America's Squeezed Middle-Class Wins it for Trump

The US has voted for Donald Trump to become the next US President and shocked global commentators and markets alike. However, the signs that Trump would win were apparent.

The Trump victory poses the second major market upset this year following on from the Brexit vote in June.

There is a good dose of incredulity at the outcome as is often the case when a consensus amongst markets is turned on its head.

But, as was the case with Brexit, the signs for such an upset were there all along as a forgotten majority desperately sought out change.

That Clinton was so easily beaten in Ohio, lost the safe-bet Wisconsin and performed poorly across the old industrial heartlands is immediately indicative of why the US delivered the result it did.

Recent research published by Pew Research Centre showed that median real household incomes in urban areas grew in just 39 of 229 metro areas between 1999 and 2014.

These urban centres are home to three-quarters of the US population.

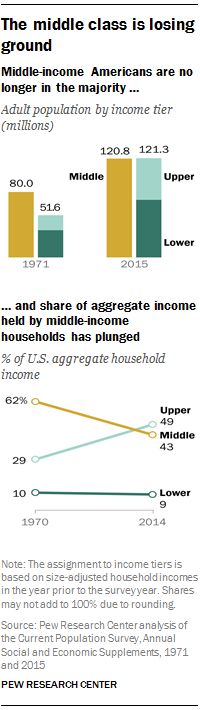

Pew also shows that the US middle-class has been steadily losing its share of national income since 1970 while the upper-class has seen its share of national income steadily grow confirming inequality rose steadily under Obama:

Pew suggests that nationwide, the median income of households in 2014 stood at 8% less than in 1999.

“These data throw light on the growth of the disaffected voter amongst the squeezed middle classes in the US and goes some way to explain the backlash against both the establishment and globalisation,” says Jane Foley at Rabobank who is one analyst explaining to clients why Trump won the vote.

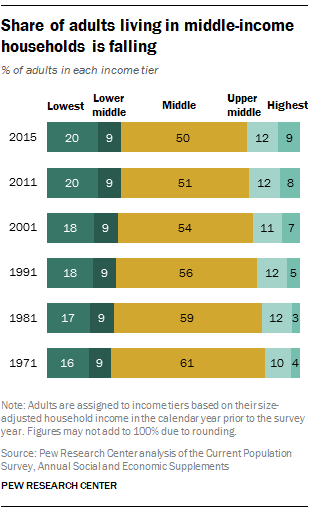

The data points to that often-cited phenonmenon of the squeezed-middle:

The following chart shows the recovery in US median incomes and in consumer confidence since the financial crisis and it confirms a trend that voters are asking Trump to address:

It also shows that rise in confidence has been most marked amongst higher earners who have been taking a larger slice of total income.

More recently policies such as quantitative easing have been seen as boosting wealth inequality by feeding asset price inflation.

Measured by the Gini coefficient, there has been a growth trend towards income inequality since the early 1980s.

So it’s no wonder Trump was able to strike a chord with disaffected voters in places like Ohio where Obama failed to raise living standards.

According to research by McKinsey, nearly one-third of those who are not advancing said they think their children will also advance more slowly in the future, and they expressed negative opinions about free trade and immigration - two of Trump's most notable drawcards.

