Gold Prices Forecast at 1,250.00 by Q4 by Morgan Stanley

Our studies confirm the gold price is at a notable cross-roads with the prospect of heightened volatility growing, the question is in which direction will the price settle on?

- "Further into 2016, we retain our price forecasts of $1,200/oz in 3Q16 and $1,250/oz in 4Q16" - Morgan Stanley

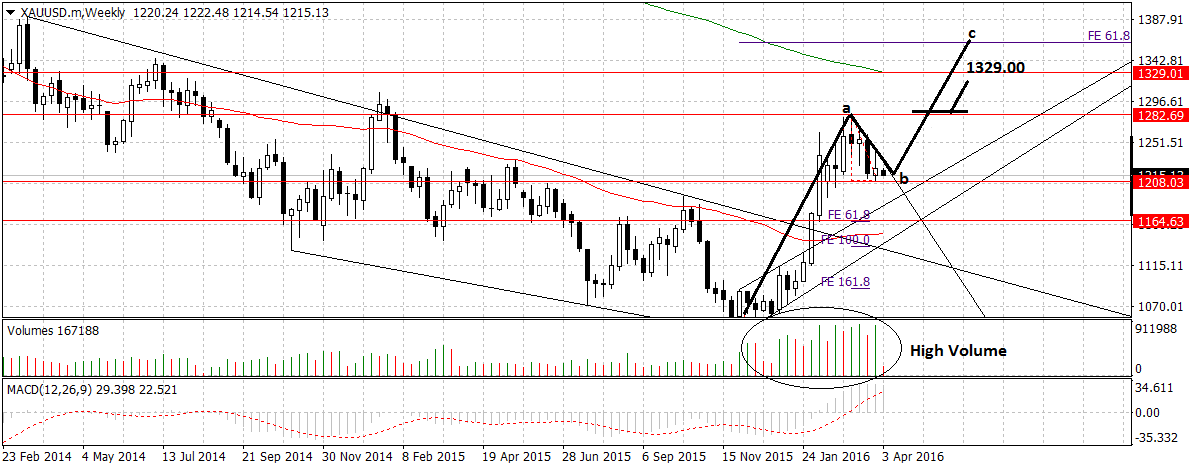

- Technicals: A break above the March 23 highs at 1284 would probably signal a continuation higher to an initial target situated at the 200-day MA at 1329

Since breaking higher at the end of 2015 investors have been asking whether gold prices are really changing course and starting a new longer-term bull trend higher, or whether it is merely correcting in the midst of a bear market.

Gold’s current technical position seems to ask the very same question; in terms of chart patterns and price action.

The gold price is at an interesting cross-roads which indicates the possibility of an almost 'binary' outcome on the horizon (by binary we mean a ‘black or white’ result).

A break higher at this critical juncture would open the way up to strong gains all the way up to 1300 and the 200-day moving average (MA) at 1329 - which is our base case scenario.

However, on the other hand, a break lower at the current juncture could initiate a strong sell-off back down towards the 2015 lows.

What is interesting about this is that a ‘binary’ outcome for gold is also probably indicative of major changes in global risk appetite, and this could affect a whole host of other assets and currencies.

Confirmation Levels

For confirmation of more upside, a break above the March 23 highs at 1284 would probably signal a continuation higher to an initial target situated at the 200-day MA at 1329.

This would probably unwind as the final C move in a large A-B-C, which started with wave A going up from the late 2015 lows to the March 23 highs and B down to the March 28 lows.

The bearish alternative view is that the pair has formed a head and shoulders topping pattern, visible on the daily chart; and that this pattern now looks set to break lower.

Such a break however must overcome the formidable obstacle of the 50-day moving average at 1210.

The 50-day MA is a tough level to break below as it will attract many buy orders from bulls expecting the exchange rate to reverse at the moving average.

However, if the exchange rate manages to make it below 1195 it will have a fairly good chance of continuing down to the next target at 1177.

Such a move would also possibly change the short-term bullish view to bearish, as the progression of peaks and troughs will have reversed.

Morgan Stanley - Risk Appetite Moderating

Investment Bank, Morgan Stanley’s Natasha Kaneva, is mildly bullish on gold due to what she sees as moderating global risk appetite, which is the primary driver for the commodity:

“Further into 2016, we retain our price forecasts of $1,200/oz in 3Q16 and $1,250/oz in 4Q16 for two reasons. First, our sense of macroeconomic risk has changed. While the risks are still skewed to the downside, concerns have clearly diminished in recentweeks, removing one of the supports for owning gold.”

Secondly, Kaneva sees the long trade getting too overcrowded - which means too many investors have bought gold and therefore the pendulum could be ready to swing the other way:

“Diminished macro risks are reflected in market positioning. While money managers continue increasing their net long positions, the rate has slowed down. Money managers are now 16.2 mn oz net long—above the 11.5 mn oz net long averaged since June 2006— implying that the market is long compared to the historical norm and suggesting there is not much room for further buying.”

In addition, she sees more upside for the dollar - at least in the short-term with the dollar revisiting its January highs mid-year as a result of a likely rate hike from the Federal Reserve around that time. Because the standard measure for the worth of gold is in dollars an appreciation in the value of the dollar will put pressure on the price of the commodity unless it’s fundamental value also increases.

Kaneva sees little likelihood of Gold’s fundamental value increasing though, given supply continues to rise steadily and extraction costs continue to fall:

“We believe that mine production will plateau over the next couple of years, but not just yet. Global gold production rose 1.8% in 2015 to 3,195 tonnes. As a result, global output is now 455 tonnes higher than in 2010.“

Like with most other commodities we are in a world of oversupply weighing on prices and not vice-versa.

Despite Morgan Stanley’s rather unremarkable forecast that gold will basically end the year below the March 23 highs, the problem with forecasting the commodity is its impossible to foresee the sort of black swan events that trigger global financial crisis and support risk-off demand for gold.

We maintain out 1329 target at the 200-day, assuming a break above the March 23 highs of 1284 for confirmation.