China's "Big Bang" Stimulus Promise Can't Come Soon Enough

- Written by: Gary Howes

Image © Adobe Stock

Chinese authorities will be keen to stimulate domestic demand after trade data released on December 10 showed the country's factories were too reliant on external markets.

Data showed that Chinese imports unexpectedly fell by 3.9% year over year (consensus: +0.9%), reflecting weak domestic demand.

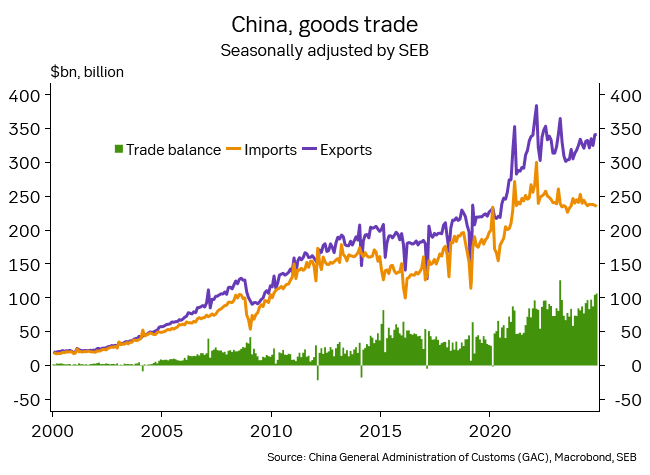

Chinese exports rose 6.7% y/y in November (consensus: 8.7%), and the trade balance increased to one of its highest levels ever.

"At the same time as factories are producing at full speed, households are struggling to keep up with the increase in supply," says Gustav Helgesson, an analyst at SEB.

Above: China's stagnant imports signal weak domestic demand.

However, Chinese authorities are acutely aware of the need to stimulate domestic demand and are acting.

The politburo said on Monday that the country's monetary policy stance would shift from "prudent" to "moderately loose" for the first time since the global financial crisis.

It said the government would adopt a more "pro‑active fiscal policy."

"The Politburo meeting on 9 December sent strong policy easing signals, raising market hopes of a 'big-bang' stimulus package," says Carol Liao, an analyst at Standard Chartered.

Following the news, Asian stocks and China-associated currencies, such as the Australian Dollar, rose.

10-year Chinese government bond yields fell 6bps to 1.85% as investors saw the potential for the People's Bank of China to bolster its monetary easing efforts. This would likely involve lower interest rates, lower reserve requirements for commercial banks, and changes to other lending benchmarks.

"Chinese stocks continue to rise in the wake of yesterday's gain of close to 3% after strong stimulus signals from the Chinese regime. The positive sentiment has spread to most stock exchanges in the region and optimism can also be discerned in the commodity market, where the price of "China-sensitive" commodities such as iron ore has increased by more than 2%," says SEB's Helgesson.

The Politburo signalled a commitment to lifting Chinese economic growth, which has struggled to meet expectations in the post-pandemic era.

"More accommodative policy will help support consumption and the broader economy. The pledges align with our expectations that the government will deliver more fiscal stimulus to counter the negative impacts of additional US tariffs on Chinese exports," says Joseph Capurso, a foreign exchange strategist at Commonwealth Bank of Australia.

Looking ahead, the annual Central Economic Work Conference (CEWC) will be held on 11‑12 December.

"We expect the Chinese authorities to set an accommodative tone. However, key economic targets and concrete policy measures are unlikely to be revealed until the annual session of the National People’s Congress in March," says Capurso.

Standard Chartered expects the CEWC to provide more details on what the Politburo called "extraordinary counter-cyclical adjustment".

"We think this may include a large increase in government bond issuance, supported by regular PBoC purchases of central government bonds from the market. The new stimulus package is likely to be more focused on boosting consumption, a departure from the old stimulus model that relied heavily on investment," says Liao.