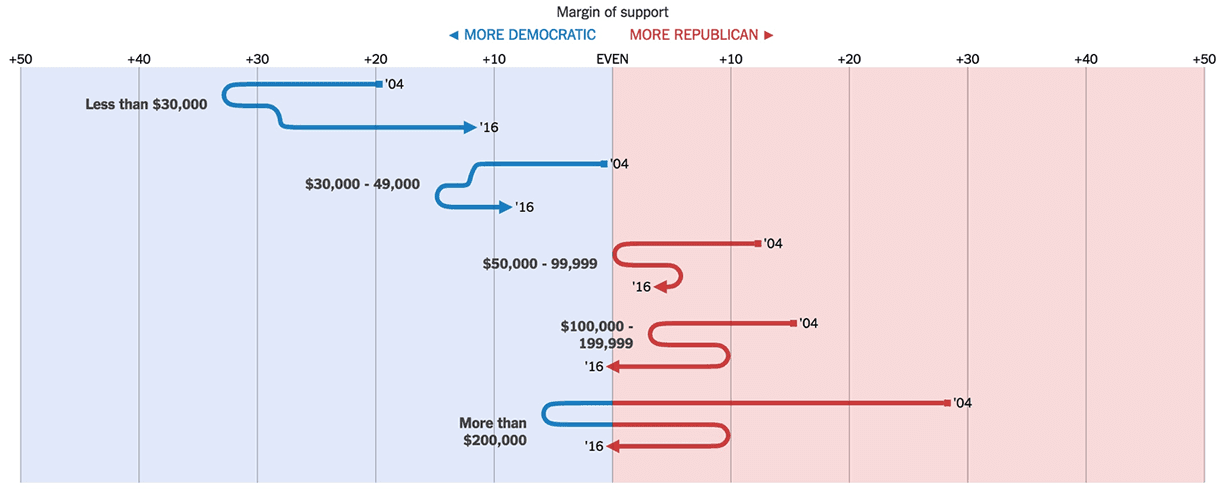

At the same tim, it was the richest vein of US society that swung towards Clinton - or the status quo Democrats - in this election's exit polling data:

“Although the popular vote appears to have been relatively close, where it mattered the Democrats’ ‘Blue Wall’ collapsed under an anti-establishment wave of protest. For example, Ohio is always considered to be one of the key swing states – Mr Trump’s victory there appears to have been by a margin in excess of 8%,” says Philip Shaw at Investec in London.

Whether or not Trump can actually shift what is clearly an entrenched trend remains to be seen.

“Although the reasons why an anti-establishment, strong man politician such as Trump has caught the imagination of the American public can be explained, it is less easy to understand how he will improve the economic prospects of the average household,” says Foley.

How will Trump Try and Fix the Problem?

Donald Trump’s campaign proposals include the following, which can all be found on his campaign website :

- Lowers the business tax rate to 15% (from 35%), this includes a 10% tax on repatriation, instantly bringing trillions of dollars back into the U.S. economy now parked overseas.

- NAFTA will be renegotiated to get a better deal for American workers. If partners do not agree to a renegotiation, America will withdraw from the deal.

- China will be labeled a currency manipulator. "Any country that devalues their currency in order to take unfair advantage of the United States will be met with [sic] sharply, and that includes tariffs and taxes.”

- Become, and stay, totally independent of any need to import energy from the OPEC cartel or any nations hostile to our interests.

- Ask Trans-Canada to renew its permit application for the Keystone Pipeline… get the bureaucracy out of the way of innovation, so we can pursue all forms of energy.”

Implications Should the Promises be Delivered

Critics suggest that Trump’s plans to cut taxes at all income levels are likely to favour the highest-income households in both USD and percentage terms.

Nevertheless, if the middle-class gets any benefit at all, he could be looking at re-election in 2020.

However, it is the prospects for global trade trade that has many analysts worried.

“From a global point of view, this election outcome is also truly revolutionary. It shows that globalisation has run into a wall, as blue collar workers across the developed world feel they have been on the losing end of the bargain. More nationalist and protectionist policies are thus more likely going for-ward, which ultimately is bad for corporate profits, in our view,” says Christian Schwarz at Mizuho in London.

Foley agrees:

"We see Trump’s trade policies as likely having a greater impact than his fiscal policies. The possibility of a trade war in 2017 will reduce expectations about US GDP growth and the Fed’s hiking path."

The implications of reduced trade are likely to be most keenly felt by smaller global trading partners and could knock some growth of global GDP.

However, if it helps stimulate demand for domestically produced goods and services Trump, and his ailing middle-classs supporters, will be happy.