Minimum Wage Nears Jobs Tipping Point

- Written by: Gary Howes

Image © Adobe Images

Raising the minimum wage has been a 'risk-free' vote winner for governments for years. But this could soon change as "cheap labour is getting a lot more expensive."

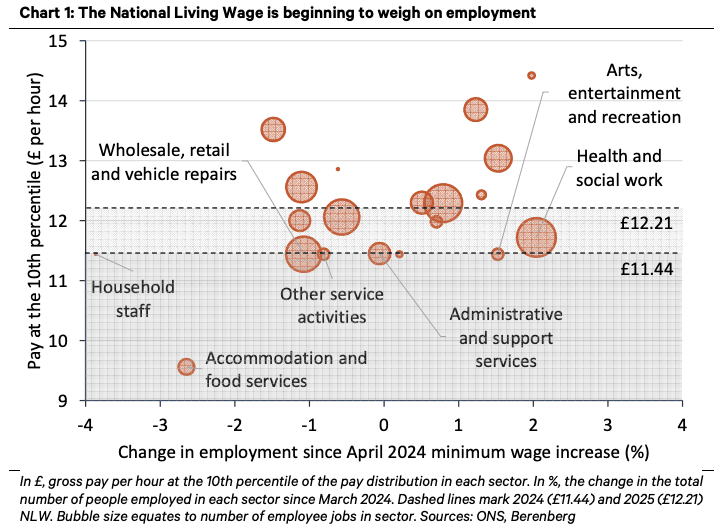

A new analysis from Berenberg Bank finds limited space left to raise the minimum wage without sparking job cuts.

"Since the UK introduced the minimum wage in 1999, the policy has successfully raised the living standards of the lowest paid workers without costing many jobs. However, the compression of the bottom half of the pay scale indicates that the UK is approaching the highest level of minimum wage achievable without triggering significant job losses," says Andrew Wishart, Senior UK Economist at Berenberg Bank.

The government announced in October that the National Living Wage for people over 21 will rise by 6.7% in April 2025, while the National Minimum Wage for 18- to 20-year-olds will increase by 16%.

This follows a 9.8% increase in the headline minimum wage for 2024 and a 14.8% increase for 18- to 20-year-olds.

The 2025 increase will be particularly hard for businesses that will have to pay a significant increase in employers' National Insurance; this is the tax a company pays to the government when paying an employee's salary.

"The further rise in the minimum wage from April 2025 with a higher payroll tax (the increase in employer National Insurance Contributions announced in the 30 October budget) will cause some job losses and an uptick in the unemployment rate," says Wishart.

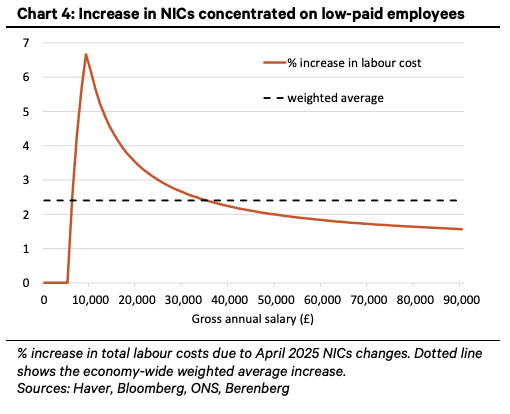

Berenberg estimates the tax hike will raise overall labour costs by 2.4%, but its design means the increase for employers of low-paid staff will be higher.

"Businesses that employ many people at or near the minimum wage will not be able to offset the increased national insurance costs with smaller pay rises, as the law requires them to give their lowest-paid staff a sizeable rise. These companies are instead likely to raise prices and reduce employment," says Wishart.

Berenberg thinks the most affected sectors will reduce employment by 1.5%, prompting the bank to lower its forecasts for overall UK employment by 150K.

As a result, it revises its forecast for the unemployment rate at the end of 2025 from 4.1% to 4.5%.

The 'canary in the coal mine' is the hospitality industry, where the number of people employed by the sector has dropped by 2.6% since March 2024.

"The experience of the accommodation and food services sector suggests that the rise in the NLW above what 10% of staff in the sector earn will cause firms in other parts of the economy to reduce employment too," says Wishart.