Oil Price Outlook: It's All About Demand say Barclays

The financial press has prioritised stories about OPEC compliance and shale oil production in the narrative on oil prices.

Whilst these are factors influencing the price, Barclays’ Michael Cohen argues they are not in fact the most significant drivers, and actually constitute ‘red herrings’ or as he puts it “alternative facts” in an investigation of Oil price fundaments.

“Market participants are hyper-focused on two issues: shale’s response to higher prices and OPEC compliance. Peddling 'alternative facts' risks skewing the big picture: excess stocks are forecast to halve by mid-year,” says in Cohen in a note seen by Pound Sterling Live.

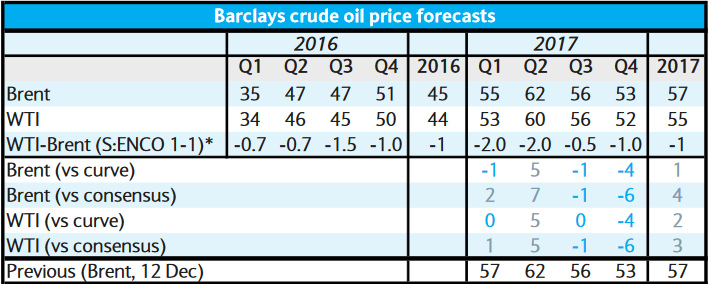

Falling inventories are likely to see oil prices peak at $62 a barrel at the end of Q2 before falling again in the second half of the year, according to Barclays’ latest forecasts on the oil price's trajectory.

Downside risks include a decline in consumer-led demand for gasoline in OECD countries and a return of supply which was previously disrupted – mainly from war-torn Libya, which would cause another glut.

"The big picture is simple: demand is forecast to exceed supply for the first time since 2013; OPEC cuts are incremental but they are not the only story. Inventories drive the time structure of the futures curves, and that, by and large, moves in concert with the front

month price," says Cohen.

Barclays expect demand to remain slightly above trend at 1.3 mb/d.

Their economists expect a rebound in economic growth from emerging economies from 4.3% to 4.9%. Russia and Brazil, as well as several key oil demand drivers including Indonesia, Malaysia, Taiwan, and Thailand are also expected to see a rebound in GDP growth in 2017.

Chinese demand continues to receive support from light end consumption after the completion of new PDH plants. And with government support, LPG demand in India is penetrating rural areas and replacing other non-oil sources of consumption.

"Currently, bullish positioning is stretched, upside price momentum is fading, and the fundamentals in February do not suggest continued strength. Therefore, we see the potential for a correction. With this in mind, we move down our 1Q17 price forecast slightly, from $57 to $55. The rest of the forecast remains unchanged," says Cohen.

The Threat From Shale

One of the “alternative facts” which receives an inordinate level of attention is the threat of increased shale production on crude.

Shale production only becomes cost effective above a certain level which lies between 40-50 dollars per barrel and when prices get above 50-60 bucks it has been said that “Shale will return with a vengeance,” according to oil bosses in Davos.

Cohen thinks the threat of shale has been over-hyped, however, and shale may still struggle due to a rising cost base, which keeps eroding profit margins.

“During the recovery thus far, some service companies have been keen to increase business without increased margins, which may have helped keep costs down on average, but rising demand is likely to challenge the sustainability of such margins. Bottlenecks are likely to include 'equipment, sand, and people,' as one major service company note,” said Cohen.

If costs rise as they are expected to, it remains to be seen how competitive fracking can continue to be.

The cost of “staffing up” to meet the increased demand may involve contracting at a higher rate, and Cohen highlights the rising cost of moving sand to fracking sites or “last mile trucking”.

“The timing of service cost increases is difficult to pin down and will depend on how long some of the more aggressive service companies can continue to expand business without seeking price improvement. Based on E&P spending expectations, it is likely to become apparent during 1H 17,” notes Cohen.

The OPEC Story

The other factor financial news networks keep focusing on is OPEC compliance, which is the extent to which OPEC members (and notable non-members) are abiding by the recent agreement to cut output.

“Compliance meetings are happening monthly, the export data show loadings are down, and at least every couple days an OPEC minister ascends a podium to talk about compliance. Minister Al-Falih, for example, said, “Compliance is great –it’s been really fantastic,” Bloomberg reported on January 23. He continued, “I think it’s been one of the best agreements we’ve had for a long time,” comments Cohen.

Yet, the analyst also points out that it is still too early to tell whether compliance is really working.

“How can observers judge compliance when the first month is not even over? OPEC ministers say they are cutting output, yet secondary sources have no way to verify what is coming from storage, what crude is blended, or at what level refineries are running. All are key pieces of the puzzle,” notes Cohen.

May OPEC Meeting Key

Cohen further argues that there is no way of knowing how well compliance is working until the summer when more data is available.

There is a risk that if prices rise into Q2 as Barclay’s forecast, and reach 60 dollars a barrel, OPEC will end their supply cap agreement at their May meeting.

If prices are lower and fall in the 40-50 dollar bracket at the May meeting, then OPEC will likely retain the agreement which will boost prices in Q3, either way, the May meeting is seen as key.

In the meantime, it may be useful to head the analyst’s advice and keep our eyes on the bigger picture, and good old supply and demand dynamics, instead of over focusing on headline-grabbing news about OPEC compliance and Shale production.