% including carry), but we hold on to our 1x1 USD/RUB call spread (61, 63.5, 24 March expiry),” said JP Morgan’s Saad Sidiqui.

The Rouble will remain “intervention proof” until Q2.

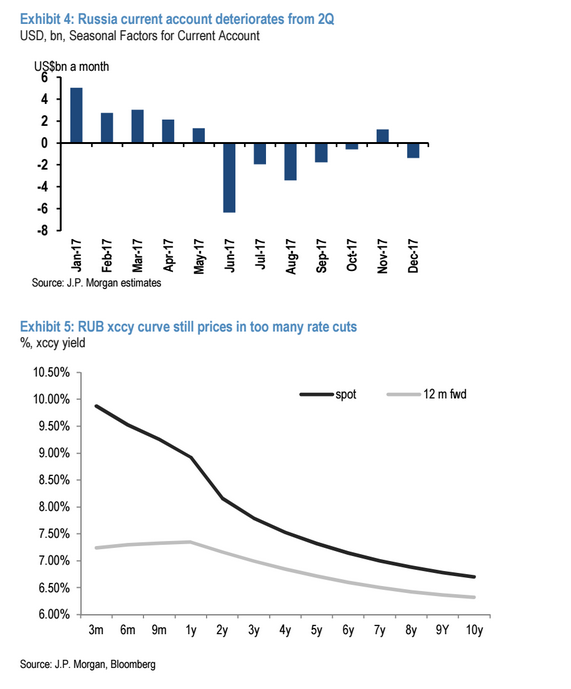

“We now think RUB-weakness on the back of FX interventions is likely to only transpire going into 2Q17, when the current account seasonally deteriorates. See RUB: Intervention-proof for now. Bought USD/RUB at 60.20 on January 26. Stopped out at a loss of -3.84%,” said Sidiqui.

Interestingly, J P Morgan have not closed their Call option despite closing their cash trade, as they hang onto the hope that the pair will rise again in Q2.

They point out, for example, that the currency is overvalued in comparison to their various models.

JP Morgan also see an increasing risk from the seasonal Current Account cycles in March as well as an increasing risk of the CBR lower interest rates - both of which are likely to weigh on the Rouble in the future.

Nordea are more bullish, seeing the current configuration ripe for a Rouble depreciation, and forecasting USD/RUB to rise to 60.00 by the end of Q1 – not Q2.

Firstly, Nordea see CBR intervention as continuing, mainly due to the oil price which remains stubbornly high.

The threshold for intervention is based on the price of oil which is so central to the Russian economy. When it is above 40 CBR intervene to weaken the Rouble, when below they desist – Nordea argue Oil is unlikely to fall below 40 for a while so interventions will continue, eventually weighing down on the Rouble.

Next, they see a seasonal effect from external debt maintenance, negatively impacting on RUB.

“Also, in March 2017, Russian companies and banks have a local peak of external debt payments. As one can see on the graph below, the volume of payment in March is 2-3 times higher than the ones due in January and February,” commented Nordea’s Lapshina.

Finally, they see more downwards pressure on emerging market currencies from an appreciating Dollar and the negative impact increased Federal Reserve rate hikes are likely to have on the exchange rate.

“And last but not least, after Janet Yellen’s testimony before the U.S. Congress, the sentiment on the emerging markets may show some deterioration. Markets anticipate a rate hike at the FOMC Meeting in March. Even though Nordea’s baseline scenario implies two hikes in 2017 with the first one in June, these expectations may play a significant role for EM dynamics,” said Lapshina.

From a technical perspective there are signs Nordea may be right, but nothing definitive yet.

The chart below shows the USD/RUB pair falling in a steady channel lower until the last few days when it appreciated quite strongly and quickly to 58s from the 56s.

The rise was accompanied by the formation of several bullish Japanese candlestick patterns concurrently, which when appearing like that clustered together at a market turn often signal a change of the longer-term trend.

The patterns were the Three White Soldiers pattern, which is comprised of roughly three green up days in a row, a Doji Star which is made up of a down day followed by an indecisive day and then an up day and a Morning Doji Star which is a variation on the Doji star but with a weaker up day.

These lead us to see growing technical evidence for Nordea’s 60 call by the end of March, however, we would ideally want to see a break above the upper channel line signalled by a move above 59 for confirmation.